Take Better Control Of Your Credit And Identity

Now including Norton™ dark web and social media monitoring, our credit and identity plans provide even more protection to reduce your risk of becoming a victim of identity crime.

Identity Protection, powered by

Just here for your free credit report? Click here*

Safeguard your credit and identity

Your credit profile and identity play a key role in your financial health.

When you apply for credit, lenders will review your credit report to assess your profile and your attractiveness as a borrower.

If you have a poor credit profile as a result of identity theft or unhealthy financial habits, it can be hard to secure the finance you need to reach your goals.

Get protected today and know when your credit or identity is at risk - before it’s too late.

The cost of identity theft†

Identity theft is one of the fastest-growing crimes in Australia. It impacts many Australians, costing them time, money, and their financial health.

- 29% of victims experienced a financial loss.

- An average of 13 hours lost reporting the damage.

- More than 1 in 4 victims did not know how their personal information was obtained.

†Stats based on: Identity crime and misuse in Australia 2023

Has your personal information been compromised in a data breach? If you have received an Equifax Protect code, sign up here. Or see our tips to protect yourself.

We can help you take proactive steps to protect your identity PLUS monitor and improve your credit health

Know where you stand

Know where you stand

See how lenders may view you as a borrower

Be informed

Be informed

Get notified of key changes to your Equifax Credit Report

Protect your identity

Protect your identity

Be alerted to early signs of potential identity theft or fraud

Take control

Take control

Enhance your knowledge of credit and identity and how it impacts you

Compare our range of Free Credit Reports and paid monthly subscription plans

If you are an Authorised Access Seeker such as a credit repairer, financial counsellor, broker or third party accessing an Equifax Credit Report on someone's behalf, you can only request Equifax Credit Reports through our My Credit File website here.

If you have been impacted by a data breach and have received an Equifax Protect promo code, redeem here.

* Eligibility criteria applies. You’re eligible if you’ve been declined credit in the last 90 days or had an item corrected on your Equifax credit report or once every three months.

2 Document expiry alerts are available for 2 passports and 2 licences.

3 Terms, conditions, exclusions and limitations apply. Click here to view the Identity Guard Insurance Policy Information Booklet

Monthly subscription products: You can cancel at any time with effect at the end of the month in which you cancel your subscription.

You need to be 18 years of age and over to order a copy of your credit report

It’s easy to get started

1. Sign up online

1. Sign up online

2. Upload your documents

2. Upload your documents

3. Get verified

3. Get verified

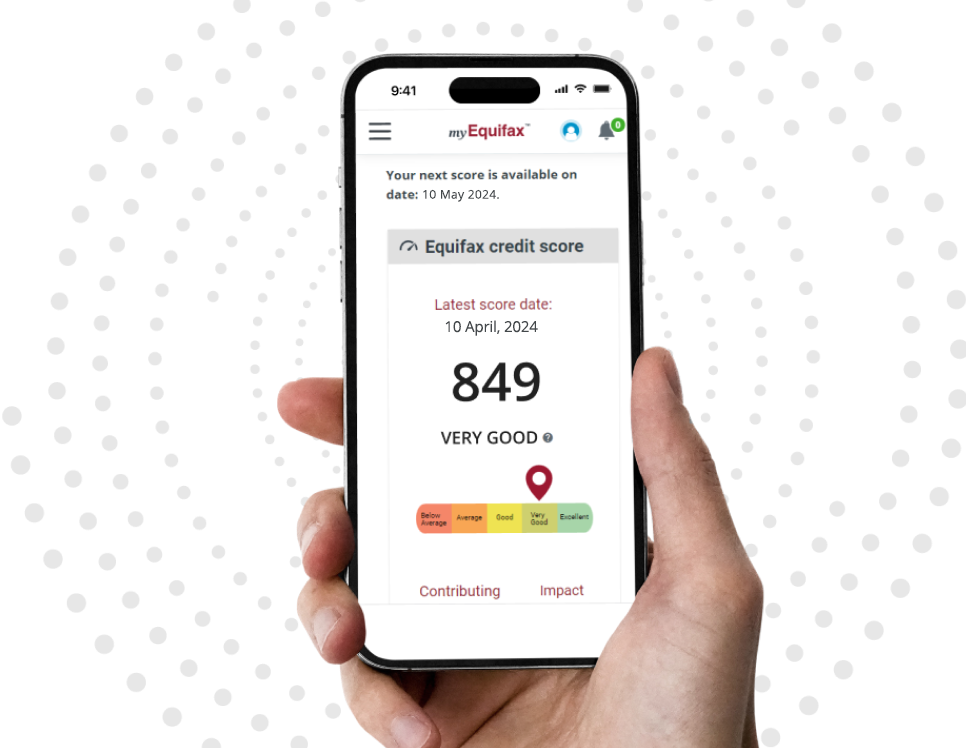

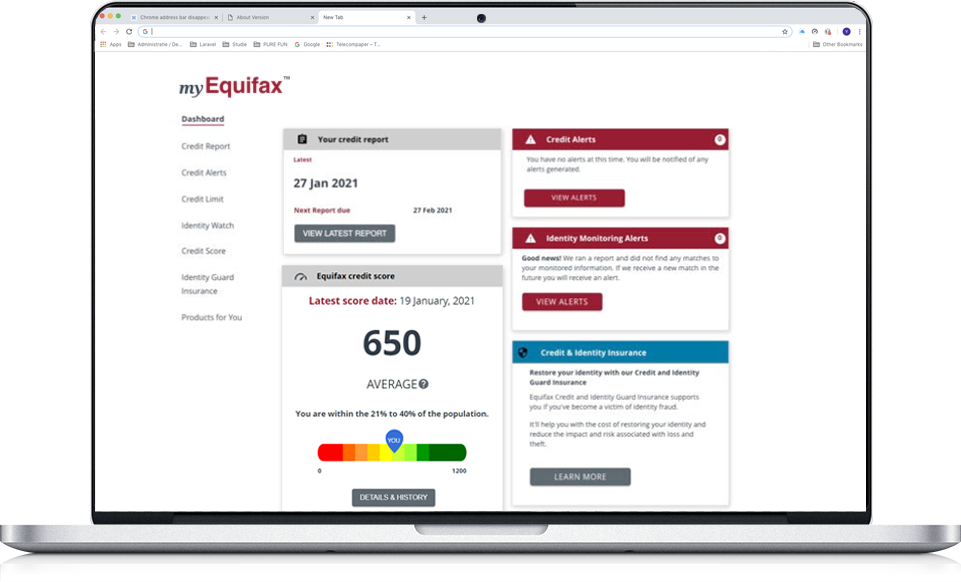

4. Access your dashboard

4. Access your dashboard

Equifax Help Centre

Access helpful services and useful information to help you take control of your credit profile, and better protect yourself from identity theft and fraud.

Understand your Equifax Credit Report

It can be quite complex but here’s a host of helpful hints in learning how to read your Equifax Credit Report

Read More

Correct your Equifax Credit Report

If you’ve found a mistake on our Equifax Credit Report, learn about what steps you can take to fix it

Read More

Learn about

Credit Scores

Why are credit scores important and how do banks and financial institutions use them?

Read More

Denied Credit

If you’ve been denied credit for a home loan, personal loan or credit card, here are some useful tips on what to do next

Read More