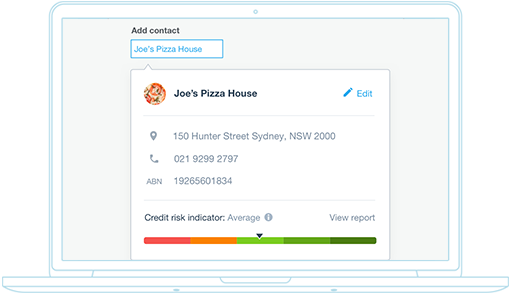

Powered by Equifax, Xero live contacts auto-fill the information you need from the Business Name Registry (BNR), eliminating data entry, avoiding typos, and ensuring company contact info is up to date.

A credit risk indicator gives you a more complete picture of the contacts you do business with. Want to know more about a contact's credit indicator? Purchase a full credit report right from your Xero contact entry.

You can purchase a Equifax SwiftCheck credit report within the contacts section of Xero’s platform. The report gives you the complete picture of a customer or supplier’s credit history and risk rating.