Despite years of doing the right financial things, Nichola found herself starting from scratch when she returned from living in New Zealand. Find out more about her experience and what she did to get back on track.

Read her storyFind out what goes into your credit score and why it matters.

Understand the impact of how some life changes impact your credit score.

Improve your financial foundation with strategies to help you rebuild your credit profile.

Understand how identity theft can impact your credit score and what you can do to help prevent it from happening.

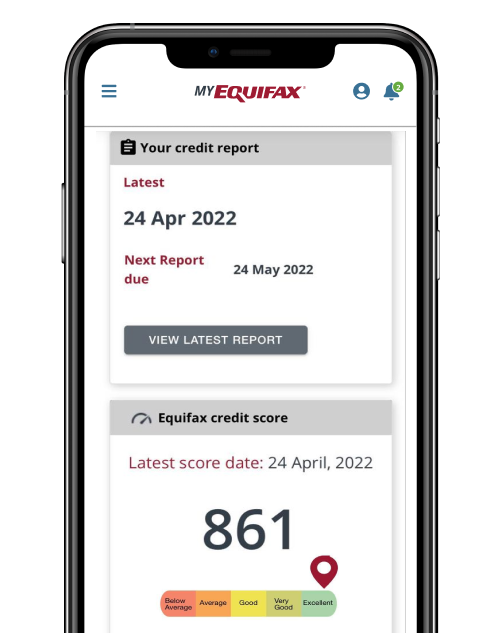

You can get your Equifax credit report for free at any time.

Find out how