Business Credit Demand Bounce-Back Hits Speed Hump

Q2 2021 figures show double-digit growth in business credit demand, with solid gains across all categories of credit, according to the latest Equifax Quarterly Business Credit Demand Index (June 2021). Sustaining this pace of recovery into the third quarter is now under question as second-wave pandemic lockdowns show signs of dampening credit demand in NSW and Victoria.

Equifax Quarterly Business Credit Demand Index: June 2021

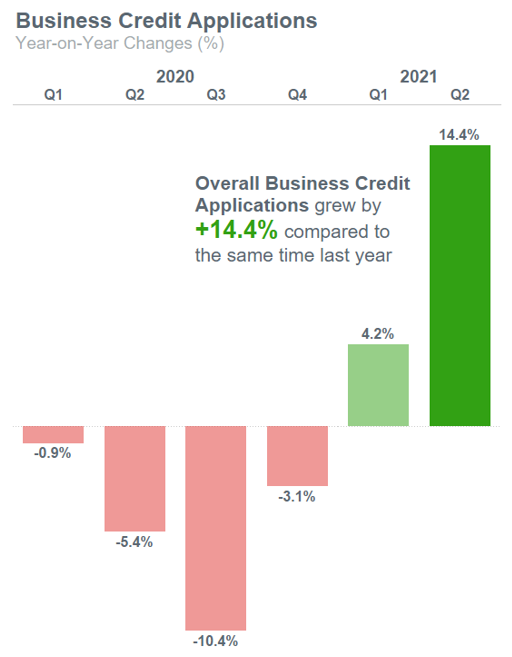

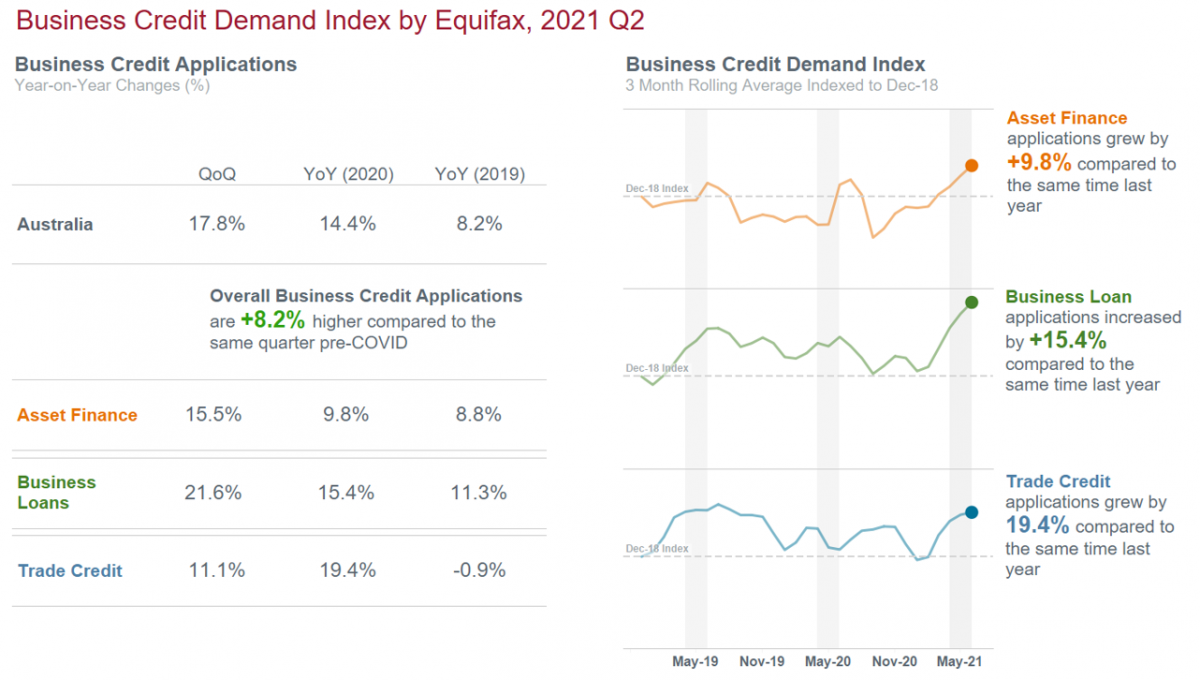

- Overall business credit applications grew by +14.4% (vs June quarter 2020)

- Business loan applications increased by +15.4% (vs June quarter 2020)

- Trade credit applications up 19.4% (vs June quarter 2020)

- Asset finance applications rose by +9.8% (vs June quarter 2020).

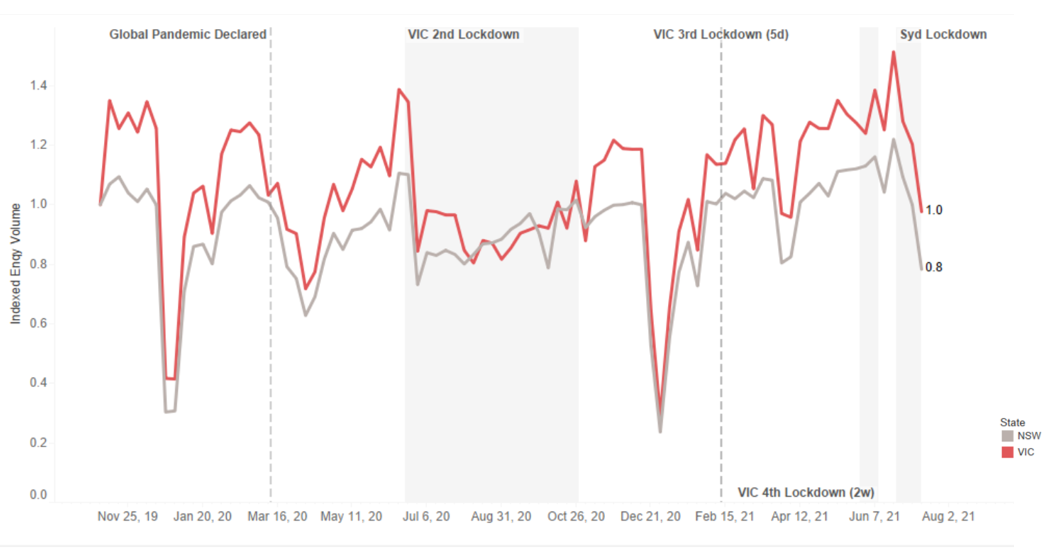

SYDNEY – 26 July 2021 – Q2 2021 figures show double-digit growth in business credit demand, with solid gains across all categories of credit, according to the latest Equifax Quarterly Business Credit Demand Index (June 2021). Sustaining this pace of recovery into the third quarter is now under question as second-wave pandemic lockdowns show signs of dampening credit demand in NSW and Victoria – refer to image 1.

Released today by Equifax, the global data, analytics and technology company and the leading provider of credit information and analysis in Australia and New Zealand, the index measures the volume of credit applications for trade credit, business loans and asset finance.

Business credit demand rebounded remarkably in the June 2021 quarter to surpass pre-COVID levels. Compared to June 2019, before the pandemic, business credit applications are up by +8.2% for the quarter. Compared to the June 2020 quarter when lockdown restrictions were in place, they increased by +14.4%.

Business loans performed strongly across the June 2021 quarter, with nearly every state and territory, Victoria included, experiencing a consistent bounce-back. Demand across Australia for business loans was +15.4% higher compared to the same quarter in 2020 and +11.3% higher than the same quarter in 2019 pre-COVID.

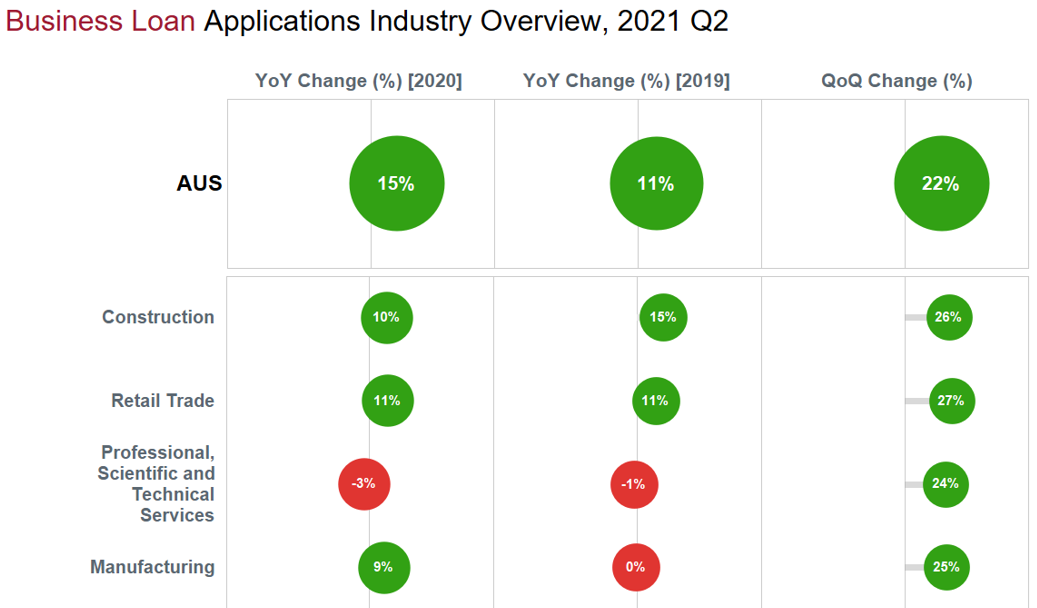

Construction and retail trade fuelled much of this growth. Demand for business loans in the construction sector was +10.0% higher than the same quarter last year and +15.0% higher than in 2019. Retail trade has been on a similar trajectory despite the unprecedented closure of retail outlets during the first wave of the pandemic. Business loan applications grew by +11.0% in the June 2021 quarter compared with the June 2020 and June 2019 quarters.

The recovery of both industries is now under question following snap COVID-19 lockdowns across three states. The impact on commercial demand in NSW is expected to be significant from this first-ever pandemic-induced shut-down of construction sites and the flow-on effects to supply chains.

Scott Mason, General Manager Commercial and Property Services, Equifax, said: “These new lockdown restrictions weigh on the good news story of Australia’s business credit demand recovery. Construction businesses are particularly reliant on the continuity of cash flow. The sector is thinly capitalised, with low margins and a fiercely competitive environment struggling to access labour and materials. Any small hiccup in the cashflow conversion cycle is likely to cause considerable pain.”

“The impact to the construction industry may well cut deeper than it has for retail trade, which has been able to pivot from brick-and-mortar operations to an online experience.”

Mason added that a substantial challenge for both sectors in this lockdown is to navigate a path forward without the breadth of stimulus and support measures and protections previously provided.

Asset finance continues to recover strongly in the June 2021 quarter, driven by auto finance and the instant asset write-off scheme. Asset finance applications were up +9.8% compared to the same quarter last year when businesses were incentivised to source relevant depreciating assets eligible for immediate write-off.

NSW led the way among the eastern states, with asset finance applications growing +14.0% year-on-year. Western Australia (+10.0%) and South Australia (+6.0%) also rose compared to the same period last year.

Trade credit demand delivered a strong performance in the June 2021 quarter (+19.4%), recovering well from the substantial fall it experienced during the pandemic. When compared with June 2019 (-0.9%), applications are on par with pre-COVID levels.

“Trade creditors, by the nature of their business, feel the impact strongly of lockdowns and falling business confidence. We’ve seen trade credit applications recover in this quarter, but at a slower rate to business loans and asset finance”, said Mason.

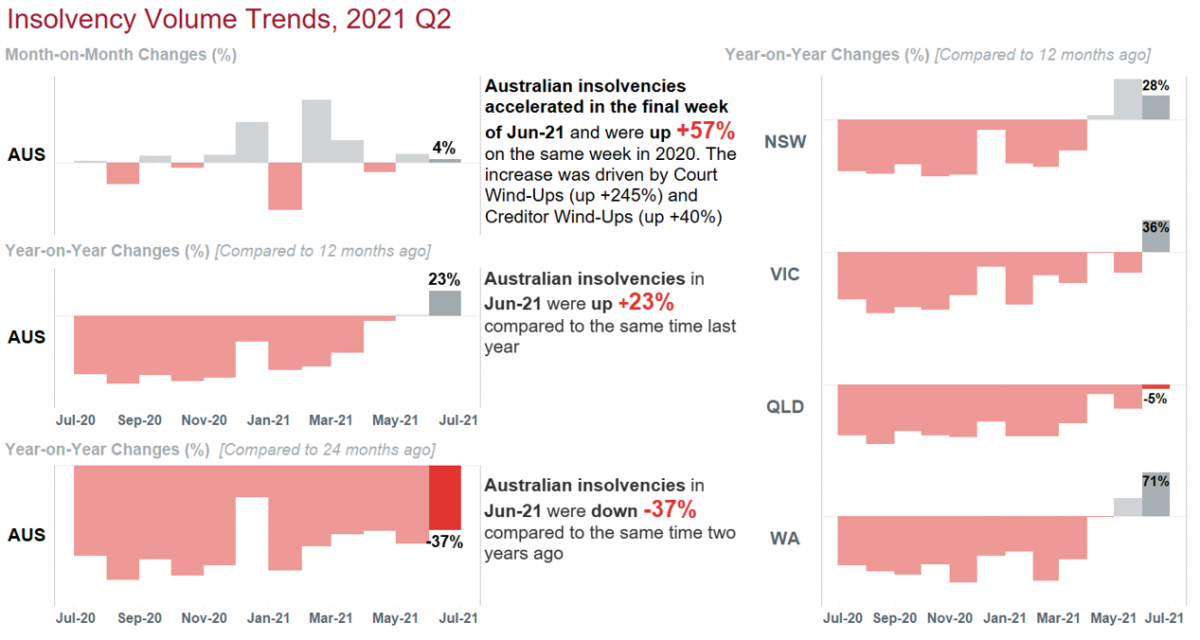

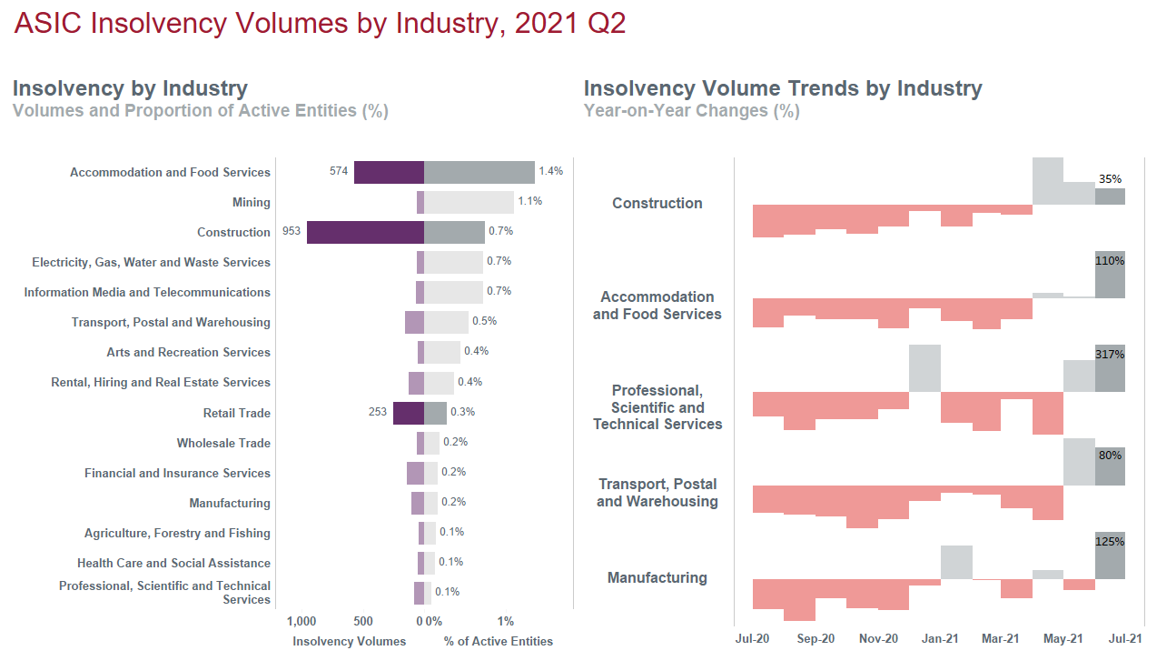

Insolvency volumes continue to climb in June 2021, up by +23.0% on the same period last year. In the Accommodation and Food Services industry, insolvencies were 110% higher than the previous year and -13% lower than pre-COVID.

Business credit demand June 2021 vs. June 2020:

Business credit applications surged in every state (+14.4%). Applications were up in NSW (+20.0%), TAS (+20.0%), VIC (+18.0%), WA (16.0%), SA (+13.0%), ACT (+13.0%), QLD (+5.0%). In the NT, applications were down by -44.0%*.

Business loan applications rebounded strongly across all states (+15.4%). Victoria led the recovery (+24.0%), closely followed by NSW (+23.0%). Applications grew in WA (+17.0%), ACT (+17.0%), SA (+16.0%), TAS (+15.0%), QLD (+2.0%) but dropped in the NT (-60.0%)*.

Trade credit applications (+19.4%) have nearly recovered their pre-COVID form. All states and territories saw positive demand, including TAS (+30.0%), ACT (+22.0%), WA (+22.0%), NSW (+21.0%), VIC (+21.0%), SA (+19.0%), QLD (+15.0%) and NT (+3.0%).

Asset finance applications continued to grow (+9.8%). Applications were up in TAS (+22.0%), NSW (+14.0%), WA (+10.0%), VIC (+8.0%), SA (+6.0%), QLD (+5.0%), ACT (+3.0%) and the NT (+1.0%)*.

*Low volumes

IMAGE 1: Business Credit Demand in NSW and Victoria – up until 15 July, 2021

Enquiry trends are indexed against the first full week of November 2019 (4 Nov 2019 – 10 Nov 2019)

IMAGE 2: Equifax Commercial Credit Demand Index – June 2021 Quarter

IMAGE 3: Equifax Commercial Credit Demand Index by categories of credit – June 2021 Quarter

IMAGE 4: Business Loan Applications Industry Overview

IMAGE 5: Insolvency Volume Trends – June 2021 quarter, Year on Year changes

IMAGE 5: Insolvency Volume Trends – June 2021 quarter, Year on Year changes

Data sourced from ASIC

IMAGE 6: Insolvency Volume by Industry – June 2021 quarter, Year on Year changes

Data sourced from ASIC

ABOUT EQUIFAX

At Equifax (NYSE: EFX), we believe knowledge drives progress. As a global data, analytics, and technology company, we play an essential role in the global economy by helping financial institutions, companies, employees, and government agencies make critical decisions with greater confidence. Our unique blend of differentiated data, analytics, and cloud technology drives insights to power decisions to move people forward. Headquartered in Atlanta and supported by more than 11,000 employees worldwide, Equifax operates or has investments in 25 countries in North America, Central and South America, Europe, and the Asia Pacific region. For more information, visit www.equifax.com.au or follow the company’s news on LinkedIn.

FOR MORE INFORMATION

NOTE TO EDITORS

The Quarterly Business Credit Demand Index by Equifax measures the volume of credit applications that go through the Commercial Bureau by financial services credit providers in Australia. Based on this, it is a good measure of intentions to acquire credit by businesses. This differs from other market measures published by the RBA/ABS, which measure new and cumulative dollar amounts that are actually approved by financial institutions.

DISCLAIMER

Purpose of Equifax media releases:

The information in this release does not constitute legal, accounting or other professional financial advice. The information may change, and Equifax does not guarantee its currency or accuracy. To the extent permitted by law, Equifax specifically excludes all liability or responsibility for any loss or damage arising out of reliance on information in this release and the data in this report, including any consequential or indirect loss, loss of profit, loss of revenue or loss of business opportunity.

Related Posts

The latest data from Equifax reveals Australians demonstrated strong financial resilience in 2025, amid an ongoing cost-of-living crisis, the national average credit score remained in the ‘Excellent’ range at 864 (out of a possible 1200), lifting by three points from the 2024 average of 861.

Survey reveals broker anticipation of commercial loans has more than tripled over the past year, while 72% of brokers say they plan to work with customers dealing with ‘mortgage regret’ amid recent rate cuts.