Business credit demand remains soft with some positive signs in business loan applications

Business Credit Demand Index by Equifax (June 2019 Quarter)

Overall business credit applications down -8.99% (vs June quarter 2018).

Growth in business loan applications up +0.90%, while trade credit applications fell -5.02% (vs June quarter 2018).

Asset finance applications decline -26.14% (vs June quarter 2018).

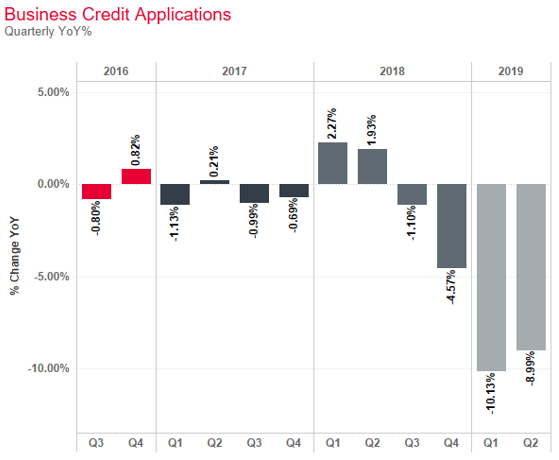

Sydney, Australia – Wednesday, 21 August 2019: Business credit demand remains down, declining -8.99% in the June 2019 quarter, according to data from the latest Quarterly Business Credit Demand Index by Equifax.

Released today by Equifax, the global data, analytics and technology company and the leading provider of credit information and analysis in Australia and New Zealand, the Index measures the volume of credit applications for trade credit, business loans and asset finance.

The Quarterly Business Credit Demand Index shows that the rate of decline in business credit applications appears to be easing compared to the March 2019 quarter (-10.13%).

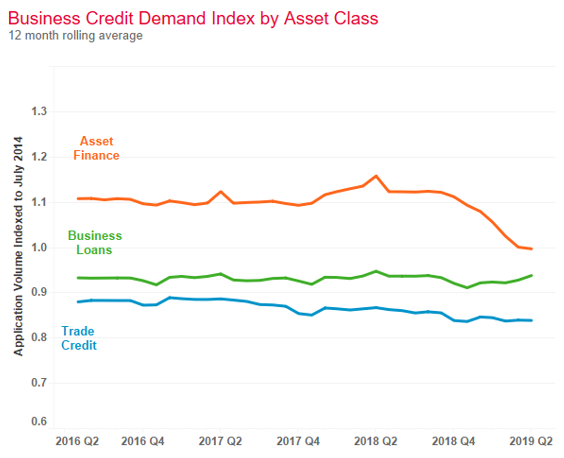

Business loan applications saw some growth (+0.90%) in the June quarter vs the same time last year whilst trade credit applications continued a negative trend, softening by -5.02% in the June 2019 quarter.

After a period of high growth in 2018, asset finance applications continue to decline, down -26.14% in the June 2019 quarter.

Moses Samaha, Executive General Manager Customer and Solutions, Equifax said “While overall business credit demand has continued to decline, it is encouraging to see a potential softening of the decline”, Mr Samaha said.

“If we look at enquiry volumes, there is a move to alternate lenders from the Big Four banks across all portfolios, this may be due to tighter lending conditions in some sectors,” Samaha added.

The pace of decline in overall business credit applications eased in the June quarter. The non-mining jurisdiction of VIC (-11.14%) and the mining jurisdiction of NT (-9.94%) experienced strong negative demand. TAS (-12.14%), NSW (-9.93%), SA (-8.73%), QLD (-7.92%) and WA (-2.07%) all experienced a slowdown in the negative trend of business credit demand. The ACT experienced positive growth (+1.04%).

Business loan applications strengthened in the June quarter (+0.90%) in most states. There was positive growth in the ACT (+5.32%), WA (+5.27%), QLD (+1.99%), SA (+1.55%) and NSW (+1.45%). A decline was seen in VIC (-1.67%), with NT (-7.03%) experiencing the largest fall in business loan applications.

Trade credit applications declined in the June quarter (-5.02%). The growth in trade credit applications was strongest in the ACT (+10.81%) and TAS (+2.73%), while NT (-8.41%), NSW (-7.49%), VIC (-5.91%), QLD (-5.07%), SA (-1.29%), WA (-0.25%) all recorded falls. NSW, QLD and VIC experienced larger declines compared to the March 2019 quarter.

Asset finance applications experienced a large decrease in the June quarter (-26.14%). The largest decline was seen in TAS (-34.44%), followed by NSW (-28.53%), VIC (-28.17%), SA (-27.84%), QLD (-24.27%), NT (-17.65%), WA (-14.24%), ACT (-13.27%).

About Equifax

Equifax is a global data analytics company using unique data, innovative analytics, technology and industry expertise to power organisations and individuals around the world by transforming knowledge into insights that help make more informed business and personal decisions.

Headquartered in Atlanta, Ga., Equifax operates or has investments in 24 countries in North America, Central and South America, Europe and the Asia Pacific region, with the acquisition of Veda, a data analytics company and the leading provider of credit information and analysis in Australia and New Zealand. Combined, the companies bring over 170 years of data and insights experience to the marketplace.

Equifax is a member of Standard & Poor's (S&P) 500® Index, and its common stock is traded on the New York Stock Exchange (NYSE) under the symbol EFX. For more information, visit www.equifax.com.au or follow the company’s news on LinkedIn.

Note to Editors

The Quarterly Business Credit Demand Index by Equifax Index measures the volume of credit applications that go through the Commercial Bureau by credit providers such as financial institutions and major corporations in Australia. Based on this it is a good measure of intentions to acquire credit by businesses. This differs to other market measures published by the RBA/ABS, which measure new and cumulative dollar amounts that are actually approved by financial institutions.

DISCLAIMER

Purpose of Equifax media releases:

The information in this release does not constitute legal, accounting or other professional financial advice. The information may change, and Equifax does not guarantee its currency or accuracy. To the extent permitted by law, Equifax specifically excludes all liability or responsibility for any loss or damage arising out of reliance on information in this release and the data in this report, including any consequential or indirect loss, loss of profit, loss of revenue or loss of business opportunity.

Related Posts

The latest data from Equifax reveals Australians demonstrated strong financial resilience in 2025, amid an ongoing cost-of-living crisis, the national average credit score remained in the ‘Excellent’ range at 864 (out of a possible 1200), lifting by three points from the 2024 average of 861.

Survey reveals broker anticipation of commercial loans has more than tripled over the past year, while 72% of brokers say they plan to work with customers dealing with ‘mortgage regret’ amid recent rate cuts.