Equifax Quarterly Consumer Credit Demand Index: December 2022

-

Overall consumer credit applications increased (+5.1% vs December quarter 2021)

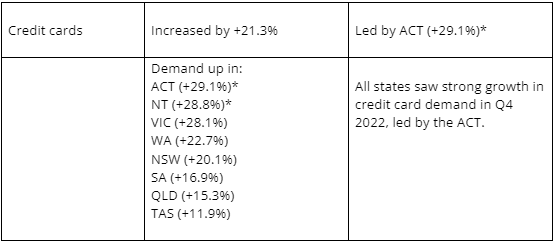

- Credit card applications grew (+21.3% vs December quarter 2021)

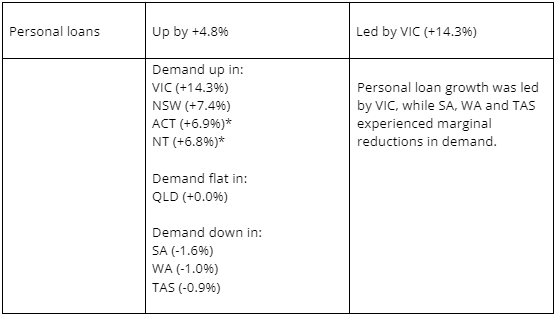

- Personal loan applications up (+4.8% vs December quarter 2021)

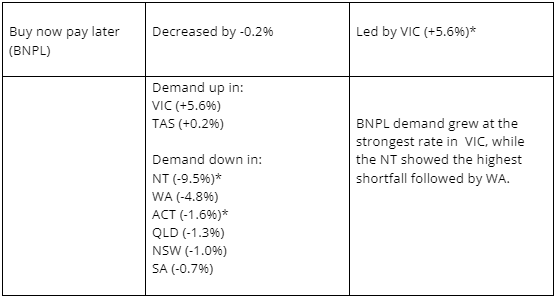

- Buy now pay later applications declined marginally (-0.2% vs December quarter 2021)

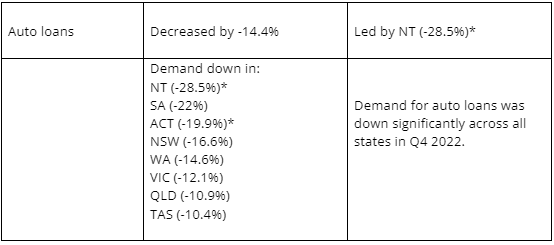

- Auto loan applications reduced (-14.4% vs December quarter 2021)

- Mortgage applications declined (-16.1% vs December quarter 2021)

SYDNEY – 21 February 2023 – Consumer credit demand softened in the December quarter of 2022 according to the latest Equifax Quarterly Consumer Credit Demand Index (December 2022), growing +5.1% compared to the same period in 2021.

Released today by Equifax, the global data, analytics and technology company and leading provider of credit information and analysis in Australia and New Zealand, the index measures the volume of credit applications for credit cards, personal loans, buy now pay later and auto loans.

Credit card demand was the primary driver of the overall growth, up +21.3% in Q4 2022 versus the same period 2021. Personal loan applications also increased, although by a lower margin (+4.8%), while demand for mortgages, BNPL and auto loans all declined.

Kevin James, General Manager Advisory and Solutions, Equifax, said: “The increase in credit card demand in Q4 can be attributed in part to the travel and retail expenses of the festive season, but likely also reflects the number of consumers turning to credit to help keep up with the increasing cost of living. To date we haven’t seen an increase in credit card arrears but, as household savings fall and the cost of living remains high, we could see financial pressure on consumers reflected in credit card usage and defaults in the coming quarters.

“Conversely, personal loan arrears are increasing alongside demand. We’re seeing an increase in arrears (<90 days past due) compared to the same quarter in both 2021 and 2020. Internationally, unsecured credit arrears are also growing in markets like the UK, US and Canada - markets that raised interest rates before we did. In Australia, 21% of personal loan customers also have mortgage commitments. The lag between arrears in personal loans and mortgages is usually about 6 months, so our current data could be an indicator of an increase in mortgage arrears to come.”

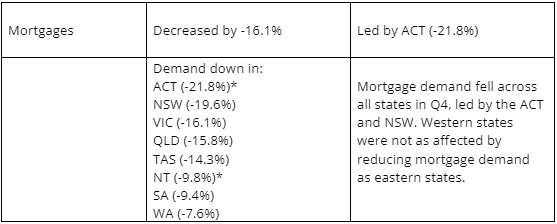

Mortgage demand continued to fall in Q4 (-16.1%), influenced by the impact of several consecutive interest rate rises, while mortgage balances are increasing. Mortgage limits increased 5.5% between December 2021 and December 2022, and are 15% up on the same period in 2020.

Demand for buy now pay later was flat in Q4, declining -0.2% compared to the same quarter 2021.

Auto loan applications experienced a significant decline in the December quarter, down -14.4% compared to the same period in 2021.

“The Buy Now Pay Later sector is facing a number of headwinds including market saturation and consumers turning back to credit cards as a primary form of credit, which could be contributing to the drop in demand,” Mr James said.

“Auto loans have also had a challenging quarter, despite Q4 historically being a strong period for auto loan demand. This suggests ongoing stock issues continue to worry the sector even with borders reopening.”

TABLE 1: Consumer Credit Demand by State (VS same quarter 2021)

Mortgage Demand

IMAGE 1: Consumer Macro Credit Demand – Quarterly YOY

Source: Equifax

IMAGE 2: Consumer Credit Applications – Indexed by Type

Source: Equifax

*Low volumes

^The data has been re-indexed from 2018 to account for the recent inclusion of Buy Now Pay Later applications:

Re-indexed data to commence in 2018 (previously 2015)

Added buy now pay later and auto loan credit enquiries as a separate trendline (previously rolled up into personal loans)

ABOUT EQUIFAX INC.

At Equifax (NYSE: EFX), we believe knowledge drives progress. As a global data, analytics, and technology company, we play an essential role in the global economy by helping financial institutions, companies, employers, and government agencies make critical decisions with greater confidence. Our unique blend of differentiated data, analytics, and cloud technology drives insights to power decisions to move people forward. Headquartered in Atlanta and supported by more than 14,000 employees worldwide, Equifax operates or has investments in 24 countries in North America, Central and South America, Europe, and the Asia Pacific region. For more information, visit www.equifax.com.au or follow the company’s news on LinkedIn.

FOR MORE INFORMATION

[email protected]

NOTE TO EDITORS

The Quarterly Consumer Credit Demand Index by Equifax measures the volume of credit card, personal loan applications, Buy Now Pay Later and auto loan applications that go through the Equifax Consumer Credit Bureau by financial services credit providers in Australia. Credit applications represent an intention by consumers to acquire credit and in turn spend; therefore, the index is a lead indicator. This differs to other market measures published by the RBA which measure credit provided by financial institutions (i.e. balances outstanding).

DISCLAIMER

Purpose of Equifax media releases:

The information in this release does not constitute legal, accounting or other professional financial advice. The information may change, and Equifax does not guarantee its currency or accuracy. To the extent permitted by law, Equifax specifically excludes all liability or responsibility for any loss or damage arising out of reliance on information in this release and the data in this report, including any consequential or indirect loss, loss of profit, loss of revenue or loss of business opportunity.

Related Posts

Mortgage demand hits four-year high as a second consecutive quarter of double-digit growth for credit cards is observed and most prominent among younger Gen Z’s.

The latest Equifax Business Market Pulse for Q4 2025 reveals a multi-speed recovery. Large businesses are leading the way on credit demand growth, with an observed increase in overall demand reaching heights of up to +19.4% (trade credit) in some sectors, such as hospitality.