Business credit scores hit 3-year high, as large businesses drive demand

The latest Equifax Business Market Pulse for Q4 2025 reveals a multi-speed recovery. Large businesses are leading the way on credit demand growth, with an observed increase in overall demand reaching heights of up to +19.4% (trade credit) in some sectors, such as hospitality.

Large Businesses are leading the way on Credit Demand Growth, while SMEs are still on a path to recovery at pre-inflation levels

Equifax Business Market Pulse: Q4 2025 Business Credit Trends

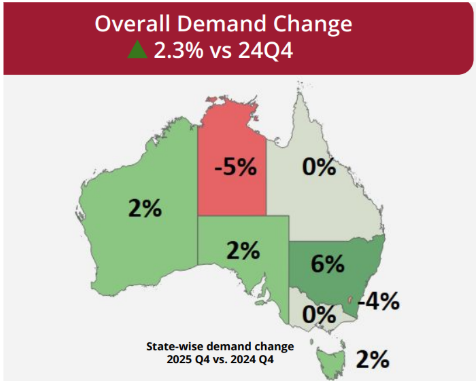

- Overall business credit demand increased +2.3% (vs Q4 2024)

- Business loan demand increased +4.1% (vs Q4 2024)

- Trade credit demand decreased by -4.9% (vs Q4 2024)

Meanwhile, the broader view of the Small and Medium-sized Enterprise (SME) sector appears to exhibit a steady, albeit gradual, recovery. Although SMEs are trailing the growth seen in larger enterprises, their demand for credit continues to rise. However, the longer-term trends still show small business borrowing is on a recovery pathway, with Q4 2025 credit demand -9% below what it was four years ago in Q1 2022.

With overall credit demand increasing by +2.3% compared to the same period in Q4 2024, Brad Walters, General Manager of Commercial at Equifax in Australia, indicates this may be the starting signs of SME recovery.

Observing the trends, Brad Walters, General Manager, Commercial, said, “The +4.5% year-on-year increase in SME demand in Q4 2025 is a positive signal - though it reflects a more measured recovery pace compared to larger enterprises.”

“While large-scale businesses appear to be accelerating their credit appetite more quickly, SMEs appear to be navigating a steadier path upward as they balance growth with external factors such as the pressures of inflation. They don't always have the means to absorb potential shocks as easily as their larger competitors, so they're choosing a steadier, more sustainable climb back to the top.”

Business Credit Scores Hit 3-Year High

Equifax insights reveal that business loan demand increased +4.1% year-on-year in Q4 2025 and, in addition, business loan quality increased by two points, achieving a three-year high.

"When we look at the past quarter, it appears to be a story of a change in the market mix. We’ve seen more enquiries from larger businesses, which often have more reserves and carry higher credit scores. This shift in the overall enquiry profile - where the larger players are currently more credit active than smaller players - is what I see driving this upward trend in credit quality. In practical terms, this shows that the credit quality of the mid-market and larger businesses overall remains quite resilient.” Walters said.

The Equifax Business Market Pulse Q4 2025 also reveals an overall year-on-year decline (-4.9%) in trade credit demand, an indication that businesses are not making as many transactions as they were this time last year.

Large Hospitality, Construction and Retail Businesses Strong Drivers of Credit Growth

Notably - hospitality, construction and retail - highlighted differences in the financial appetite of large businesses and SMEs in Q4 2025.

Hospitality showed one of the largest gaps. Credit enquiries from large hospitality businesses drove increased demand across trade credit (+19.4%), business loans (+9.1%) and asset finance (+5%).

“The hospitality sector shows one of the widest discrepancies in overall demand for large businesses compared to SMEs in Q4 2025. While trade credit demand in large hospitality businesses increased by +19.4% year-on-year, overall credit demand growth from SMEs (+1.9% year-on-year) was marginal.

While insolvencies in the hospitality sector remain high overall, the past quarter showed an encouraging -9% reduction compared to Q4 2024, in addition to a -1.5 day reduction in Days Beyond Terms (DBT) for trade payments over the same period”, said Mr Walters

In the construction sector, insolvencies remained high but relatively unchanged year-on-year. Credit demand, however, told a different story.

Mr Walters stated, "The demand we are seeing could suggest big builders are confidently securing materials for their project pipelines, driving a +6.6% year-on-year (vs Q4 2024) increase in trade credit. Now, during this same time period, small construction businesses appear to be avoiding broad debt, seen by a slight reduction (-0.7%) in overall demand, and only borrowing for specific tools via asset finance (+4%).”

In the retail sector national demand from large retailers increased by +7.9% year-on-year, compared to a stagnant +0.7% for SMEs in Q4 2025. Large NSW retailers were particularly active, increasing their business loan enquiries by a staggering +25%.

Mr Walters concluded, “While we have seen strong demand growth among large retailers, the wider sector still shows some signs of pressure, with the past quarter revealing a substantial +64% increase in retail insolvencies year-on-year.”

Overall Credit Demand Change, 2025 Q4

FOR MORE INFORMATION

[email protected]

NOTE TO EDITORS

The Equifax Business Market Pulse (formerly Business Credit Demand Index) measures the volume of credit applications for business loans, asset finance and trade credit that go through the Equifax Commercial Bureau by financial services credit providers in Australia. Based on this, it is considered to be a good measure of intentions to acquire credit by businesses. This differs from other market measures published by the RBA/ABS, which measure new and cumulative dollar amounts that are actually approved by financial institutions.

DISCLAIMER

Purpose of Equifax media releases: The information in this release does not constitute legal, accounting or other professional financial advice. The information may change, and Equifax does not guarantee its currency or accuracy. To the extent permitted by law, Equifax specifically excludes all liability or responsibility for any loss or damage arising out of reliance on information in this release and the data in this report, including any consequential or indirect loss, loss of profit, loss of revenue or loss of business opportunity.