2025 Automotive Finance Forum Wrap Up

The 2025 Equifax Auto Forum convened industry leaders to explore the evolving automotive landscape. Discussions provided valuable insights into the profound impact of China's automotive industry, strategies for combating fraud, the transition of the vehicle market, and critical commercial insights.

The central theme emphasised the dynamic shifts within the auto sector, highlighting the need for businesses to adapt to new market forces, technological advancements, and evolving consumer behaviours.

Here's a summary of the key insights and talking points.

China’s Impact on the Auto Industry

Steven Bragg, Partner - Motor Industry Services, Pitcher Partners

Steven’s session begins with ‘Even Elon Musk didn’t see it coming’, in reference to the rapid and unanticipated rise of China as a global automotive powerhouse and its significant influence on the industry.

Key Takeaways:

- Rapid transformation: China's automotive industry transformed from producing basic, low-cost cars to becoming a global leader in under 15 years, exemplified by BYD's plant development from 2010 to 2025.

- Global economic contributor: China contributed 30% of the world’s economic growth between 2013 and 2023, surpassing the G7 combined, using the same playbook as it did to achieve dominance in flat panel TV manufacturing.

- Dominance across the value chain: China leads in vehicle production, cost efficiency, chip production, EV manufacturing, technology, rare earth refining, exports, battery production, and AI innovation, making it the "centre of the automotive universe."

- Export-led growth: China exported 2.83M vehicles between January to May 2025, up 20% from the same period the previous year. Legacy OEM’s are struggling to respond as rushed EV regulations and tariff-chaos are weakening the West’s position.

- Choose OEMs that help build business equity: Australia is a logical export market, with Chinese-made vehicles representing an estimated 19% of total 2025 vehicle sales in Australia. Choose your OEM partner carefully, as the current 129 Chinese brands are expected to consolidate to fewer than 15 brands by 2030.

Fraud & Identity Insights

Tehani Legeay, General Manager, Identity and Fraud Digital Services, Equifax

“Is fraud a cost centre in your business or an enabler for sustainable growth?” asked Tehani in a presentation that urged auto financiers to ‘fight smart fraud with brave change’.

Key Takeaways:

- Significant fraud savings: The Equifax Fraud Data Consortium, which includes 31 auto finance members, helped save $1.4 billion in attempted application fraud over the last 12 months.

- Targeting high-value products: Consortium data shows fraudsters often target high-value credit products to maximise their returns.

- Combatting first-party fraud: A key challenge identified by the Consortium is first-party fraud, where perpetrators misrepresent their identity or financial situation and/or give false information for financial and material gain.

- Multi-layered defence: Effective fraud prevention requires layering multiple defences, including data verification, industry intelligence sharing, biometrics, and ‘quiet’ searches on device, email, and behavioural patterns. These processes should operate seamlessly to ensure a smooth experience for trusted customers while adding necessary authentication for potentially risky ones.

Driving the Transition - Policy Ambition and Consumer Reality

Tony Weber, Chief Executive, Federal Chamber of Automotive Industries

Tony discussed the automotive industry's transition, outlining potential outcomes influenced by consumer adoption of electric vehicles under the New Vehicle Efficiency Standards.

Key Takeaways:

- Dominance of SUVs: SUVs constitute the largest segment of vehicles sold year-to-date in 2025, accounting for 62.5% of sales, while passenger vehicles are at 13.9% and light commercial vehicles (LCVs) at 23.6%.

- Asian vehicle origin: Vehicles sourced from Asia (Japan, China, Thailand, Korea) collectively represent 81.7% of total sales in Australia year-to-date 2025.

- EV market share: Battery Electric Vehicles (BEVs) accounted for 7.5% of total sales year-to-date in 2025, with hybrid vehicles at 15.3% and Plug-in hybrid electric vehicles (PHEVs) at 4.1%.

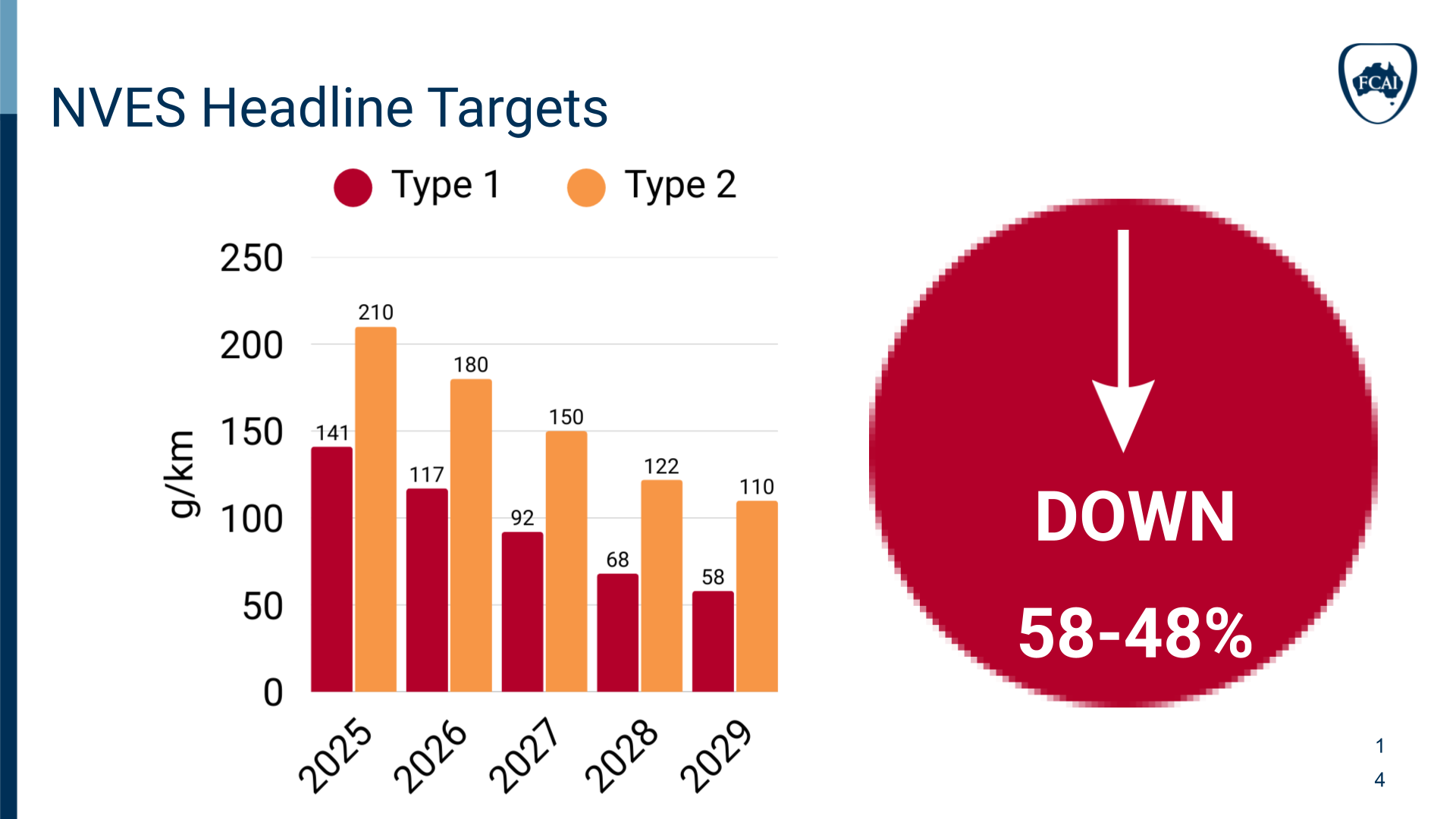

- CO2 emissions: Australia’s New Vehicle Efficiency Standard (NVES), which came into effect on 1 January 2025, introduced CO2 emissions targets, credits, and penalties, favouring fuel-efficient cars and potentially increasing choice and savings for consumers.

Equifax Commercial Insights

Ashley Schumacher, Solutions Consultant, Equifax

Ashley provided a comprehensive overview of the macroeconomic environment, credit demand, and loan performance, offering key commercial insights for the auto industry.

Key Takeaways:

- Easing inflation: The Reserve Bank of Australia (RBA) has been able to cut interest rates due to a reduction in underlying inflation, which coupled with strong employment, has provided some relief to households.

- Strong employment and wage growth: Interest rate cuts, strong employment figures, and post-COVID wage growth (up 4% year-ended) have positively impacted household income and consumption.

- Increasing credit demand: Credit demand is slowly increasing across both consumer and commercial sectors, with notable growth in credit cards (13.4%) and personal loans (8.5%) for consumers, and business loans (6.0%) for commercial.

- Mortgage holders driving auto demand softening: The softening in consumer auto loan demand over the last few years has largely been driven by mortgage holders, although auto credit quality is slowly improving as they return to the market.

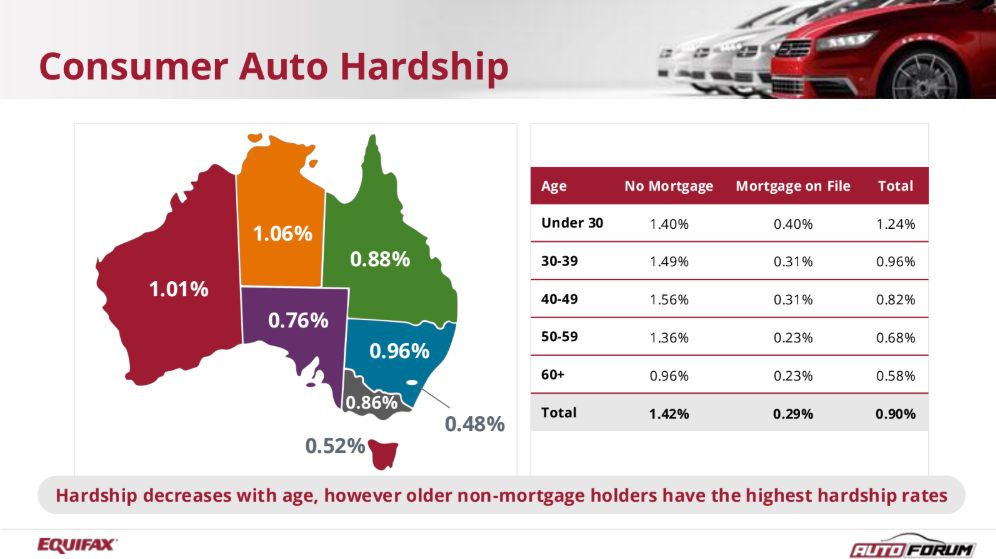

- Rising hardship and defaults: While mortgage arrears remain stable, personal lending and auto hardship are increasing, particularly among non-mortgage holders. Hardship decreases with age, however older non-mortgage holders have the highest hardship rates.

Fireside Chat

Andrew Maeer of Nissan Financial Services Australia and Moses Samaha, Executive GM, Equifax

Key talking points:

- Dynamic auto market: Post-pandemic, the auto market is seeing significant shifts in both consumer demand and manufacturer supply.

- Key market challenges: Fraud, consumer stress, and intense competition are pressing concerns, compounded by the cost of living impacting car-buying decisions.

- EVs and Chinese dominance: The EV market is a sustainable trend, with Chinese brands increasingly influencing the Australian automotive landscape.

- AI’s role in auto finance: Artificial intelligence has the potential to transform auto financing, specifically its ability to enhance risk assessments, accelerate loan origination and improve customer experience.

Book a call with us today to explore how our data-driven solutions can support your business.

Related Posts

The latest data from Equifax reveals Australians demonstrated strong financial resilience in 2025, amid an ongoing cost-of-living crisis, the national average credit score remained in the ‘Excellent’ range at 864 (out of a possible 1200), lifting by three points from the 2024 average of 861.

Survey reveals broker anticipation of commercial loans has more than tripled over the past year, while 72% of brokers say they plan to work with customers dealing with ‘mortgage regret’ amid recent rate cuts.