2025 Year of Resilience: The Majority of Australians Maintained 'Excellent' Credit Scores, Defying Economic Headwinds and the Cost-of-Living Crisis

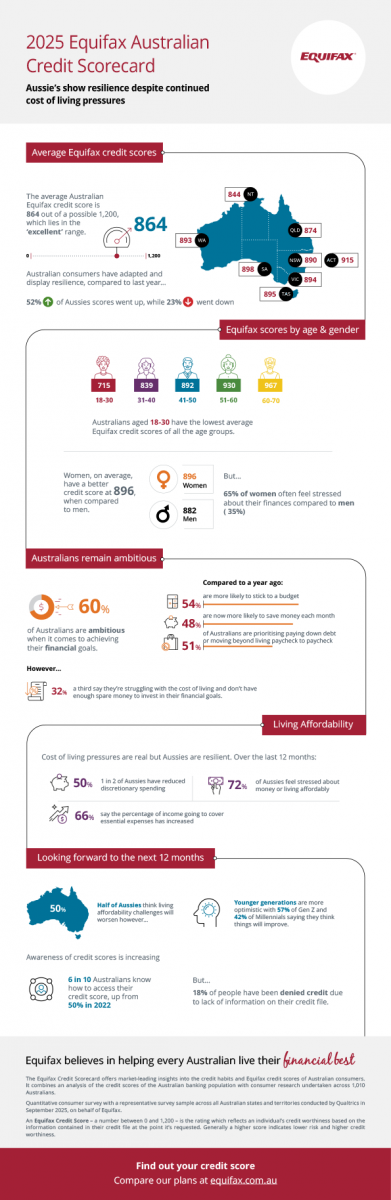

The latest data from Equifax reveals Australians demonstrated strong financial resilience in 2025, amid an ongoing cost-of-living crisis, the national average credit score remained in the ‘Excellent’ range at 864 (out of a possible 1200), lifting by three points from the 2024 average of 861.

- Just over 1 in 2 Aussies (52%) improved their credit scores, while 23% saw a decline over the past 12-months

- The national average Equifax credit score was ‘excellent’ (864), rising by 3 points year-on-year

- Compared to 12-months ago: 54% of Aussies more likely to stick to a budget, 48% more likely to save money each month and 51% prioritised paying down debt or trying to move beyond living paycheck-to-paycheck

Sydney, Australia – 8 December 2025 – The latest data from Equifax reveals Australians demonstrated strong financial resilience in 2025, amid an ongoing cost-of-living crisis, the national average credit score remained in the ‘Excellent’ range at 864 (out of a possible 1200), lifting by three points from the 2024 average of 861.

The Equifax 2025 Australian Credit Scorecard offers market-leading insights into Australians’ credit habits, behaviours and attitudes towards financial matters. It combines Equifax analysis on the credit scores of the Australian banking population with consumer research undertaken across 1,010 Australians.

Amid an affordability crisis that challenged most household budgets throughout the year, the data reveals how Australians actively and tightly managed their financial situations. This discipline is evident across key behaviors: 54% said they were more likely to stick to a budget compared to a year ago, while 51% said they prioritised paying down debt or moving beyond living paycheck-to-paycheck. Additionally, Australians said they had curbed their discretionary spending over the past year, with just under half (48%) reporting they were less likely to spend on items such as fashion, travel, and dining out.

“While 23% of Australians’ credit scores saw a decline, a significant 52% increased, lifting the average score by three points from last year’s average result of 861,” said Melanie Cochrane, CEO and Group Managing Director of Equifax ANZ.

Cochrane added, “Combined with credit delinquencies remaining stable in the third quarter of this year, these are encouraging signs. We understand that with cost-of-living pressures, maintaining good credit health can be challenging, but building financial resilience means that Australians are protecting their credit scores – and therefore enabling their access to credit when they need it most.”

State, demographic, and gender breakdowns paint a positive picture, with no major outlier across the states and territories struggling. Credit scores tend to rise with age, primarily because older Australians have more time to establish a comprehensive and responsible credit history. Unsurprisingly, the youngest group, Australians aged 18–30, hold the lowest average score at 715. However, the score sees a significant jump in the next decade, rising to 839 for those aged 31–40. This 124 point leap is the largest credit score increase across the age groups that range from 18-71+. Women lead the way in average credit scores, achieving a score of 895, 13 points higher than men at 882. Despite this, surveyed data shows a significant difference in financial stress: 65% of women report often feeling stressed about their finances, compared to just 35% of men.

| State | ACT | NSW | NT | QLD | SA | TAS | VIC | WA |

|---|---|---|---|---|---|---|---|---|

| Ave. Credit Score | 915 | 890 | 844 | 874 | 898 | 895 | 894 | 893 |

Budgeting for Living Affordability

More than 70% of Australians identified groceries and utilities as their biggest expense increases, while 42% flagged rising insurance premiums as a challenge. In addition, 66% said that the percentage of their income going to cover essential expenses has increased.

To stay financially resilient, Australians are taking proactive steps with saving a key focus; 48% of Australians report saving money each month. Gen Z led the charge with 75% of respondents aged 18–30 saying that saving is a top priority for them.

Reflecting the pressure on household budgets, many Australians are turning to credit products to manage affordability challenges. 33% of Australians said they use credit cards, and 24% use Buy Now, Pay Later (BNPL) services. Among younger Australians, BNPL is even more prevalent with 38% of Gen Z nominating it as their preferred way to manage costs.

Commenting on the findings, Melanie Cochrane observed, “In line with the research, we’ve seen the demand for unsecured credit products significantly increase year-on-year, suggesting Australians are relying more and more on credit to cover daily living expenses. For those with home loans, searching for a better deal has become a priority, with our data showing more people re-financing than applying for new mortgages over the last 12 months.”

Optimism Remains Strong for 2026, Despite Cost-of-Living Concerns

Looking ahead to the next 12 months, half of Australians believe living affordability will worsen. However, opinions vary significantly across generations. While 42% of Millennials and 57% of Gen Z expect affordability to improve, 56% of Baby Boomers anticipate conditions will deteriorate.

Despite these concerns, Australians remain optimistic about their financial aspirations. Almost two-thirds (60%) describe themselves as ambitious when it comes to financial goals. This rate has not shifted since 2024, but it remains a significant drop from 69% in 2022.

Affordability pressures explain the gap, with one in three (32%) ambitious Australians admitting they are struggling with everyday costs, leaving no spare funds to invest in their goals.

“Despite challenging circumstances, seeing Australians improve their financial education and better understand how to navigate different forms of short-term credit is positive and reinforces a strong signal of resilience. It’s encouraging to see Australians are optimistic about the year ahead, with one in five (21%) planning a major lifestyle purchase, such as a new car or a significant holiday in the next 12-months,” said Cochrane.

Melanie Cochrane noted that financial literacy remains a key focus nationwide, “70% of Australians rate it as ‘very important’, with Tasmanians leading the way, with an overwhelming 95% emphasising the importance of financial education”.

ABOUT EQUIFAX CREDIT SCORES.

An Equifax credit score will fall into one of five bands, each representing a consumer’s level of risk according to their Equifax score. The score bands are:

- Excellent (853 – 1,200)

- Very good (735 – 852)

- Good (661 – 734)

- Average (460 – 660)

- Below Average (0 - 459)

An Equifax credit score is a summary of an individual’s credit information held by Equifax and indicates how credit providers may view consumers when they apply for credit. Equifax credit scores may be used by consumers to help them negotiate when applying for credit.

ABOUT EQUIFAX INC.

At Equifax (NYSE: EFX), we believe knowledge drives progress. As a global data, analytics, and technology company, we play an essential role in the global economy by helping financial institutions, companies, employers, and government agencies make critical decisions with greater confidence. Our unique blend of differentiated data, analytics, and cloud technology drives insights to power decisions to move people forward. Headquartered in Atlanta and supported by nearly 15,000 employees worldwide, Equifax operates or has investments in 24 countries in North America, Central and South America, Europe, and the Asia Pacific region. For more information, visit www.equifax.com.au or follow the company’s news on LinkedIn.

FOR MORE INFORMATION

[email protected]

ABOUT EQUIFAX CREDIT SCORECARD 2025

The Equifax Credit Scorecard offers market-leading insights into the credit habits and Equifax credit scores of Australian consumers. It combines an analysis of the credit scores of the Australian banking population with consumer research. This research was undertaken by Qualtrics on behalf of Equifax. The total sample size was 1,010 Australian 18+ adults. Fieldwork was undertaken in September 2025. The survey was carried out online. The figures have been weighted and are representative of all Australian adults (aged 18+).

The Equifax Credit Scorecard offers market-leading insights into the credit habits and Equifax credit scores of Australian consumers, based on an analysis of more than two million Equifax credit scores. An Equifax credit score is a summary of an individual’s credit information held by Equifax and indicates how credit providers may view consumers when they apply for credit. Equifax credit scores may be used by consumers to help them negotiate when applying for credit.

HOW TO ACCESS YOUR FREE EQUIFAX CREDIT REPORT AND EQUIFAX CREDIT SCORE

Consumers can access their free credit report from Equifax at equifax.com.au.

DISCLAIMER

Purpose of Equifax media releases:

The information in this release does not constitute legal, accounting or other professional financial advice. The information may change, and Equifax does not guarantee its currency or accuracy. To the extent permitted by law, Equifax specifically excludes all liability or responsibility for any loss or damage arising out of reliance on information in this release and the data in this report, including any consequential or indirect loss, loss of profit, loss of revenue or loss of business opportunity.

Related Posts

Mortgage demand hits four-year high as a second consecutive quarter of double-digit growth for credit cards is observed and most prominent among younger Gen Z’s.

The latest Equifax Business Market Pulse for Q4 2025 reveals a multi-speed recovery. Large businesses are leading the way on credit demand growth, with an observed increase in overall demand reaching heights of up to +19.4% (trade credit) in some sectors, such as hospitality.