Consumer Credit Demand Eases as Omicron Impacts Confidence and Spending Behaviour

Strong personal loan growth constrained by decreased demand for BNPL, credit cards and auto loans. Consumer credit demand eased in Q4 2021, as factors including supply chain issues and a resurgence in COVID cases impacted consumer spending behaviour.

Equifax Quarterly Consumer Credit Demand Index: Dec 2021

-

Overall consumer credit applications increased by +4.7% (vs Dec quarter 2020)

- Credit card applications declined -6.3% (vs Dec quarter 2020)

- Personal loan applications up +23.0% (vs Dec quarter 2020)

- Buy now pay later applications flat at +0.9% (vs Dec quarter 2020)

- Auto loan applications reduced by -3.1% (vs Dec quarter 2020)

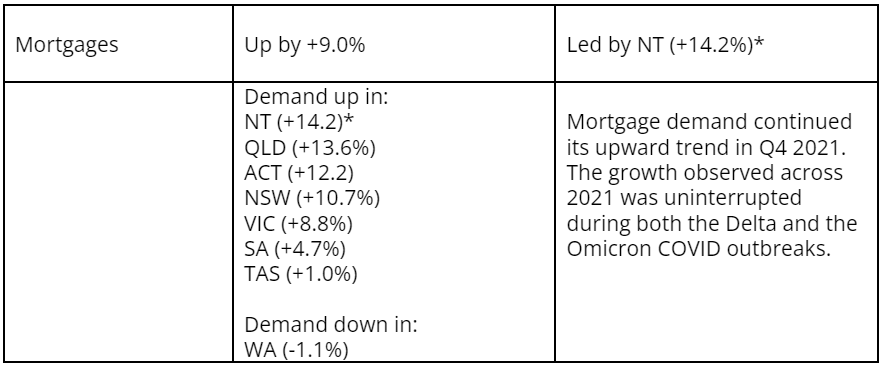

- Mortgage applications up +9.0% (vs Dec quarter 2020).

SYDNEY – 22 February 2021 – Consumer credit demand eased in Q4 2021, as factors including supply chain issues and a resurgence in COVID cases impacted consumer spending behaviour. While overall consumer credit demand was up +4.7% compared to the December quarter 2020, the rate of growth slowed from Q3 2021 and continued to trail pre-COVID demand, with Q4 2021 lower than the same period in 2019 by -18.3%.

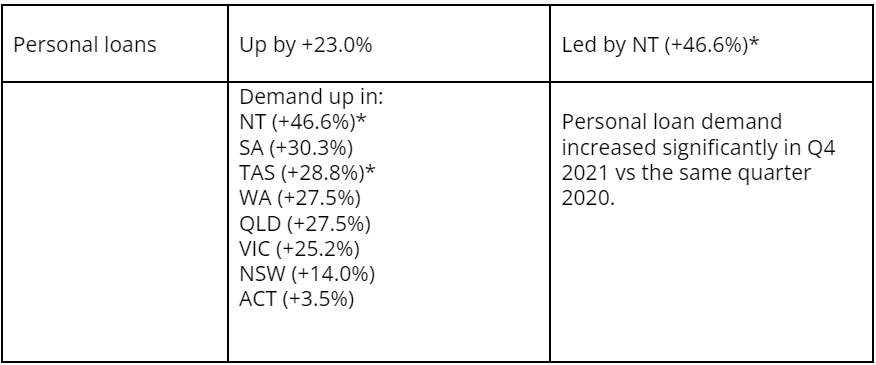

According to data from the latest Equifax Quarterly Consumer Credit Demand Index (Dec 2021), overall growth was led by increased demand for personal loans (+23.0%) , but declines in credit card and auto loan applications, and decreased appetite for buy now pay later, resulted in a drop in momentum. Mortgage demand continued to remain strong, up +9.0% for the December quarter 2021 compared to the same quarter the previous year.

Released today by Equifax, the global data, analytics and technology company and the leading provider of credit information and analysis in Australia and New Zealand, the index measures the volume of credit applications for credit cards, personal loans, buy now pay later (BNPL) and auto loans.

Kevin James, General Manager Advisory and Solutions, Equifax, said: “The easing of consumer credit demand in Q4 is reflective of Australia’s uneven COVID recovery. A number of industries were left vulnerable in the face of Omicron, with workers in industries such as tourism and hospitality particularly hard hit by the ‘shadow lockdowns’ experienced in several states. Additionally, the spike in cases around the festive period - usually a time of higher spending - meant consumers were wary of spending on traditional holiday activities like travelling and entertaining.”

Overall, consumer credit applications were up +4.7% in the December 2021 quarter compared to the same quarter in 2020, with the uptick driven by the strong performance of personal loan (+23.0%) applications. This marks the highest year-on-year growth for personal loans in the past four quarters, with demand edging back towards pre-COVID levels.

Mortgages also remain up on pre-COVID levels (+29.9% vs Q4 2019), with 62% of enquiries in 2021 coming from consumers with high credit scores of between 900-1100.

“The percentage of mortgage enquiries from people with high credit scores has been growing since 2018, reflecting a property market that has been increasingly dominated by investors - a trend that looks set to continue into 2022,” said James.

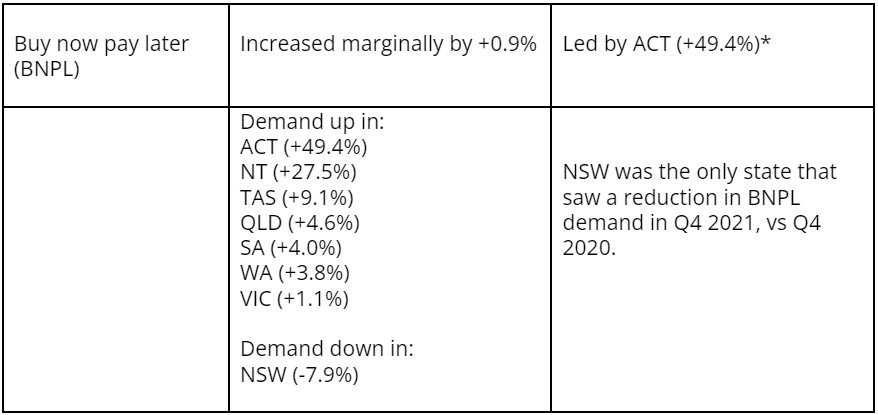

BNPL applications improved marginally in Q4 2021, up +0.9%. This was a steep drop from Q3, when BNPL applications were up +31.4%. NSW was the only state to experience a decrease in demand (-7.9% vs. Q4 2020), influenced by the Omicron lockdowns.

“The drop in demand for BNPL suggests the market is entering a more mature state. However, we expect to see another phase of growth for BNPL as the big banks and traditional financiers enter the market with their own products. Members of older demographics, who might appreciate the convenience of BNPL but are reluctant to engage with newer providers, may be more willing to engage with a BNPL option from an established financial institution,” said James.

Despite these gains, overall consumer credit demand remains -18.3 % lower than its pre-COVID level (Q4 2019).

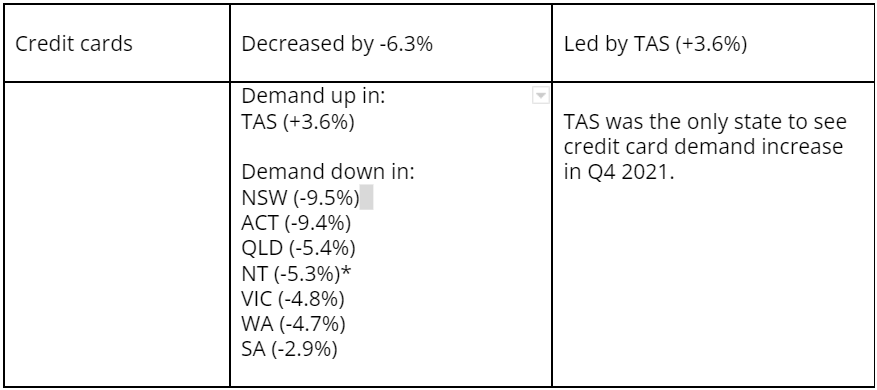

Credit card demand declined in Q4 2021, down -6.3% on the same quarter the previous year. Tasmania was the only state or territory to record an increase in credit card demand in Q4, while NSW recorded the largest decline. The downturn was a reflection of reduced consumer confidence during the Delta variant recovery period and the onset of Omicron.

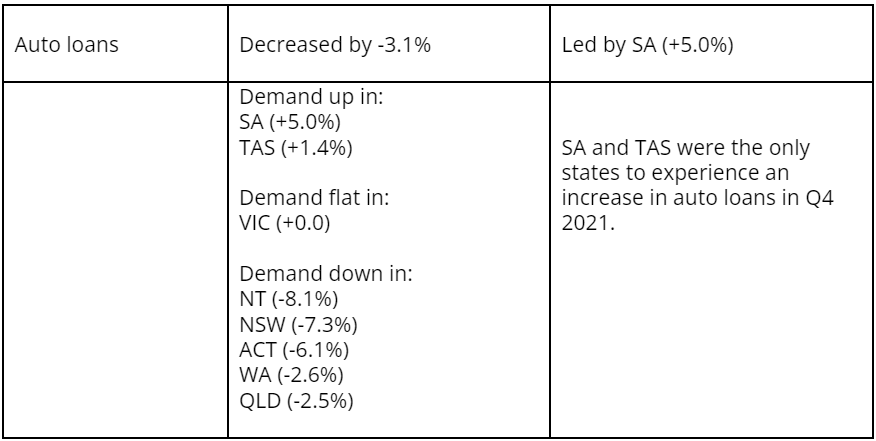

Auto loan enquiries reduced by -3.1% in the December quarter compared to the same period the previous year, although demand continued to vary between states. Supply chain issues contributed to mixed auto loan demand across the country, and is likely to be an ongoing challenge for the industry.

TABLE 1: Consumer Credit Demand by State (VS same quarter 2020)

Mortgage Demand

*Low volumes

IMAGE 1: Consumer Macro Credit Demand – Quarterly YOY

IMAGE 2: Consumer Credit Applications – Indexed by Type

* The data has been re-indexed* from 2018 to account for the recent inclusion of Buy Now Pay Later applications:

Re-indexed data to commence in 2018 (previously 2015)

Added buy now pay later and auto loan credit enquiries as a separate trendline (previously rolled up into personal loans)

ABOUT EQUIFAX INC.

At Equifax (NYSE: EFX), we believe knowledge drives progress. As a global data, analytics, and technology company, we play an essential role in the global economy by helping financial institutions, companies, employees, and government agencies make critical decisions with greater confidence. Our unique blend of differentiated data, analytics, and cloud technology drives insights to power decisions to move people forward. Headquartered in Atlanta and supported by more than 11,000 employees worldwide, Equifax operates or has investments in 25 countries in North America, Central and South America, Europe, and the Asia Pacific region. For more information, visit www.equifax.com.au or follow the company’s news on LinkedIn.

FOR MORE INFORMATION

NOTE TO EDITORS

The Quarterly Consumer Credit Demand Index by Equifax measures the volume of credit card, personal loan applications, Buy Now Pay Later and auto loan applications that go through the Equifax Consumer Credit Bureau by financial services credit providers in Australia. Credit applications represent an intention by consumers to acquire credit and in turn spend; therefore, the index is a lead indicator. This differs to other market measures published by the RBA which measure credit provided by financial institutions (i.e. balances outstanding).

DISCLAIMER

Purpose of Equifax media releases:

The information in this release does not constitute legal, accounting or other professional financial advice. The information may change, and Equifax does not guarantee its currency or accuracy. To the extent permitted by law, Equifax specifically excludes all liability or responsibility for any loss or damage arising out of reliance on information in this release and the data in this report, including any consequential or indirect loss, loss of profit, loss of revenue or loss of business opportunity.

Related Posts

The latest data from Equifax reveals Australians demonstrated strong financial resilience in 2025, amid an ongoing cost-of-living crisis, the national average credit score remained in the ‘Excellent’ range at 864 (out of a possible 1200), lifting by three points from the 2024 average of 861.

Survey reveals broker anticipation of commercial loans has more than tripled over the past year, while 72% of brokers say they plan to work with customers dealing with ‘mortgage regret’ amid recent rate cuts.