Equifax Quarterly Consumer Credit Demand Index: Mar 2022

-

Overall consumer credit applications were flat (+0.6% vs Mar quarter 2021)

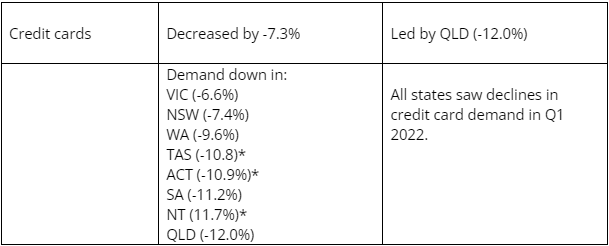

- Credit card applications declined -7.3% (vs Mar quarter 2021)

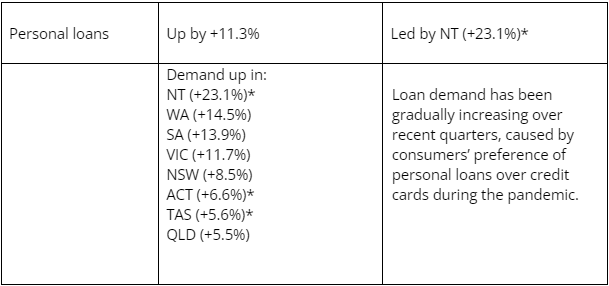

- Personal loan applications up +11.3 (vs Mar quarter 2021)

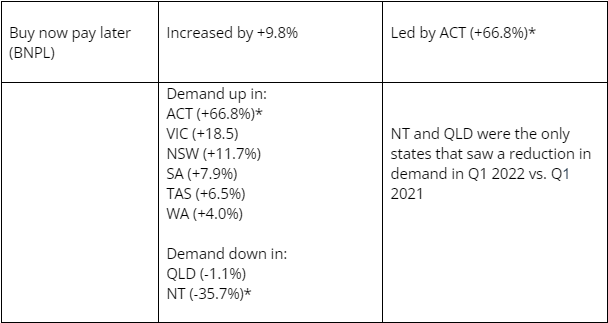

- Buy now pay later applications grew +9.8% (vs Mar quarter 2021)

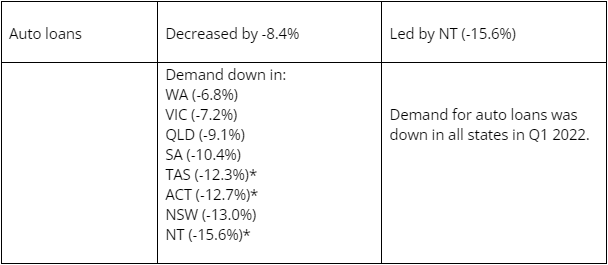

- Auto loan applications reduced by -8.4% (vs Mar quarter 2021)

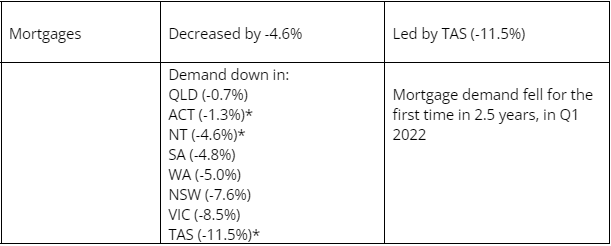

- Mortgage applications declined -4.6% (vs Mar quarter 2021).

SYDNEY – May 2021 – Mortgage demand fell -4.6% in Q1 2022, marking the first decline in more than two years according to the latest Equifax Quarterly Consumer Credit Demand Index (Mar 2022).

Released today by Equifax, the global data, analytics and technology company and leading provider of credit information and analysis in Australia and New Zealand, the index measures the volume of credit applications for credit cards, personal loans, buy now pay later (BNPL) and auto loan.

According to the latest data, consumer credit demand also eased significantly in Q1 2022, with moderate growth in buy now pay later and personal loan applications not enough to offset softening consumer spending behaviour and ongoing declines in credit card applications.

Kevin James, General Manager Advisory and Solutions, Equifax, said: “The decline in mortgage demand suggests that factors such as interest rate rises and uncertainty around what impact this will have on the housing market has started to have a tangible impact on consumer behaviour, both for prospective new home buyers and existing mortgage holders. We anticipate demand to slow further as additional interest rate increases are expected in coming months.

“While states that have contended with surging house prices for some time - like Tasmania, NSW and Victoria - saw significant drops in mortgage demand this quarter, Queensland remained relatively resilient. This could be indicative of recent migration to the state by people from cities like Sydney and Melbourne, who were able to negotiate greater work/life flexibility during the pandemic.”

Overall, consumer credit applications were up just +0.6% in the March 2022 quarter compared to the same quarter in 2021, and remain -12.2% below pre-COVID levels (Q1 2020).

Demand for personal loans (+11.3%) and buy now pay later (+9.8%) grew this quarter, with BNPL applications likely buoyed by post-Christmas and New Year sales purchases.

However, declines in credit card (-7.3%) and auto loan (-8.4%) applications led to the flat result in overall consumer credit demand.

“Throughout the pandemic, consumers have increasingly been turning to personal loans over credit cards, and this trend shows no sign of reversal,” said James.

Both credit card and auto loan demand fell in all states and territories, while personal loan demand rose across the country. Queensland and the NT were the only regions to record a decline in BNPL demand this quarter.

TABLE 1: Consumer Credit Demand by State (VS same quarter 2021)

Mortgage Demand

IMAGE 1: Consumer Macro Credit Demand – Quarterly YOY

IMAGE 2: Consumer Credit Applications – Indexed by Type

ABOUT EQUIFAX INC.

At Equifax (NYSE: EFX), we believe knowledge drives progress. As a global data, analytics, and technology company, we play an essential role in the global economy by helping financial institutions, companies, employees, and government agencies make critical decisions with greater confidence. Our unique blend of differentiated data, analytics, and cloud technology drives insights to power decisions to move people forward. Headquartered in Atlanta and supported by more than 11,000 employees worldwide, Equifax operates or has investments in 25 countries in North America, Central and South America, Europe, and the Asia Pacific region. For more information, visit www.equifax.com.au or follow the company’s news on LinkedIn.

FOR MORE INFORMATION

NOTE TO EDITORS

The Quarterly Consumer Credit Demand Index by Equifax measures the volume of credit card, personal loan applications, Buy Now Pay Later and auto loan applications that go through the Equifax Consumer Credit Bureau by financial services credit providers in Australia. Credit applications represent an intention by consumers to acquire credit and in turn spend; therefore, the index is a lead indicator. This differs to other market measures published by the RBA which measure credit provided by financial institutions (i.e. balances outstanding).

DISCLAIMER

Purpose of Equifax media releases:

The information in this release does not constitute legal, accounting or other professional financial advice. The information may change, and Equifax does not guarantee its currency or accuracy. To the extent permitted by law, Equifax specifically excludes all liability or responsibility for any loss or damage arising out of reliance on information in this release and the data in this report, including any consequential or indirect loss, loss of profit, loss of revenue or loss of business opportunity.

Related Posts

The latest data from Equifax reveals Australians demonstrated strong financial resilience in 2025, amid an ongoing cost-of-living crisis, the national average credit score remained in the ‘Excellent’ range at 864 (out of a possible 1200), lifting by three points from the 2024 average of 861.

Survey reveals broker anticipation of commercial loans has more than tripled over the past year, while 72% of brokers say they plan to work with customers dealing with ‘mortgage regret’ amid recent rate cuts.