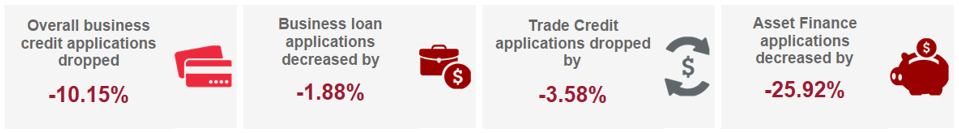

- Business loan applications decreased by -1.88% (vs March qtr 2018)

- Trade Credit applications dropped by -3.58% (vs March qtr 2018)

- Asset Finance applications fell by -25.92% (vs March qtr 2018)

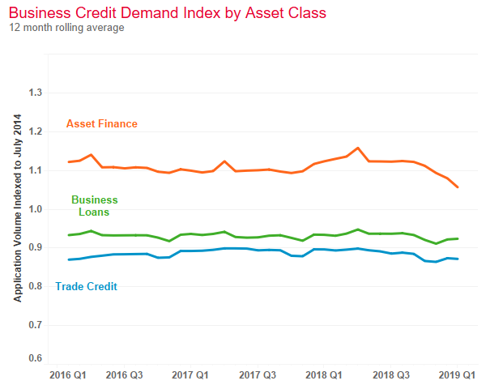

The Business Credit Demand Index by Equifax measures the volume of credit applications that go through the Commercial Bureau by credit providers such as financial institutions and major corporations in Australia. Based on this it is a good measure of intentions to acquire credit by businesses. This differs to other market measures published by the RBA/ABS which measure new and cumulative dollar amounts that are actually approved by financial institutions.

Related Posts

19th Feb 2026

Highlights:

Boost straight-through-processing by instantly applying custom underwriting rules to verified income data

Achieve speed without compromising risk or regulatory compliance

Improve customer experience while lowering operational costs.

Read more

Highlights:

Mitigate the surge in AI-generated digital forgeries by moving from document-based checks to source-verified payroll data Combat sophisticated salary staging and liar loans with an automated, single source of truth Establish digital trust at the point of contact to protect your organisation from credit and compliance risks.