Equifax Market Insight: Navigating the current retail credit market

A clear picture of the future for credit markets is challenging in the short term. However, as lenders attempt to navigate through this period of enormous market uncertainty, Equifax aims to help provide some clarity on what trends are developing, what challenges are foreseeable, how lenders can assess the risks to portfolios and make changes to risk management controls.

External Environment

As at 18 March 2020, COVID-19 was declared a global pandemic. Australia, like other countries is continuing to implement a number of unprecedented controls to prevent community transmission and these controls are likely to cause significant economic disruption. To counter this, the Federal Government has also made announcements on stimulus packages for individuals and businesses.

There are some impacts that are strongly evident and will start to impact credit markets in the near term, these include:

- International Tourism – including travel agents, accommodation, airlines and cruises

- Events – including sports, conferences and catering

- Arts and entertainment – including casinos, theatre and concerts

- Hospitality – restaurants, cafes, pubs and clubs

Tourism alone makes up over 13% of GDP and these industries above employ a significant number of permanent, casual and contract workers. This will have an immediate impact on both unemployment and underemployment whilst controls remain in place. The analysis that follows will seek to elaborate on the scale of the impact to individuals in these industries.

Origination

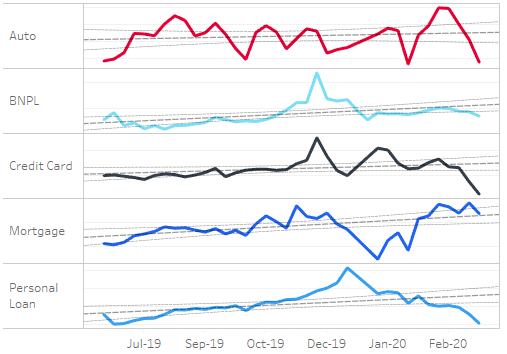

Weekly credit demand volumes are showing some potential trends developing, however given that societal impacts only commenced in early March, it is too early to confirm trends. Weekly credit enquiry volume trends to 22 March are shown in Figure 1. Observations as follows:

- Mortgage showing little change in trend

- Auto showing a drop in w/c 16 March only

- Personal Loans showing drop from w/c 9 March.

- Credit Card demand is down 20% since the beginning of February

- Buy-Now-Pay-Later are showing a flattening in demand since Christmas. This is largely to be expected due to retail spending patterns

Figure 1 – Weekly credit enquiry volumes, excluding w/c 23/12 and 30/12

Credit Risk Implications

As various industries are affected by social distancing measures, lenders should consider expanding the questions asked as part of a responsible lending assessment about income. Impacts to businesses and their response will vary not only by industry, but also by company.

Immediate effects on unemployment and underemployment will vary significantly by industry and job type. Bill Evans, Chief Economist at Westpac is forecasting unemployment to rise to 11.1% by June 2020 before recovering to 8.8% in the December quarter1.

The industries; Accommodation and Food Services, and Arts and Recreation services account for 5.2% of full time and 16.2% of Australia’s full-time workforce2.

On the positive side, other industries may see an increase in employment, for example: Health care and social assistance, and Information Media and Telecommunications.

Portfolio Management

As economic disruption progresses, repayment history information is likely to become more important in understanding individual risk and aggregate portfolio risk. The monthly reporting cycle for CCR data means sufficient data is not yet available for insights, however it will be much more timely than we have ever had in the past.

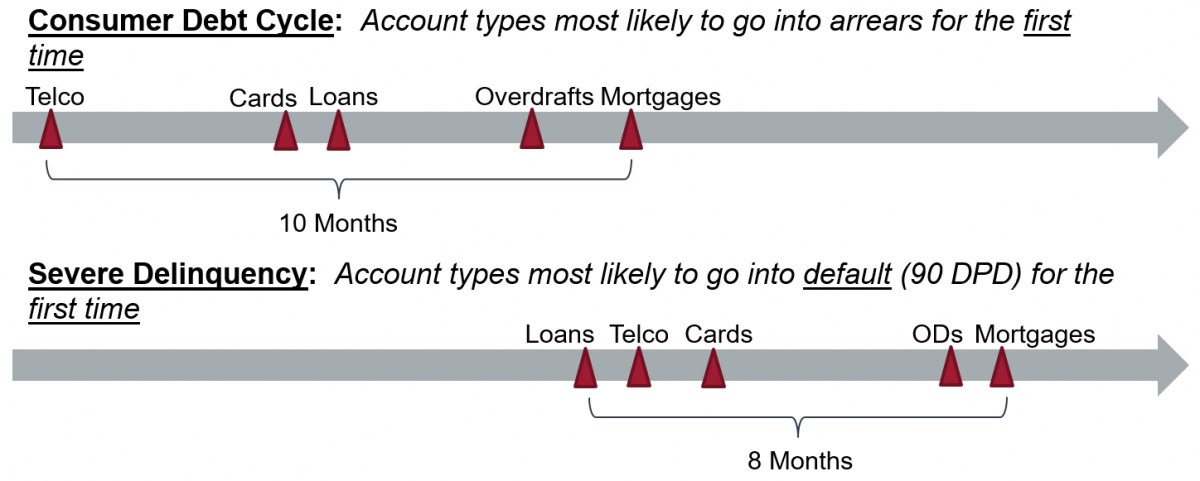

Analysis Equifax previously conducted in New Zealand has shown that consumers’ payment behaviour differs by portfolio. This results in arrears and delinquency appearing at different times in different portfolios as shown in figure 3.

Figure 2: Arrears and delinquency by account type

Recent analysis of Australian data confirms these trends, and that repayment behaviour also varies depending on whether accounts are with the same lender or across different lenders.

Credit Risk Implications

Portfolio management will be a key focus for many organisations. The economic disruption has, and will continue to, result in significant changes to key underlying assumptions for portfolio arrears, loss rates, provisioning, resourcing and capital adequacy.

There are a number of actions lenders may take to help better prepare portfolios as the economic disruption evolves. These may include:

- Stress testing portfolios based on potential economic scenarios

- Assessing the proportion of at-risk individuals in portfolios

- Developing customer assistance strategies to mitigate consumer impact

- Reviewing funding covenants alongside forecast scenarios

Collections

There will be an increase in arrears portfolios in the short to medium term and potentially beyond. Lenders are likely to start seeing delinquency trends in April as the impact of March economic disruption starts to affect consumers.

The key economic indicator of unemployment and underemployment will need to be monitored closely as it has a symbiotic relationship to arrears.

Collections operations are heading into a difficult period balancing internal staff safety while having an ability to communicate with customers. Immediate impacts will be felt by any offshore operations in Manila and India with quarantine measures being implemented that have impacted call centre staff from reaching work sites.

Credit Risk Implications

The primary consideration for policy change or development is the identification and treatment of vulnerable customers and hardship. Through this period an influx of over indebtedness, unemployment and the volatility of consumers’ incomes will be identified in portfolios. Identifying customer segments most vulnerable as early as possible will help gain insight into the risk within portfolios. A large portion of these customers will need some sort of hardship assistance. A number of lenders are already offering 6 month payment holidays to home loan customers.

Business Continuity Plans (BCP) will be tested, if not already. Interruptions to operations will be felt in different forms and locations, so if you have limited digital communications capability, investment in this area may assist with maintaining continuity.

Summary

These are unprecedented times that continue to develop at a record pace. The success of mitigating impacts being deployed by governments and organisations at the health, social, economic and operational level will become clearer in the coming months. It is incumbent upon credit risk professionals to evaluate the current and future impact to customers, portfolios and business profitability in order to help ensure better outcomes for all stakeholders.

Retail Credit Insights prepared by Stuart Musgrave, Principal Advisory Services Consultant, and Nick Jenkins, Debt Services Solution Consultant, Equifax

1 https://westpaciq.westpac.com.au/Article/42722

2 ABS 6333.0 - Characteristics of Employment, Australia, August 2019, Table 10