Equifax Market Insight: Navigating the Current Retail Credit Market

As lenders attempt to navigate through this period of enormous market uncertainty, Equifax will provide a series of regular analysis. Presenting a clear picture of the future for credit markets is challenging in the short term, we hope to provide some clarity on what trends are developing, what challenges are foreseeable, how you can assess the risks to your portfolios and make prudent changes to your risk management controls.

The focus for this edition will be to review the current economic situation, its impact on credit demand and to share some analytical insight we have completed on the performance of credit analytics in a crisis / recessionary period.

External Environment

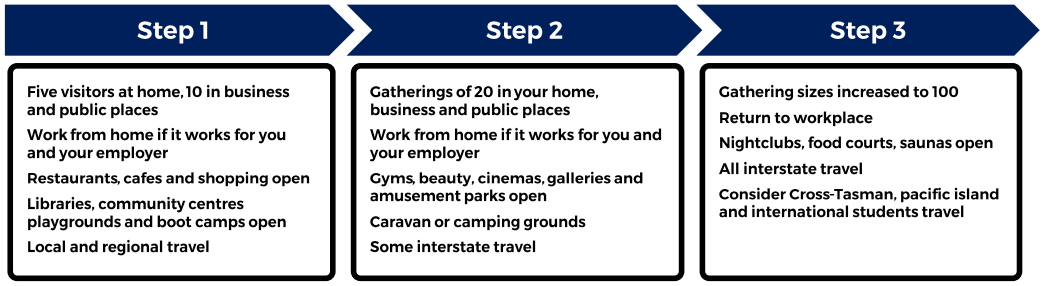

Following a seven week shutdown that appears to have been largely successful in suppressing the spread of COVID-19, Federal and State Governments have released plans to a controlled relaxing of social distancing measures. Australia and New Zealand are now in a position to be able to begin charting an economic path forward1.

Importantly, this plan provides some visibility as to the timing that different industries will be permitted to return.

The economic stimulus packages have started to provide funds to individuals and businesses with around $20 billion paid out in April and another $30 billion forecast for May2. The success of these programs will be critical to their recipients’ solvency until such time as demand returns to near normal levels. However, return to a ‘normal’ state in the near term is unlikely for several industries that rely on mass gatherings, such as education, tourism and hospitality.

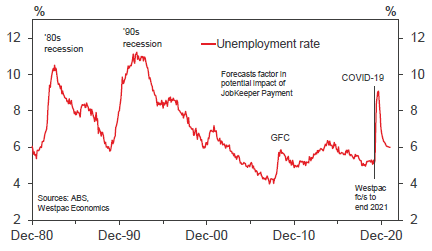

Westpac economists have maintained their forecasts for economic growth and unemployment, with the following high-level conclusions3:

- June quarter GDP to contract by 8.5%, with unemployment peaking at 8.9%

- December quarter GDP to lift by 7.7%, with unemployment recovering to 7.6%

Figure 1 - Unemployment History and Forecast

They also noted that the forecast for unemployment had been reduced from 17% to 8.9% on the basis of the government stimulus measures.

The measures being taken by the Federal Government are important for credit risk management as they help to firm up scenarios of how a downturn may impact on credit portfolios. These scenarios allow us to develop strategies to manage aggregate portfolio risk and formulate appropriate customer assistance.

Many lenders have now made assistance programs available to affected customers. Market disclosures indicate that some 643,000 loans with an aggregate value of over $200 billion are now subject to payment deferral programs4. These programs predominantly relate to mortgages (392,000). This represents over 5% of all mortgages on issue but has been reported as a significantly higher proportion for some lenders.

The fourth quarter of 2020 is shaping up to be particularly critical for credit risk management. At present, the following programs are scheduled to end in September:

- JobKeeper payments

- JobSeeker increased payments

- Lender six-month payment deferral programs

The Federal Government is targeting to have the majority of the country at Step 3 on the COVIDSafe roadmap by July, which would enable many individuals and businesses to return to work before September. This does however rely on:

- Each state being able to suppress transmission sufficient to progress through to Step 3

- Consumer consumption and business activity to return to normal levels

Origination

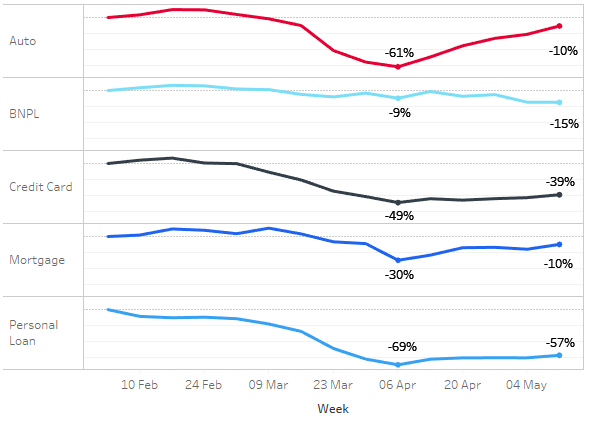

Weekly credit demand volumes are showing some significant short-term trends. Weekly Equifax credit enquiry volume trends to 10 May are shown in Figure 1. Observations as follows:

- Mortgages fell modestly up until Easter, subsequently recovering half of the loss

- Auto dropped up until Easter, followed by a stronger demand

- Cards and Personal Loan (fixed) have had the most significant falls. The decline appears to have stabilised since Easter

- Buy Now Pay Later has shown little or no impact on demand

Figure 2 - Enquiry volume trends

Origination volumes too have generally fallen in line with credit demand.

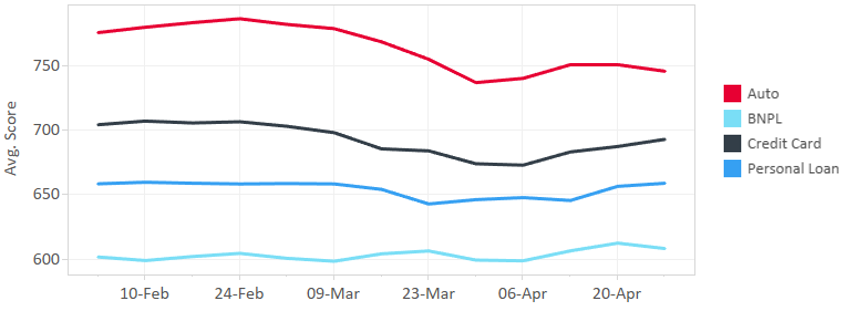

Credit quality has remained steady for Mortgages and Buy Now Pay Later. Personal loans saw a small decrease in credit quality, which has since recovered. Credit Cards and Auto evidenced more significant declines that have not fully recovered. In the case of Auto, the application channel could be having an influence as dealer originated applications may be of higher credit quality than those initiated online.

Figure 3 - Credit quality by loan type

Credit Risk Implications

The primary consideration for potential changes to origination credit policy at this point remains stability of income. Timings for easing of unemployment and underemployment by industry and job type can be guided by the COVIDSafe roadmap.

A responsible lending assessment requires inquiry and verification on income and inquiry about foreseeable changes in financial situation. It is likely that a significant proportion of applicants will have and continue to evidence some change in the amount of income received, especially those employed on a casual basis or who receive regular overtime. As such, additional inquiry and verification may be required for many applicants for at least the remainder of 2020.

A number of lenders have adjusted their origination policies to slightly more conservative settings. The primary motivator for some has been internal risk appetite, although some have been influenced by funders or insurers. These measures have included:

- Reduction or suspension of marketing activity

- Applying additional criteria for approval or verification for applicants in nominated industries

- Adjustment of score-based cut-offs

- Changes to policy settings such as loan amount maximums or LVR requirements

Credit Analytics

We have received a number of questions from lenders and other industry stakeholders for information about how credit analytics are likely to perform through this crisis, particularly with the number of payment deferral and assistance programs that are currently in place. Added to this uncertainty is that Australia has not experienced a technical recession since the early 1990’s.

In order to provide an assessment of performance through this economic downturn, we have analysed the following:

- Performance of bureau scores through the Global Financial Crisis (GFC)

- Simulation of payment deferrals on RHI using Equifax Apply

Performance through the GFC

The Australian economy was not severely affected through the GFC, due to the government stimulus that was employed and a sharp reduction in interest rates. Nevertheless, unemployment rose from 4.0% at the beginning of 2008 to 5.9% in Q2 of 20095. By contrast, forecasts for the current economic downturn are for it to be more severe.

Significant increases in bureau default rates were observed by Equifax post-GFC when compared to the prior comparable period.

Figure 4: Change in default rates

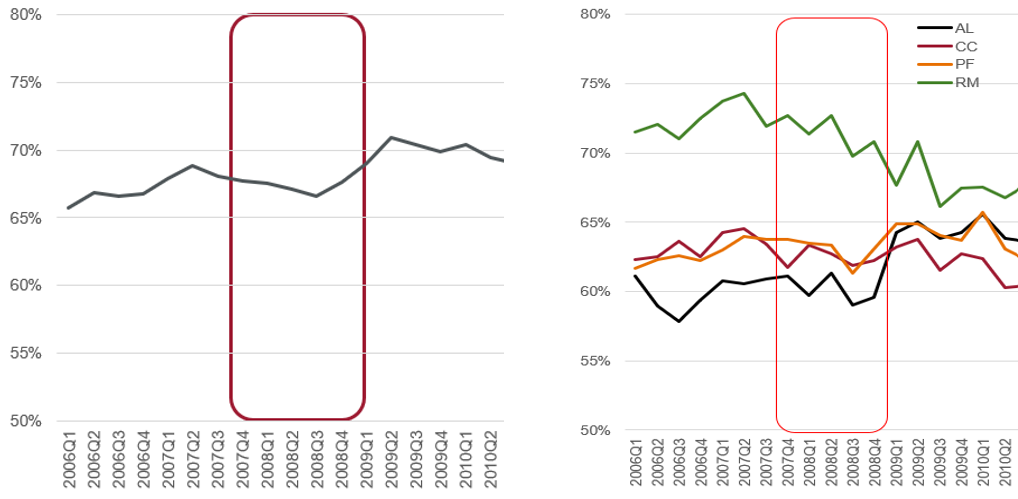

Interestingly, the average Equifax score had been decreasing in the lead up to the GFC, but then increased through to 2010, particularly in secured portfolios.

Performance of the Equifax Apply (Negative) score as measured by the Gini coefficient (Gini) remained relatively stable, both overall and by portfolio. This indicates that the score was able to risk rank effectively through this period.

Figure 5: Equifax Apply Gini performance Figure 6: Gini by portfolio

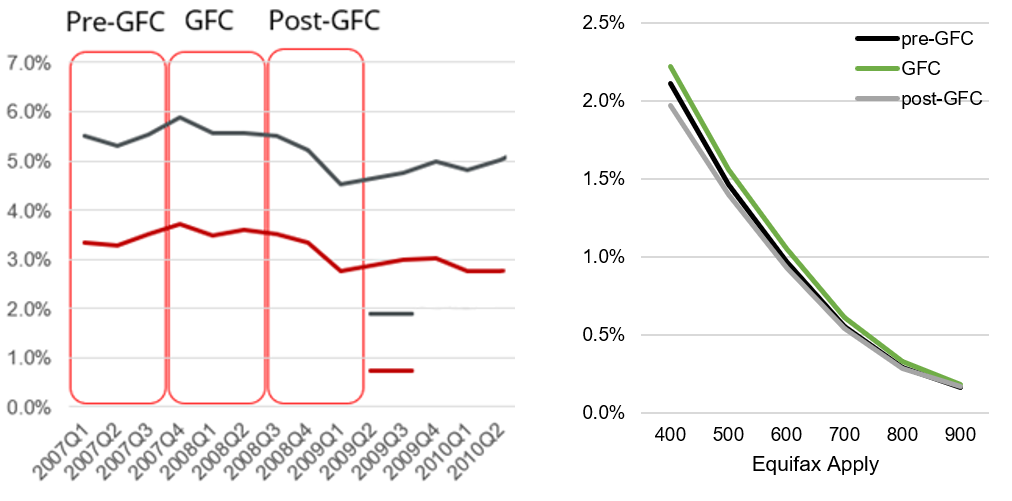

Gini performance is important, however change in bad rates above a score cut-off will define portfolio performance. A higher level of arrears across the population usually translates into an increase in bad rates across the board. This was the case in Australia during the GFC.

Figure 7: Population bureau bad rates Figure 8: Bad rate above score cut-off

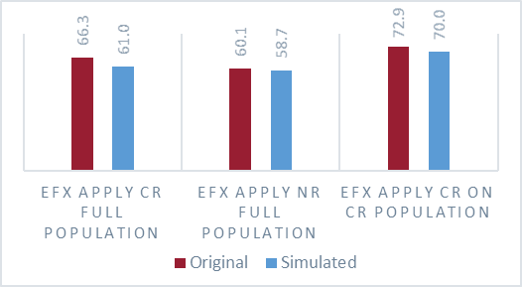

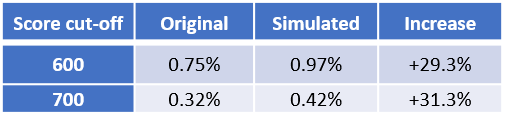

Score cut-offs around 600-700 are common for prime credit portfolios. Looking at these cut-off levels specifically, we can see that there was a modest increase in bad rates, as shown in Figure 9.

Figure 9: Bad rates above score cut-off

There was some variance in the impact at a portfolio level, however this was relatively modest. Mortgages saw the largest increase (+13-14%) whilst Personal Loans resulted in the least impact (+3-6%).

Payment Deferral Simulation

Concern has been raised about the impact on credit analytics resulting from the widespread payment deferral and hardship programs being offered to consumers. The most common treatments currently in use that affect credit reporting information are:

- Payment deferrals – resulting in RHI=0 for up to date accounts and RHI suppressed for accounts in arrears

- Hardship – resulting in RHI suppression with consequent delays in default listing and/or debt sale.

To assess possible impact, we sampled 645,000 credit enquiries from Q4 of 2018 and assumed a worst-case scenario involving:

- RHI set to zero for six months for all up to date accounts

- RHI suppressed for six months for all accounts in arrears

- RHI for newly opened accounts set to zero

- Removal of six months of default listings

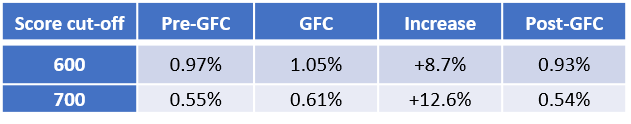

Simulating these changes on the sample population showed only a small decrease in Gini for both the negative and comprehensive Equifax Apply scores. This is shown in Figure 10.

Figure 10: Gini performance of Equifax Apply

The reduction in Gini can be attributed to:

- RHI changes creating a calibration shift

- Recently open accounts moving to Negative score segment (13%)

- Removal of recent defaults

The impact on bad rates was also modelled under this simulation. The impact on Equifax Apply negative was negligible, however the impact on Equifax Apply Comprehensive was more significant, as shown in Figure 11.

Figure 11 - Simulated bad rate impact on Equifax Apply CR

The impacts noted above to both Gini and bad rate above a cut-off are based on a worst-case simulation. The current expectation in market is likely to limit the impacts to score performance as follows:

- CCR data supply has increased from 59% to 87% since 2018 Q4

- Payment deferral programs are currently reported to cover up to 10% of retail accounts

- Default listing has slowed, but not ceased – financial default volumes in April-20 were 57% of average

Together, these factors are likely to result in a much smaller impact to score performance as measured both by Gini coefficient and bad rate above a score cut-off.

Credit Risk Implications

The analysis and simulation detailed above show that bureau scores can be impacted by both crisis events and lender assistance programs. Experience from the GFC and simulations of current payment deferrals show that in both scenarios, scores continue to risk rank very effectively. A more significant impact is likely to be felt in the calibration of the score to the resultant bad rate, as the bad rates increase across the population.

The current COVID-19 crisis and economic downturn are forecast to be more severe than most of us have experienced in our working careers. This makes it difficult to forecast the magnitude of changes to bad rates over the foreseeable future. At this point in time, it may be prudent to maintain conservative risk policy settings within an organisation’s risk appetite. Scenario modelling may help estimate potential impacts based on an organisation’s portfolios and customer base. Many lenders are likely to now be able to estimate key parameters relating to the current impact on customers. By continuing the conversation with borrowers, further improvement in the outlook accuracy may be achieved as data is gathered about returning to work at different stages of the COVIDSafe Roadmap.

Summary

The last 2-3 months have turned many plans and forecasts, both personal and professional on their head. Thankfully Australia appears to be navigating an enviable path from both a health and economic perspective. There is still a long way to go to recover, and build a ‘new normal’. This will take time, however, the path forward is becoming progressively more certain.

Understanding what hasn’t changed is often as important as learning about what has. To this end, I hope through this analysis that we have been able to give you a better perspective on how credit analytics can provide some stability through effective risk ranking your applicant population.

Retail Credit Insights prepared by Stuart Musgrave, Principal Advisory Services Consultant, Equifax.

1https://www.pm.gov.au/sites/default/files/files/covid-safe-australia-roa...

2https://ministers.treasury.gov.au/ministers/josh-frydenberg-2018/speeche...

3https://westpaciq.westpac.com.au/wibiqauthoring/_uploads/file/Australia/...

4https://www.bankingday.com/public/7b6d6f28-0e9b-498a-a5f9-e1b808b77f7a

5https://www.abs.gov.au/ausstats/abs@.nsf/mf/6202.0