Insolvencies on the rise | Get the latest insights

(29 April, 2021)

Whether or not the end of the JobKeeper wage subsidy will lead to a spike in corporate insolvencies is a hotly debated topic. Some believe that Australia's strong economic recovery and favourable trading conditions will insulate against a wave of business failures.

Others argue we can't be that lucky.

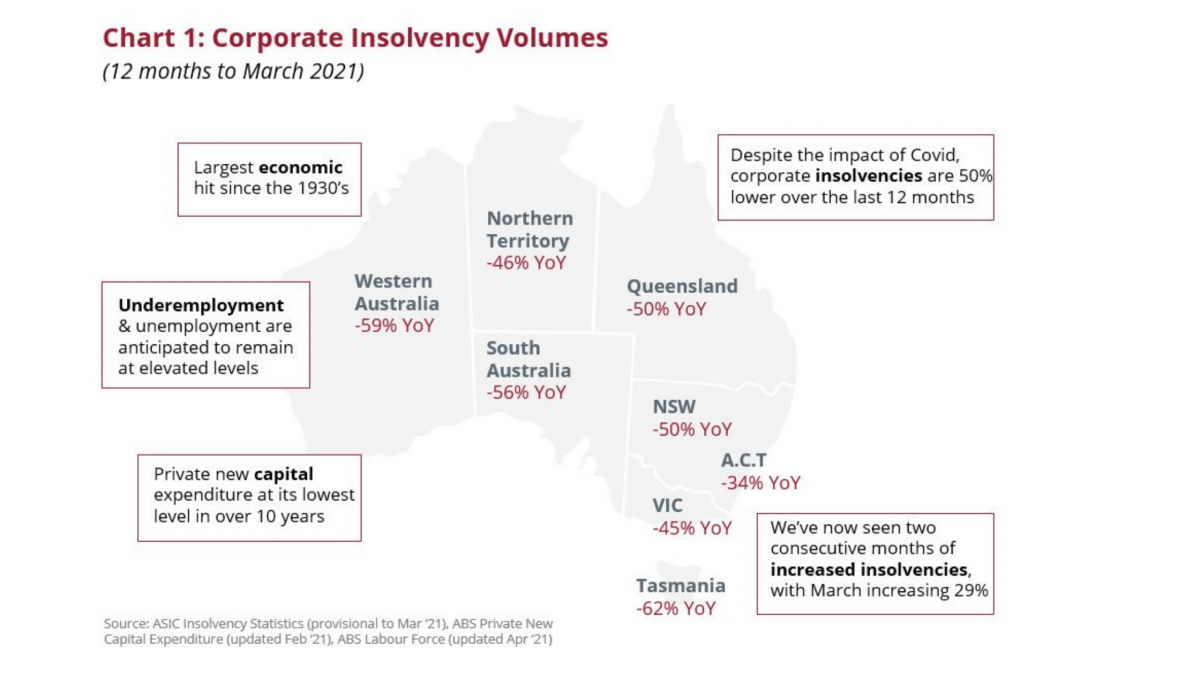

The Australian economy has indeed weathered COVID-19 better than was initially predicted. Corporate insolvencies are more than 50% lower than pre-pandemic levels and at their lowest overall level in more than 20 years. But with the last of the wage subsidy stimulus removed, the outcome can only go one way. The withdrawal of that type of cash will start to uncover financially stressed businesses, and corporate insolvency levels will inevitably increase.

While Australia's recovery will be multi-speed, Equifax analysis shows corporate insolvencies will more than double over the next twelve months, with particular risk across deferral and hardship populations. However that is only the tip of the iceberg, and we should expect to see hundreds of thousands of business exits over the next twelve months. And following recent reviews of the new small business restructuring procedure, some have suggested many businesses will be too poor to go broke, and owners will simply walk away from their insolvent businesses.

The perfect insolvency-generating storm

Despite all the upbeat commentary of recent months, it remains the case that Australia has recently suffered its deepest economic contraction on record, with GDP collapsing 7% through the June 2020 quarter. Although the jobless rate didn't reach double-digit levels, it did attain its highest level in over a decade, as did the underemployment rate. And now, with the expiry of JobKeeper, the aggregated unemployment and underemployment rate is anticipated to remain at elevated levels. Despite an increase in forward orders and capacity utilisation, it remains the case that private new capital expenditure is at its lowest level in ten years.

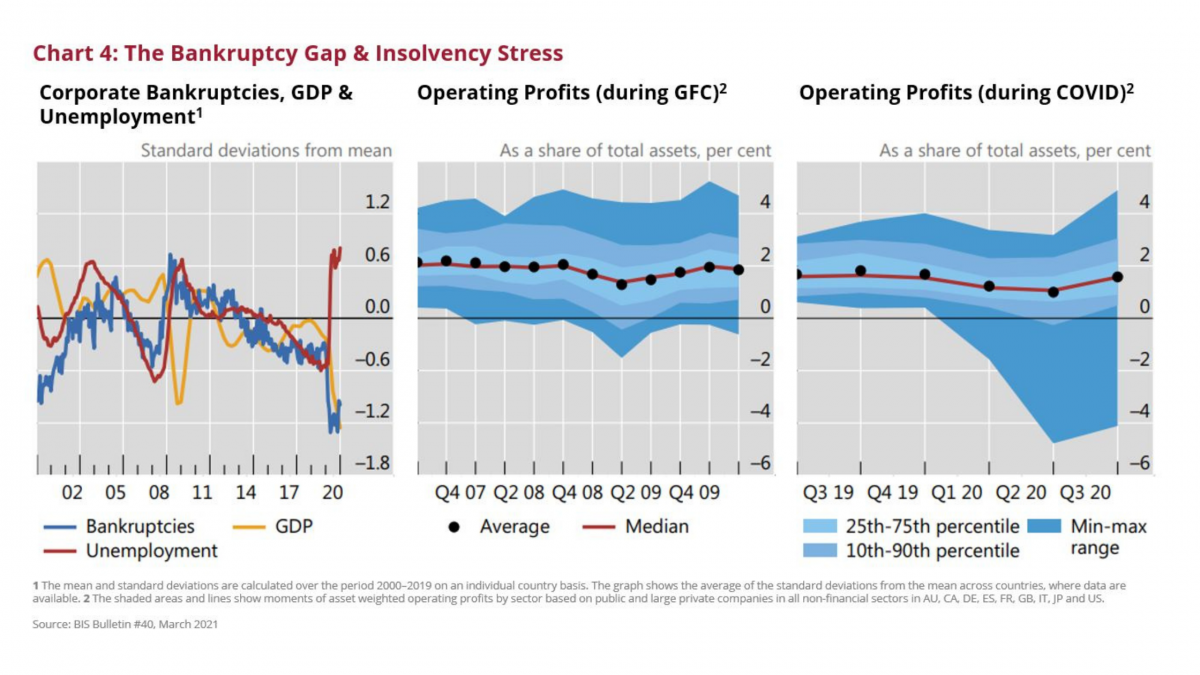

The fall in GDP that Australia experienced last year was far greater than it experienced during the global financial crisis (GFC). In their April 2021 update of the World Economic Outlook, the International Monetry Fund (IMF) reported that the COVID-19 pandemic has led to a severe global recession, with global output declining three times as much as during the GFC, in half the time. And while their assessments of medium-term economic scarring will continue to evolve, medium-term output losses following the pandemic are expected to be significant.

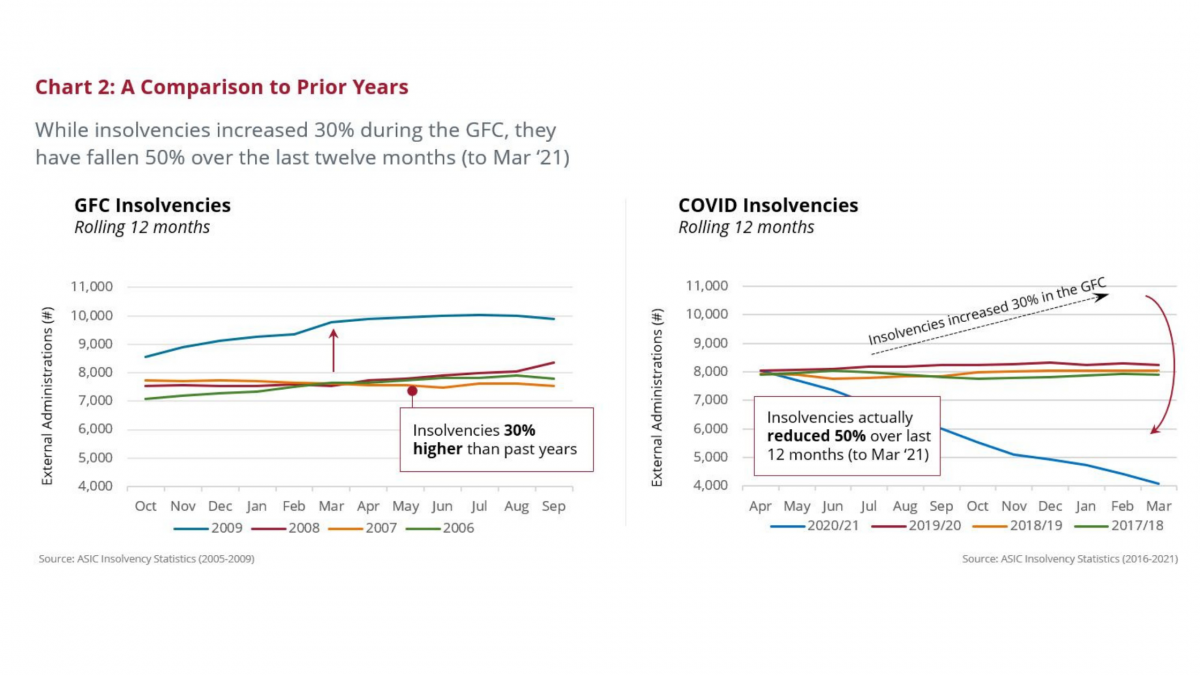

During the GFC, Australia was fortunate that the Reserve Bank of Australia (RBA) had plenty of scope to cut interest rates. Also, China was eager to import lots of Australian resources to use in economy-stimulating infrastructure projects. The Australian Government also applied targeted fiscal stimulus to support the building and construction industry through the $42b nation building plan. And despite these measures, corporate insolvencies increased 30%.

Today there is limited capacity to get the economy moving by cutting interest rates, and we are on the other side of China's infrastructure investment peak, with a softer investment outlook in the years ahead. However, the Australian Government moved quickly and decisively in executing a number of economic support packages including JobKeeper, being one of the largest fiscal and labour market interventions in Australia’s history.

Businesses kept alive by insolvency policy action

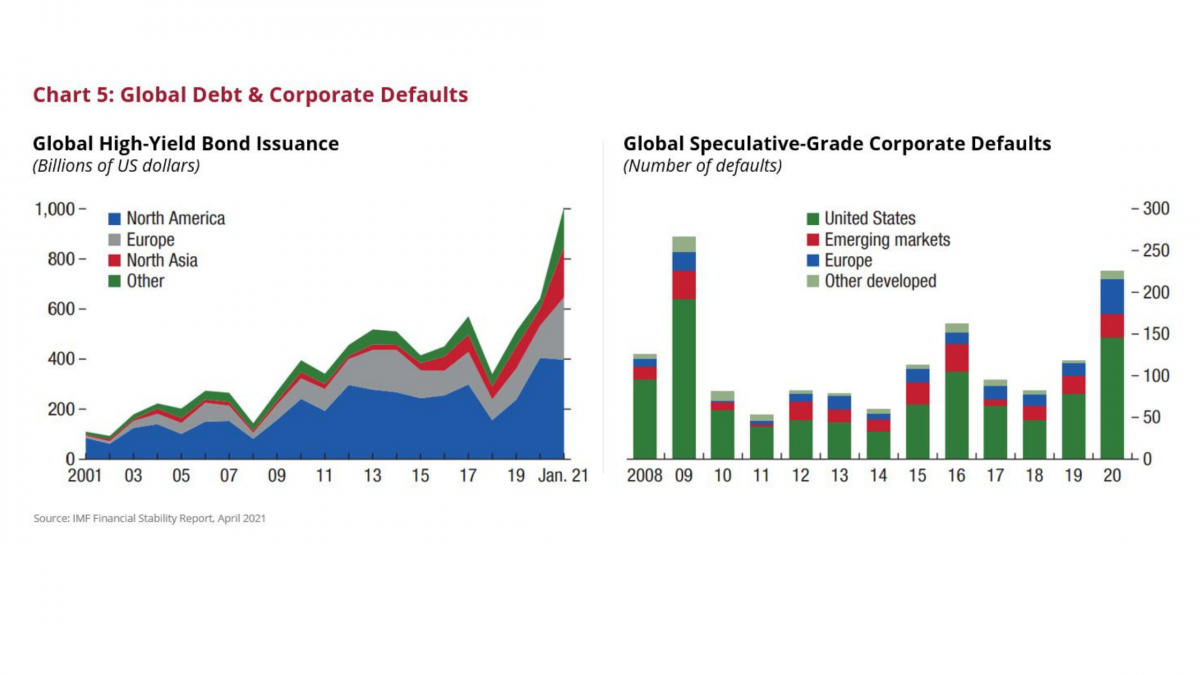

Overall there has been an enormous increase in global debt across Governments, businesses and households, and the Institute of International Finance reported the pandemic added US$24 trillion to global debt levels last year. The IMF advised public debt has reached record highs, with the fiscal response being unprecedented in speed and size. Many nations pursued initiatives to support continued access to credit and to sustain employment. Combined with other temporary support programs, these measures resulted in a decline in corporate bankruptcies, despite widespread lockdowns and supply chain disruptions.

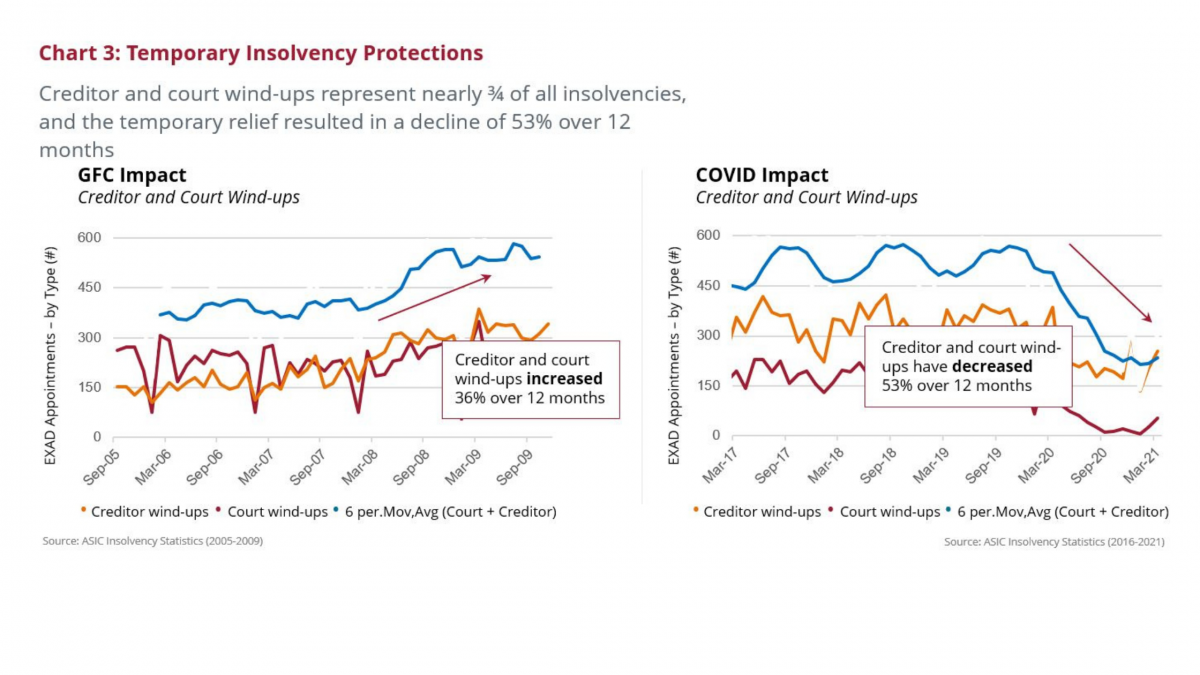

The IMF acknowledged the decline in bankruptcies was also influenced by other policies that prevented creditors from enforcing claims on struggling firms. In Australia, the temporary relief for financially distressed businesses included raising the threshold at which creditors could issue a statutory demand for unpaid monies, as well as the threshold when they could initiate bankruptcy proceedings. More specifically, the threshold before creditors could issue a demand was increased ten times (from $2k to $20k), with the period extended from 21 days to six months.

In effect, the creditor's gun had its firing mechanism removed, so they could not pull the trigger to recover unpaid monies. And when court and creditor wind-ups represent nearly three-quarters of all corporate insolvencies, it's no surprise that we have seen such a significant drop in corporate insolvencies.

Many unprofitable businesses were able to continue trading, being able to accumulate further trading and financial debts. In a recent bulletin from the Bank for International Settlements (BIS, March 2021), they highlighted that debt has increased strongly in loss-making firms, and that borrowing for many loss-making firms has exceeded their accumulated losses. They reported that “whilst the increase in credit has prevented business firms’ insolvency in the short-term, it has also increased their indebtedness”.

The Australian Institute of Credit Management (AICM) have advised that their members are reporting instances where businesses moving towards insolvency before lockdowns now have debt levels that are ten times higher due to the temporary moratoriums. While some have described this as 'kicking the can down the road', others recognise Australia's insolvency policy action has increased the size of the overall debt burden and likened it more to 'a snowball that has been growing in size'.

There has been much debate on the impending impact of zombie firms, despite highly accommodative and supportive settings, global debt issuance has risen to record levels as companies have sought to deal with liquidity pressures. The IMF also reported the number of corporate defaults from firms issuing speculative-grade debt has reached its highest level since the GFC. And while policy action has undoubtedly kept many viable firms afloat, it has also kept alive inefficient firms that would have failed even without the downturn. And now with the withdrawal of this support, the unfortunate truth is that it will hit smaller firms the hardest.

Last month Assistant Governor at the RBA, Chris Kent, acknowledged that smaller businesses overall had "suffered significantly" from economic hardship due to the pandemic and warned that business failures were expected to rise as some of the pandemic support measures were phased out.

Financially distressed businesses seek relief

The unfortunate reality is that when people are financially distressed, the large majority do the wrong thing. A review of corporate insolvencies undertaken before the pandemic revealed that director and officer misconduct was apparent in 9 out of 10 external administrations. Corporate liquidators reported that despite there being reasonable grounds to suspect company insolvency, 71% of all reported misconduct involved breaches of insolvent trading provisions.

These findings were consistent with personal bankruptcies. Overwhelmingly, most people going bankrupt sought more credit when they knew they were already over-committed, causing even more financial harm. This is concerning as the Melbourne Institute declares stress levels have increased since late last year, with 3 out of 10 people reporting financial stress. (Pulse of the Nation Survey, April 2021)

Since September last year, Equifax has seen a continual increase in arrears across personal loans. We also know that many small to medium-sized businesses (SMBs) often lean on their personal finance to prop up and support their business. Last year we saw many SMBs drawing down on facilities and deferring debt repayments, noticing that business proprietors were 50% more likely to postpone mortgage repayments than others.

Businesses that use debt deferral, especially those that have deferred for longer periods, are more likely to enter into arrears following the expiry of these programs. Since late last year, Equifax has noticed that business proprietors with mortgages are starting to show signs of stress, with an increase in 30 days arrears for this demographic.

Harder for SMBs to obtain credit

This business distress coincides with a more challenging period to obtain further finance, especially for those more thinly or aggressively capitalised. To that end, the Government has sought to extend the SME responsible lending exemption further and provide a new recovery loan scheme to provide continued assistance to firms that received JobKeeper. For those eligible, the Government will guarantee 80% of SMB loans (up to $5m), and lenders can offer borrowers a repayment holiday of up to 24 months.

However, in addition to debt finance, SMBs typically operate on a network of trade credit, which for many businesses typically represents nearly the same amount as bank debt. And following the withdrawal of credit insurance and the collapse of Greensill, many investors and insurers have been carefully considering their appetite for supply chain finance and working capital solutions. SMBs are typically the primary beneficiaries of this type of finance. The worldwide trade association, ITFA, has warned that as SMBs are generally under-funded, this will hurt them badly. Most are critically dependent on regular cash flow to sustain their operations, and overall it will be a tougher market for SMBs to obtain credit.

The trade network effect may multiply cash flow impacts. There is also concern about increased credit risk contagion, especially when more than 92% of unsecured creditors get nothing back when exposed to another collapse. It's a dangerous game of dominos, and some are referring to the inherent risk across value chains as a 'cascading insolvency crisis'.

The season ahead will present some serious challenges. The March business conditions survey from the ABS reports that nearly 2 out of 10 small businesses will find it difficult or very difficult to meet their commitments over the next three months. And 3 out of 10 firms were still accessing support.

Now with the expiry of JobKeeper, more businesses will be unable to honour their obligations in the months ahead. Consider this within the context that the temporary insolvency measures, which included relief from insolvent trading and extended creditor and statutory demands, expired in December 2020.

Insolvency reforms encourage early engagement

It's against this backdrop that we have seen the greatest insolvency reform in over 30 years. A new streamlined regime to support small business restructuring has taken effect, providing directors with greater control than the traditional 'creditor-in-possession' style liquidation model. Together with continued safe harbour protections and extended payment timeframes, the Government hopes the new regime will encourage SMBs to engage early when experiencing financial distress.

On the flip side, the chairman at ASIC advised last year that many Australians would end up on the wrong side of this. He also warned there might not be enough liquidators to handle the coming tsunami of insolvencies. So it shouldn't be a surprise the reform also opened up access for other accounting professionals to support small business restructuring activities. Considering insolvency practitioners were starved of work last year, the competitive landscape for these types of services will be fierce. We would encourage businesses seeking to go down this path to engage a suitably qualified and experienced professional.

Our Ultimate Advice: Protect Yourself

The good news is that businesses don't fail overnight. There are early warning signs if you know what to look for. Corporate liquidators have also called out the many signals that are evident well in advance of trouble, including:

- Financial statements disclosing a history of working capital shortfalls, unprofitable trading and/or deteriorating cash flow

- Evidence of dishonoured payments and/or difficulty paying amounts by due dates, including statutory debts (e.g. PAYGW, SCG, GST)

- An overdraft (or other finance facility) at its limit

- Difficulty collecting debts

- Evidence of poor financial management (e.g. a lack of records).

While most Australian companies will recover from the financial hit they took during 2020, a significant minority won't. Protect your business from customer or supplier insolvencies by staying alert to these early warning signs. Ways to achieve this include:

- Due diligence reviews: Examine the way you review and onboard customers, suppliers and other third parties. Aim to apply a fit-for-purpose approach based on the size and scale of your risk exposure.

- Monitoring and surveillance: Monitor for early warning signs of risk by activating commercial alerts that are configured to the needs of your organisation, including the use of appropriate triggers.

- Strategic risk oversight: Evaluate your processes for identifying potential phoenix operators. Also, tighten up how well you evaluate indirect risk exposure to the credit risk contagion from your accounts' counterparties.

The impact of doing nothing

Corporate insolvencies affect both secured and unsecured creditors. For the 37% of corporate insolvencies with secured creditors, around one quarter had more than $500k debt owed to them. And it was even more concerning for unsecured creditors, with 38% of insolvencies having more than $250k owed to them, knowing they recover nothing back in more than 92% of all insolvencies.

Keeping an eye on the books of high-risk companies is critical in preventing a worst-case scenario. In no fewer than 54% of cases, external administrators find insolvent businesses have failed to maintain appropriate records or keep adequate books.

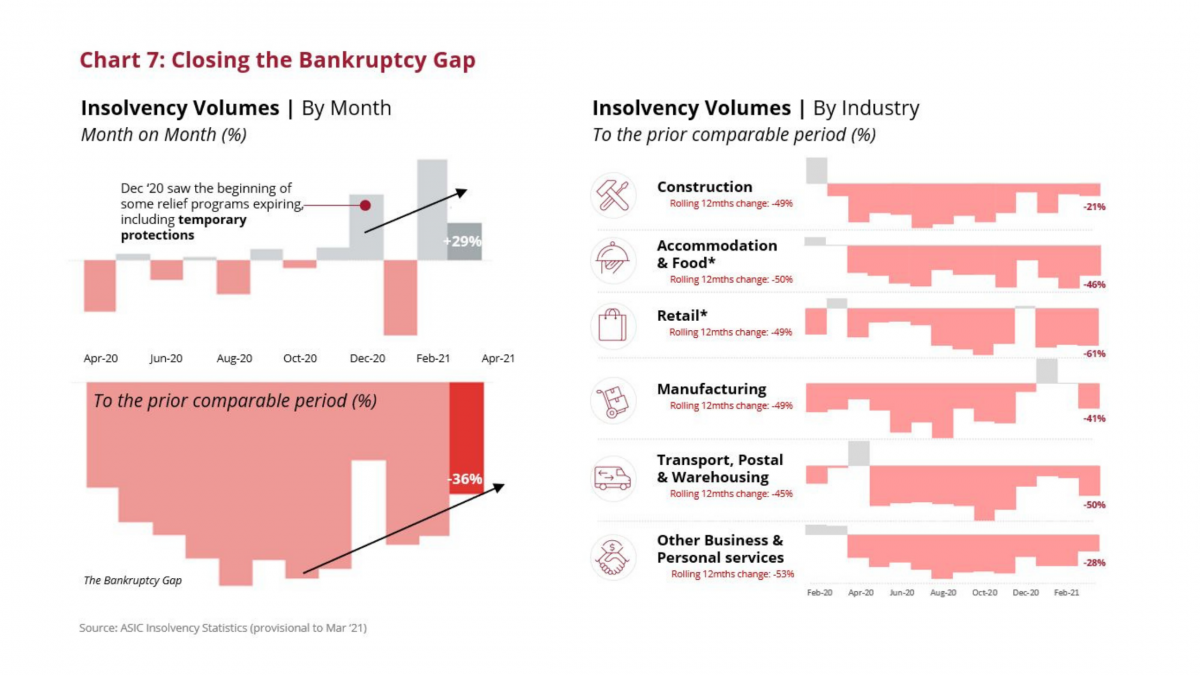

And its within this context that credit and procurement managers are carefully reviewing existing approaches to ensure they are capitalising on these insights. Especially now with corporate insolvencies having increased for two consecutive quarters, rising 29% in March.

Insolvencies on the rise

December 2020 was a key pivot point, and the expiry of the temporary insolvency protections saw corporate insolvencies increase 51%. And the final months of JobKeeper also saw insolvencies increase across both February and March. While March insolvencies were still 36% lower than March 2020, the margin has been reducing as the unwinding of the bankruptcy gap begins.

The latest data for March revealed 11 (out of 19) sectors experienced an increase in insolvencies, with five sectors in particular seeing an acceleration of insolvencies beyond February’s growth rate.

These included:

|

Increased 51% |

|

Increased 64% |

|

Increased 250% |

|

Increased 167% |

|

Increased 67% |

Other sectors that observed an increase in March included:

|

Increased 44% |

|

Increased 75% |

|

Increased 50% |

|

Increased 11% |

|

Increased 133% |

|

Increased 300% |

Four (4) sectors maintained similar insolvency volumes from February into March, including Mining; Manufacturing; Education & Training; and Public Administration & Safety. The remaining four (4) sectors, having all seen significant increases in insolvencies across February, reported slightly lower volumes in March, including: Construction; Transport, Postal & Warehousing; Rental, Hiring & Real Estate Services; and Administrative & Support Services.

The Rocky Road Ahead

We now see a convergence of factors that will create a pivotal shift in insolvency activity. With the JobKeeper program officially over, the ATO has also confirmed it will resume pursuing and enforcing debt recovery action. This coincides with the end of the commercial leasing code of conduct established by the Federal Government at the start of the pandemic. This code prevented landlords from terminating leases due to non-payment of rent and required them to offer tenants reductions in rent that were proportionate to the decline of a tenant's turnover.

All in all, it's hard to imagine a more insolvency-generating perfect storm.

Winter is coming, don't get bitten by zombie companies. Now is the time to double down on risk management fundamentals, as industry leaders seek to future-proof and protect themselves from the coming credit risk contagion.

Data and analytics is the new black, and anyone heading into this type of adversity without investing in data and analytics is ill-equipped. Access as much data as possible and get real-time indicators when customers are experiencing financial stress.

Get started today on reducing your risk exposure to customers and suppliers.

Contact Equifax to find out about our portfolio reviews, commercial risk reports, financial viability assessments and commercial alerts for a head-start on identifying financial distress.

Disclaimer

This information does not constitute legal, accounting or other professional financial advice. The information may change, and Equifax does not guarantee its currency or accuracy. To the extent permitted by law, Equifax specifically excludes all liability or responsibility for any loss or damage arising out of reliance on information in this release and the data in this report, including any consequential or indirect loss, loss of profit, loss of revenue or loss of business opportunity.