From Day 1 to Year 1

February 2020. It’s the much-anticipated launch date for Australia’s Open Banking ecosystem to go live. As industries and business across Australia watch with great interest, the Consumer Data Right (CDR) will be rolled out across the banking sector. First, the Big Four Banks, followed by the whole banking sector a year later.

By the end of 2021, a full rollout is expected into the energy and telecommunications sectors, expanding the ecosystem from Open Banking into Open Data.

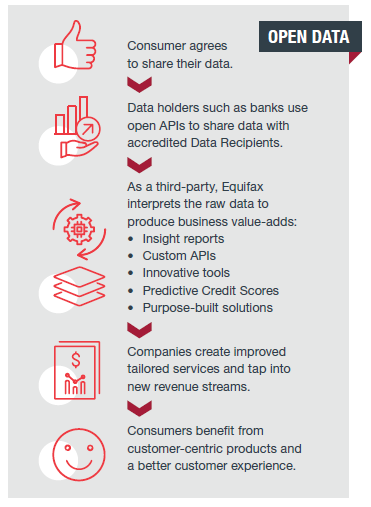

This new data-driven environment will change banking as we know it. The CDR has been legislated by the Government to give Australians greater control over their data. Under Open Banking, consumers must provide consent to share their transaction data with accredited Data Recipients. A Data Recipient will be required to be certified by the regulator and meet strict requirements about how they collect and use raw data.

It’s the interpretation of this data where the real excitement lies. With the help of artificial intelligence and machine learning, the analysis of this voluminous data can provide significant value to both consumers and business. The potential exists for the discovery of meaningful new insights that will give organisations a better view of their customers. And allow consumers to make better-informed decisions about the products and services they use.

Personalised financial products, a greater capacity to assess borrowing risk and new revenue streams are just some of the notable possibilities that may stem from Open Banking. But to get there, organisations must have access to the right tools and technology. Open Data requires the use of a machine learning API, otherwise known as an Application Programming Interface. An API allows software programs to communicate with each other, facilitating the quick sending and receiving of information and knowledge between companies and across multiple spectrums.

Careful design is required if an organisation is to create its own API. A digital platform capable of delivering the insights a business needs must be purpose-built and scalable to meet demand. Customer transparency and control must be at the centre of its design.

“The availability of transaction data via Open Banking API’s creates huge opportunities for businesses to operate in ways that are, ironically, ‘more human’. The main question for businesses to ask themselves is: How will this data facilitate true automation and delight end consumers? The availability of transaction data will bring down lots of boundaries that used to make our interactions with consumers very procedural,” says Head of Open Data Products at Equifax, Alex Scriven.

Alex gives the example of an organisation whose primary objective is to discover customer income insights. “It’s vital to work out how information should be clumped together to achieve this objective. The machine learning model must search for patterns and possible thresholds around which income can be defined.”

He questions whether organisations want to take on the complex and arduous task of bringing together a whole team to build a custom, scalable platform. “Or do you want a third party to build it for you and provide you with a single API that gives you the data in the way you need it?”

Screen scraping technology currently used to access customer banking data is not prohibited under the Consumer Data Right. But chances are this practice will become redundant with the increased data availability under Open Banking.

In the UK, Equifax has made a significant contribution to the rollout of Open Banking since its launch in early 2018. Our innovative solutions and partnerships have helped financial institutions address the challenges, as well as capitalise on the benefits of Open Banking. The knowledge and experience learned from UK’s implementation will be used to support our Australian customers as they adapt to an Open Data environment.

As Open Banking takes off, Equifax will take a leading role in providing single API solutions for financial institutions. When the extensive data Equifax already holds is harmonised with bank transaction data, there are exciting possibilities around our solutions for ‘making sense’ of data. Our advanced analytic capabilities position Equifax as an ideal technology partner for unlocking the power of data and helping clients tailor their products and services to customer needs and expectations.

Practical Innovation in the UK

Equifax and HSBC launched the first live use case of Open Banking for credit applications in the UK. Now HSBC UK customers can choose to have their bank transaction information accessed electronically to facilitate quick affordability assessments.

Equifax and HSBC launched the first live use case of Open Banking for credit applications in the UK. Now HSBC UK customers can choose to have their bank transaction information accessed electronically to facilitate quick affordability assessments.

A process that previously took weeks to complete and required customers to provide multiple months of hard-copy bank statements is now completed in a few minutes. Outgoing and incoming account transaction information is categorised electronically to provide detailed insight, then presented to HSBC in real-time. It’s an example of a next-level data service that enables faster, better-informed decisions for banking customers.

Equifax UK has also launched the first live ID check in the open market. Identity information such as the consumer’s name, address and date of birth, can for the first time be matched with transaction data provided through Open Banking in real-time. This will help reduce fraud, allowing credit providers using Open Banking to confirm that account information belongs to the person applying for credit, and not a potential fraudster.

6 Challenges and Advantages for Early Open Data Adopters

1. Understanding Income

The income of a borrower is defined currently as what information the loan application discloses, backed up by proof of employment from payslips and group certificates. With fraudulent payslips an ever-growing issue, there is an opportunity to use Open Data to detect customers who withhold information or deliberately mislead lenders. With more and more transactions happening in a cashless society, data sharing will give lenders access to a fully digital data set that is standardised enough to be used confidently for income verification.

The income of a borrower is defined currently as what information the loan application discloses, backed up by proof of employment from payslips and group certificates. With fraudulent payslips an ever-growing issue, there is an opportunity to use Open Data to detect customers who withhold information or deliberately mislead lenders. With more and more transactions happening in a cashless society, data sharing will give lenders access to a fully digital data set that is standardised enough to be used confidently for income verification.

In this new digital ecosystem, Equifax machine learning can be employed to analyse bank transaction data to understand an individual’s income patterns. This will pave the way for more accurate assessments of income and responsible lending decisions.

2. Measuring Expenses

Over time, Open Data will enable lenders to move beyond the Household Expenditure Method (HEM) as a guide to borrowers’ living expenses. Although this move has already begun with lenders measuring household spending via expense categories, the next step is more revolutionary.

Over time, Open Data will enable lenders to move beyond the Household Expenditure Method (HEM) as a guide to borrowers’ living expenses. Although this move has already begun with lenders measuring household spending via expense categories, the next step is more revolutionary.

Moving from these broad categories of expenses, lenders in the future may be able to predict which key expense areas are indicative of credit risk for individual borrowers. Equifax will be working to discover key attributes within expense data. And in doing so, enable lenders to calculate living expenses in a way that is appropriate to the life stage and lifestyle of their borrowers.

“We plan to experiment with different models and build flexible tools to solve our customer’s problems. By using innovative approaches to working with expense data we will be able to create solutions that give an accurate assessment of risk while also accounting for the patterns of individual spending,” explains Marcus Bruhn, General Manager, Data Science at Equifax.

Another longer-term promise of Open Data is the possibility of meaningful risk tolerance thresholds. Technology may be able to close the gap between what a borrower states as their living expenses on the application form, compared to what the data actually shows. With the right tools, lenders will be able to progress applications faster based upon whether a borrower’s estimate is close to reality.

3. Evolving the Humble Credit Score

As data is shared more openly by consumers, there is the opportunity to combine the insights we have from their transaction behaviour with our tried and tested methods of scoring on credit information.

As data is shared more openly by consumers, there is the opportunity to combine the insights we have from their transaction behaviour with our tried and tested methods of scoring on credit information.

Subject to legal frameworks being understood and implemented there could be an opportunity to ‘step up’ the original credit score of an individual and also to create a whole new score based on a blended credit and open banking understanding of a consumer. It’s an evolving space, and many are doing experiments now. Equifax believes bureau data holds the key to unearthing the power of transaction data but only in a safe, secure, compliant and accessible environment.

4. Introducing Transaction Data Alerts

As a fraud detection tool, financial institutions may have the opportunity to use Open Data technology to help monitor their customers’ transaction behaviour. Automated alerts could be generated to detect red flags and inconsistencies, which may signal application fraud.

As a fraud detection tool, financial institutions may have the opportunity to use Open Data technology to help monitor their customers’ transaction behaviour. Automated alerts could be generated to detect red flags and inconsistencies, which may signal application fraud.

Likewise, consumers may opt to receive alerts over time, inviting them throughout different life stages to take up specific products or offerings. For example, when a borrower reaches a certain income threshold, they may be eligible for a discount on their home loan interest rate.

5. Creating Accurate Benchmarks

In this new digital ecosystem, there is the potential to create living expense benchmarks based on real transaction data and real people. Lenders will be able to make decisions around a set of facts, not estimates, which will be useful in verifying customer living expenses.

In this new digital ecosystem, there is the potential to create living expense benchmarks based on real transaction data and real people. Lenders will be able to make decisions around a set of facts, not estimates, which will be useful in verifying customer living expenses.

The loan application process may well evolve into a cascading series of engagement points led by machine learning. Depending on the information provided at each stage of the process, machines models will make decisions about loan suitability based on accurate benchmarks. If a borrower’s expense estimate fails to align with the benchmark, the lender can dig deeper, requesting further information or explanations from the customer.

Not only is there the potential to reduce unnecessary manual intervention, but also for lenders to better understand their customers.

6. Informing Cash Flow Decisions

The effective management of cash flow is key to the long-term survival of a business. With insights gleaned from an Open Data environment, there will be exciting possibilities for improved cash flow management.

The effective management of cash flow is key to the long-term survival of a business. With insights gleaned from an Open Data environment, there will be exciting possibilities for improved cash flow management.

Open Data technology will have more involvement than ever before in guiding organisations to make crucial financial decisions and plan for business success. There will be greater clarity, for example, around whether a business has the funds to honour its loan commitments or whether it can afford to take out a financial lease.

Contact us today to discuss how we can help you with your open banking journey.