Should You Worry What Your Customers Think of the PPSR?

Some of your customers might understand the importance of the PPSR, but others may be confused by it, or unaware of its existence. Where your customer sits on this sliding scale is more important to your business than you might think. We spoke to Cheryl O’Brien from Fletcher Building Limited to find out the benefits of educating customers about the PPSR and how to go about doing it.

When Fletcher Building first started registering security interests on the Personal Property Securities Register (PPSR), they got varied reactions from customers.

Cheryl O’Brien, Head of Credit Management and Debt Recovery, Fletcher Building Limited, recalls that many customers misunderstood the meaning of ‘personal property’ in the context of the Personal Property Securities Act (PPSA).

“I remember some of our customers worrying that we were trying to gain possession over their personal things,” she says.

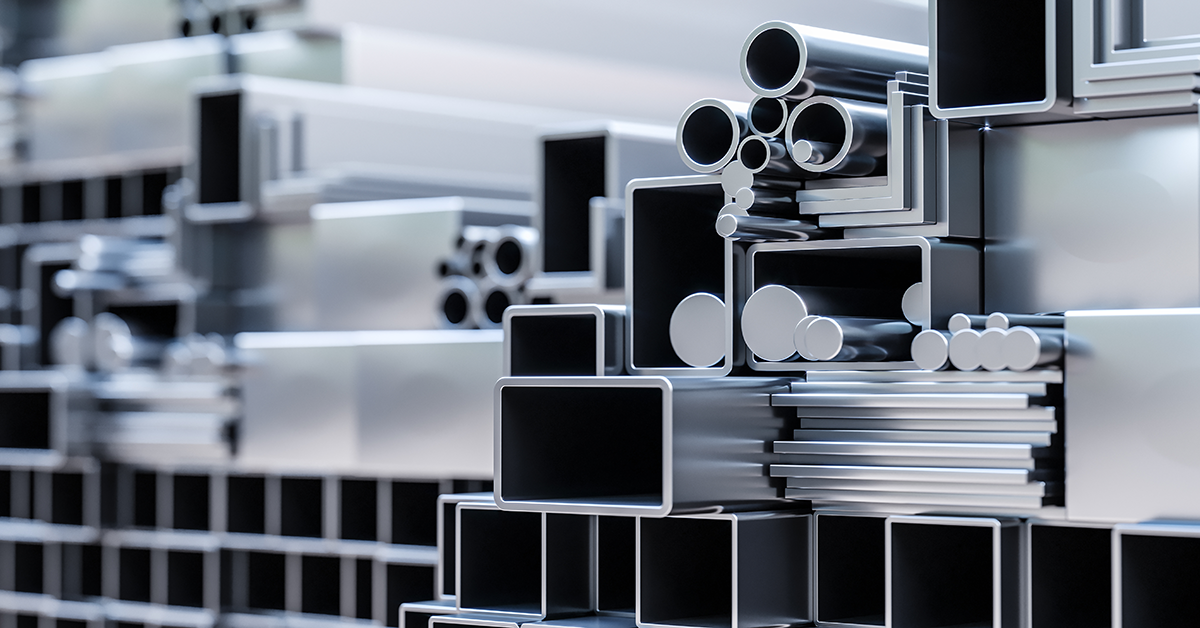

As one of the largest listed companies in New Zealand, Fletcher Building is a significant manufacturer, home builder, and partner on major construction and infrastructure projects. It was ten years ago, when they first embraced the PPSR in one of their New Zealand business divisions, whose customers ranged from homeowners and residential builders to steel fabricators and subcontractors.

“We had a hugely diverse customer base and we realised early on it was in our best interests to raise awareness about the PPSA within our customer base,” says Cheryl.

“If our customers understand the importance of registering with the PPSR it means they’re helping protect their credit risk and trading position. If they don’t get paid by a customer or are recovering from customer insolvency, the impact on their business can be reduced if they are PPS registered.”

Cheryl explains that building knowledge and awareness of the PPSA and PPSR is an essential part of doing business on trade credit terms. “I don’t believe you can ever over-communicate on this topic. The more customers understand the basics of this complex legislation, the smoother the process for everyone.”

Here Cheryl shares the methods Fletcher Building uses to communicate the PPSR to its customers:

Conversations with key customers

For the larger customers, Cheryl and her team speak to them in person to manage expectations up front. Some of the reactions from customers have included:

“Why are you registering against me personally?”

“No one else registers, why do you?”

“I don’t want to know about it.”

Cheryl explains that she is empathetic but ready with answers that will put their concerns to rest.

“I talk through what the legislation means, including the definition of personal property. I reassure that it doesn’t impact on their business unless they don’t pay for product and that it is our policy to register against all trade credit accounts under this legislation.”

Customer roadshows

After several customers were hit by bad debt a number of years ago, Cheryl said they had the idea to start doing road shows.

“We knew we had to get the message out there. So, we went directly to our customers and spoke to them in their workplace. The roadshows went down well, and our message spread further afield as people began to talk about our visits.”

Customer-facing staff training

Equally important was educating the sales and customer-facing team. Cheryl explains that her team holds training sessions at sales meetings to give staff enough knowledge about the PPSR to answer customer questions.

“We don’t expect the sales team to understand the intricacies of the legislation, but we want them to know enough to be able to talk confidently about the PPSA.

“We put together a training pack of ten slides that we use during the training session to break the message down in simple terms. Included is a bit about the legislation, what it does, how to register and the benefits.”

For purpose-fit guidance and exceptional support in validating, updating and renewing PPS registrations, contact our PPSR specialists at EDX by Equifax. With 40 years of combined experience in insolvency and credit management, they make it their mission to help businesses like yours use the PPSR to insulate against risk, including negotiating with insolvency practitioners to protect your rights as a creditor.

Related Posts

Highlights:

Mitigate the surge in AI-generated digital forgeries by moving from document-based checks to source-verified payroll data Combat sophisticated salary staging and liar loans with an automated, single source of truth Establish digital trust at the point of contact to protect your organisation from credit and compliance risks.