News, opinions and discussions to enhance the

way you think about data and analytics.

The Equifax Q1 2025 Commercial Credit Report reveals a nuanced picture of the commercial credit landscape. Overall business credit applications saw a modest rise, but underlying trends reveal caution among Small and Medium Enterprises (SMEs) and significant pressures in key industries.

Read more

Mortgage demand continues to fall, while personal loan arrears suggest further financial turbulence ahead

Equifax Group Managing Director, Melanie Cochrane, explains why financial inclusion should be a top-of-mind issue as Australia braces for an economic slowdown. The vulnerability of financially excluded groups who struggle to access credit is likely to escalate with increased pressures on household budgets. With limited or no access to the credit system, it's harder for Australians to start or grow a business or take control of their financial wellbeing in a way that contributes to the broader economy.

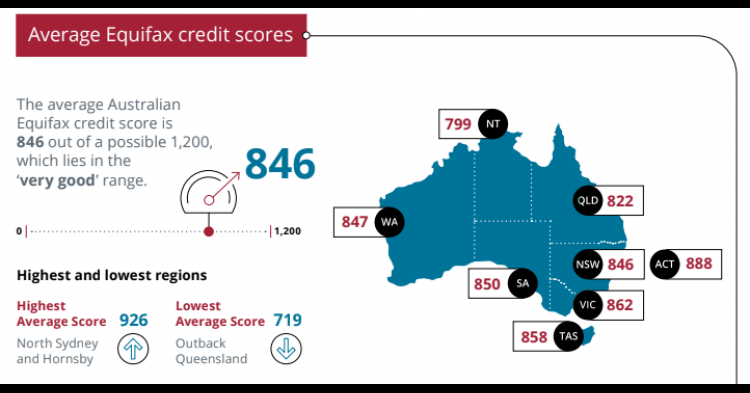

Australians are now taking strategic action to improve their finance and credit standing to combat an uncertain economy, reveals the Equifax Australian Credit Scorecard 2022

Introducing the Equifax A/NZ Sustainability 2023 Focus Areas

While there is no silver bullet for the prevention of cybercrime, there are measures your organisation can take to minimise the impact of a data breach.

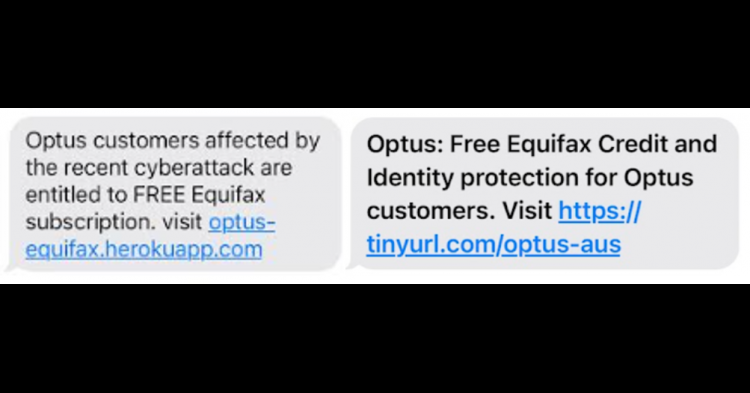

Equifax is aware of an ongoing SMS phishing campaign targeting people impacted by the Optus data breach. DO NOT click on the link, respond to the sender or enter your personal information. Equifax will never ask you to validate your identity by providing your credit card details.

Business credit demand has increased year-on-year in the September quarter, returning to growth following a dip in Q2.

Equifax data shows strong demand for unsecured credit, while buy now pay later growth eases and mortgage demand continues to fall

If you are a residential builder or developer and fail to make adequate legal provisions to protect your customers, your iCIRT rating may be affected.

Market conditions tighten the reins on financial management, requiring a sophisticated 360-customer view, according to the National Credit Managers Survey 2022 from Equifax