AML/CTF Tranche 2: What Real Estate Agents Need to Know

If you're a real estate agent in Australia, you may be hearing about “Tranche 2" and wondering what it means for your business. Tranche2 refers to major changes to Australia's Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) regulations that will be applicable to all real estate agencies from July 2026.

The reforms are expected to bring about a substantial shift in how your agency approaches risk management and operational processes, including client onboarding. For real estate professionals, preparing for these new obligations is essential to ensure compliance and avoid severe penalties.

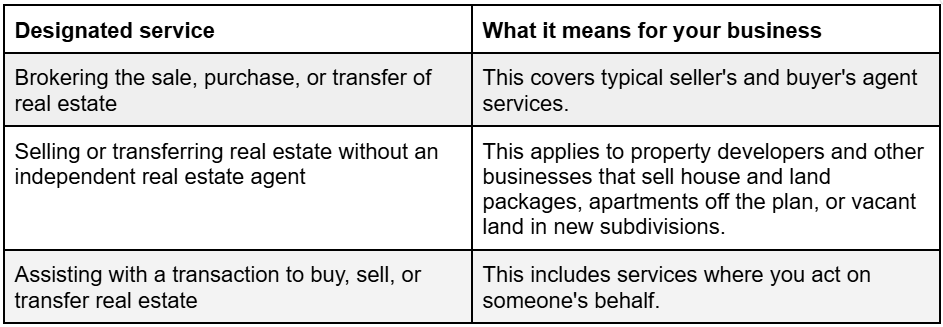

If your real estate agency provides one or more of the following ‘designated services’, the AML/CTF regulations will apply to you:

Why are AML/CTF reforms happening?

Australia's existing AML/CTF laws, drafted in 2005, have not kept pace with the evolving tactics of serious and organised crime. This regulatory gap has allowed criminals to exploit legitimate businesses to launder money, which often funds further illicit activities.

The Tranche 2 reforms will close this gap, bringing Australia in line with international standards set by the Financial Action Task Force (FATF). This is a critical step to ensure Australia can effectively deter, detect, and disrupt financial crime.

Who is impacted?

The compliance net is broadening significantly. While AML/CTF compliance has previously been limited to approximately 19,000 reporting entities1, primarily from the banking and financial services sector, the new reforms will bring in an additional 90,000 entities2. This new group of regulated professionals includes:

- Lawyers and conveyancers

- Real estate professionals

- Accountants

- Virtual Asset Service providers (e.g., digital currency exchanges)

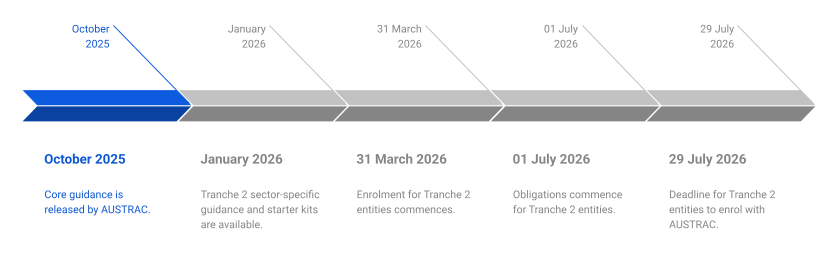

- When do real estate professionals have to comply?

The rollout of the Tranche 2 reforms is staged, with key deadlines you need to be aware of:

What will compliance look like for my real estate agency?

The reforms shift the focus of AML/CTF to a risk-based, harm-prevention model. AUSTRAC, the financial intelligence and regulatory agency, will be looking to see that you are taking meaningful action to prevent financial crime.

Early preparation and a focus on simplicity are essential to ensure your AML/CTF program is effective and not overly costly. The core obligations you will need to implement include:

1. Enrolment with AUSTRAC

Your real estate agency must register with AUSTRAC by 29 July, 2026. Your obligations will commence on 1 July 2026.

2. Conduct a risk assessment

This is the foundational step. A thorough risk assessment of your practice will pinpoint potential vulnerabilities and develop a clear understanding of your exposure to money laundering and terrorism financing.

3. Develop an AML/CTF program

The Tranche 2 reforms provide flexibility to develop a program tailored to your firm’s specific risks, size and complexity. It must, however, include key policies and procedures for areas like customer due diligence, transaction monitoring, and reporting - all designed to prevent financial crime and show that your firm is focussed on meaningful outcomes, not just on process.

4. Customer Due Diligence (CDD)

You must identify and verify the identity of individual clients and beneficial owners, and understand the risk they pose, before providing a designated service.

5. Ongoing Customer Due Diligence (OCDD)

Due diligence doesn’t stop after onboarding. You must continue to monitor client relationships over time to detect changes in behaviour and transactions. Any change to the risk profile of the client must trigger the appropriate due diligence checks.

6. Enhanced Customer Due Diligence (ECDD)

A deeper level of due diligence is required for high-risk clients, including Politically Exposed Persons (PEPs) or transactions with no apparent economic or legal purpose.

7. Reporting

Your firm will be required to report certain transactions and any suspicious activity to AUSTRAC.

8. Record keeping

You must maintain a full audit trail of your compliance activities including records of customer identification, transactions and your AML/CTF program.

How Equifax Can Help

We understand that balancing compliance with user experience is crucial for real estate professionals. This is why it's vital to use AML/CTF solutions tailored to your industry.

At Equifax, we are experts in AML/CTF and can provide efficient verification tools to help you conduct necessary checks while upholding your professional duties. As a trusted partner to financial institutions since the inception of the original AML/CTF Act, we have the expertise and technology to help you navigate these regulations.

Our platform and advanced capabilities are designed to help you meet compliance requirements, enhance client trust, and operate securely.

- Compliance: When the stakes are high, you want the best of the best by your side. Our fraud and identity solutions help accounting professionals meet their AML/CTF customer due diligence obligations by helping you verify a client's identity, understand their risk, and build a solid foundation for your agency's compliance.

- Comprehensive identity verification: Our multi-layered solutions enable you to verify clients using trusted data sources, government-issued identity documents and industry leading fraud detection capabilities. This allows you to flexibly align the verification process with the specific risk level of each client.

- Robust watchlist screening: Our automated system provides real-time screening against global sanctions, PEPs, adverse media as well as your own watchlist. This helps you identify and mitigate risks throughout the client lifecycle.

- Audit trail: We automatically maintain a complete audit trail of your verifications, helping you meet your record-keeping obligations with ease.

- Fast: Our fully automated process provides a yes/no answer in seconds, saving you and your clients valuable time.

- User experience: Our elegant mobile workflow verifies individuals in seconds, creating an efficient and user-friendly onboarding process.

Get ready now

Failure to act swiftly could result in severe penalties, including hefty fines, legal repercussions, and irreparable damage to your reputation. The risk of being exploited for money laundering or terrorism financing increases significantly if proper compliance measures are not in place.

Contact us today for a free consultation <link to eloqua form> to learn how our fraud and identity protections solutions can help your real estate agency firm navigate Tranche 2 compliance.

The content of this document is provided for information purposes only. It does not constitute legal or compliance advice and should not be used as such. Further, the information in this document is provided on the basis that all persons accessing it undertake responsibility for assessing the relevance and accuracy of its content. Should you consider it necessary, please seek your own legal or compliance advice for application of any this information to your own circumstances. 1 AUSTRAC 2 Norton Rose FulBright

Related Posts

If you're a real estate agent in Australia, you may be hearing about “Tranche 2" and wondering what it means for your business. Tranche2 refers to major changes to Australia's Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) regulations that will be applicable to all real estate agencies from July 2026.

If you're an accounting firm in Australia, you may be hearing about “Tranche 2" and wondering what it means for your practice. Tranche2 refers to major changes to Australia's Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) regulations that will be applicable to all accounting firms from July 2026.