New Design & Distribution Obligations: How Ready Are You?

The new Design and Distribution Obligations (DDO) for financial and credit products comes into force by the 5th of October 2021 and requires you to publicly document and justify why a product is consistent with the likely objectives, financial situation and needs of a class of consumers.

The new regulations apply to existing products sold as well as new products in the pipeline.

Most financial and credit products are caught by the new obligations which represent a significant shift from relying on product disclosure statements to an onus on creators and distributors to document and justify product suitability for the market it is aimed at.

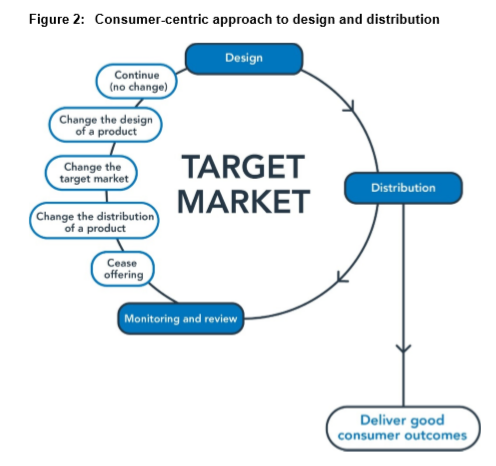

At its core is a customer-centric approach to the design, marketing and distribution of financial products. Most all financial and credit products will have to publicly document

- Who is the target consumer – why the product meets their likely objectives, financial situation and needs;

- What triggers may make it no longer appropriate;

- Who should distribute the product;

- Whether distribution is consistent with the target market determination.

The obligations continue once in market with an ongoing obligation to ensure the continued suitability of the product to its intended market.

(Page 17 of ASIC’s draft regulatory guide)

Matt Strassberg, Equifax General Manager, External Relations Australia & New Zealand, believes DDO represents a momentous change in product development. “These obligations require a lifecycle view. It’s about understanding the financial situation and demographics of your customer base, then only developing and selling the products that are likely to be suitable,” he explains.

“It also tests your ability to monitor if the product remains relevant to its consumer market. If there is a wholesale shift in the circumstances of your target market, processes must be in place to ensure compliance.”

What are the regulator’s requirements?

ASIC’s draft regulatory guide repeatedly emphasises that a product must be:

“designed in a way that is likely to be consistent with the likely objectives, financial situation and needs of the class of consumer”.

The steps expected in a target market determination require you to:

- describe the class of consumer for the product (target market)

- specify any distribution conditions and restrictions on distribution

- specify review triggers, events that may flag the target market determination is no longer appropriate

- specify when the first and subsequent reviews of the target market determination must occur

- specify obligations on the distributor to report complaints to the issuer, including what must be reported and how frequently

- take reasonable steps to ensure that a financial product is distributed consistently with its target market determination

- if there are significant issues where the product is not performing consistent with the target market determination, ASIC must be notified within ten working days.

Distributors also have new obligations, and robust product monitoring processes are needed to ensure whoever is selling a product understands their obligations, including the reporting back of consumer complaints.

ASIC has powers to intervene

In addition to the Design and Distribution obligations, ASIC has Product Intervention Powers where there is a risk of consumer detriment on a large scale because of unsuitable products. Using these powers, the regulator can intervene to issue stop orders and impose changes to the way the product is marketed or sold.

How ready are you?

The impact of these obligations is all-encompassing, requiring careful consideration of your end-to-end product lifecycle. ASIC’s draft regulatory guide is well advanced and lays out clearly what the regulator expects you will have completed by October 2021. Contact us to find out more.

Related Posts

Highlights:

Mitigate the surge in AI-generated digital forgeries by moving from document-based checks to source-verified payroll data Combat sophisticated salary staging and liar loans with an automated, single source of truth Establish digital trust at the point of contact to protect your organisation from credit and compliance risks.