How to Improve Your Credit Score

07 September 2025

A credit score is a measure of all your debt and credit history. Banks and other lenders will use the credit rating system to see if an individual is suitable for a loan. People with a higher-than-average credit rating are considered lower risk and, therefore, a better loan applicant. If you’re thinking about applying for a loan, or you’ve recently been denied a loan, you should order a credit report from Equifax to check your rating.

In your credit report from Equifax, you are given a credit rating from 0 to 1200. Other credit reporting agencies may use a slightly different scale. At Equifax, we use five Credit Rating bands, as follows:

- Below Average (0–459)

- Average (460–660)

- Good (661–734)

- Very Good (735–852)

- Excellent (853–1200)

If you have a very good to excellent credit score or rating, you may find it easier to get a loan. If you have a bad credit score, you may need to change your financial habits to achieve a credit score increase.

If you’re not looking for a loan in the next few months, preparing your credit history is good for any future loans. Credit information stays on your credit report for different durations depending on what it is. Credit enquiries, for example, will remain for two years while defaults will remain for five years.Following these ways to improve your credit score can help you in the future (e.g., for a home loan mortgage).

Why is it necessary to improve your credit score?

The most common reason people in Australia seek to improve their credit score is to borrow money. When starting and building a credit score, you can take out small loans or apply for a credit card. A credit card is an excellent way to increase your credit rating as these require a good amount of discipline to maintain. Provided you consistently keep your card under its limit and make regular payments that are more than the minimum, you’ll likely see an improvement in your credit rating.

If you’ve recently applied for a loan and have been rejected, you can order your credit report from Equifax and check your credit rating. In many cases, a low credit rating is the main reason you were not approved for a loan. Banks and other lenders will check your credit rating and, in conjunction with their own lending criteria, then decide if you pose a reasonable risk for their business. On larger loans, such as a home loan, banks tend to be more cautious and less likely to lend money to people with a bad credit score.

After ordering your credit report from Equifax, you can read through the details and check that everything is accurate. Many people in Australia have found some inconsistencies in their reports. If you find an error or a loan record that you did not authorise, you can contact the credit reporting agency, and they’ll investigate. Most of the time, these issues will be an error caused by the lender not reporting something correctly, but occasionally it may also be due to identity theft.

How to improve your credit score?

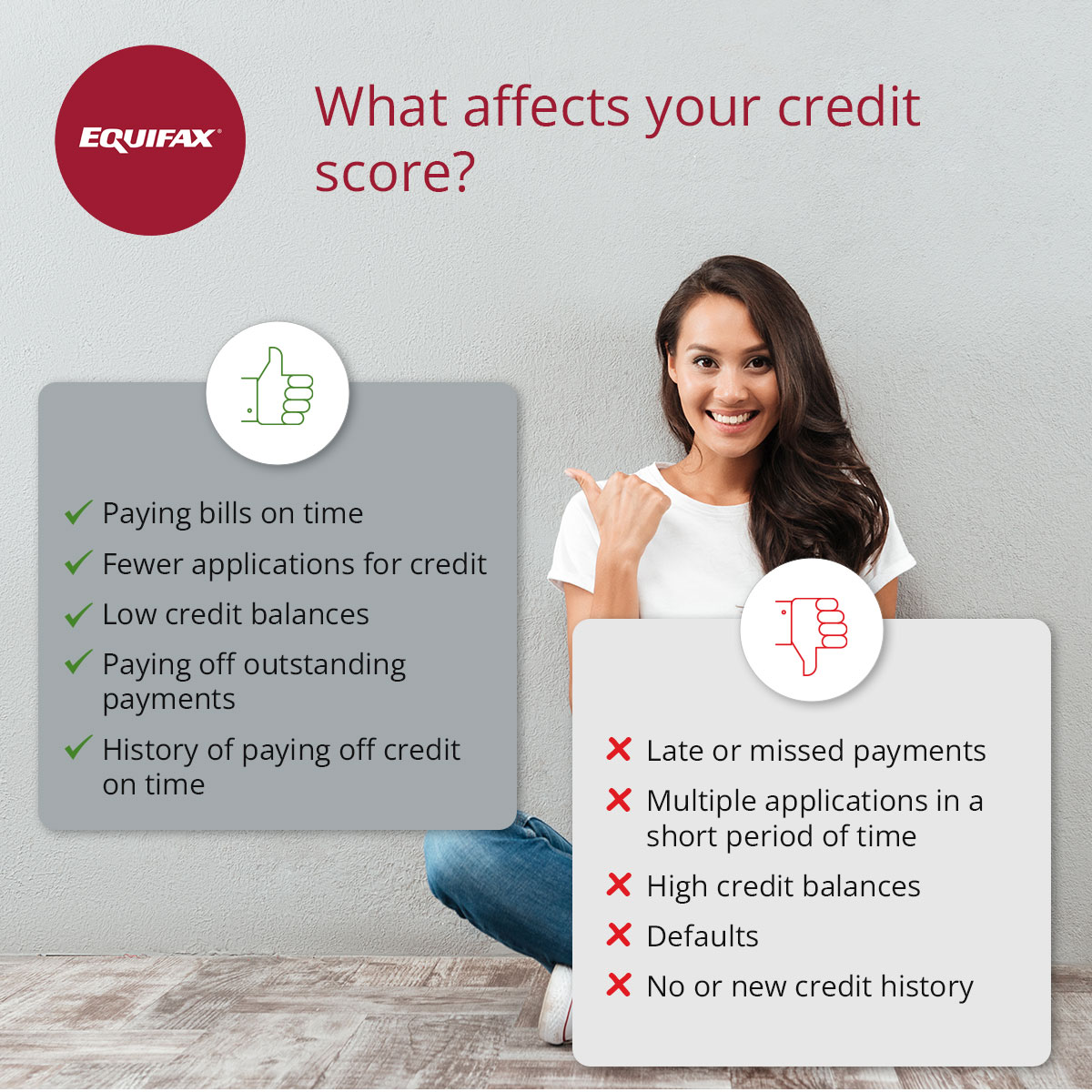

The best way to improve your credit score is to build good financial habits. Even if you’ve had past issues, it’s never too late to change this around and rebuild or improve on your current credit rating. Before working on your credit rating, ensure you get a copy of your credit score and report. Check through it and clear off any errors. If judgments are made against you, it may still be possible to have these removed. Removing a judgement will firstly require you to satisfy the judgment debt, and then seek approval from the creditor or apply to a court to have it set aside. After you’ve made your credit report clear of everything you can, it’s time to build your score.

Ensure any loans you have (including a mortgage) are all up to date with their payments. Most banks in Australia offer online banking, and you can set up automatic payments to your loans so you don’t forget your loan payments. If you have a few credit cards, you can look into closing any of those you don’t need. For any credit cards you plan on keeping, you can reduce their limits. In addition to your credit cards and loans, you should ensure that all bills in your name are paid on time. While bill payments are not usually reported to your credit history, paying these on time will help build good financial habits.

When attempting to build credit fast, try not to submit many loan applications within a short period of time as these can have a negative effect. There are many ways to improve your credit score, but keeping track of your finances is the easiest one to follow.

How long does it take to improve your credit score?

The length of time it takes to improve your credit score depends on the problem. If you have some minor details that need to be cleared up, such as a lender not updating a closed account, these can be altered quickly. However, if you have an issue caused by ID theft, achieving results from a credit repair may take longer.

If you’ve had a bad credit history, you can start making immediate changes to your finances to improve your situation. At Equifax, we have a credit and identity monitoring service (as part of a paid subscription) that can alert you when key changes are made to your credit report, including when others access it. The service also provides Identity Guard insurance^ to help cover against identity fraud, and we can monitor the dark web for any information about your details being shopped around or sold.

Improving your credit score can help make you more attractive to lenders. People with a higher-than-average credit rating may be offered better interest rates and loan terms. Having a good credit score can make it easier to obtain a loan, so it pays to keep a close watch on your current score to see if you need to make changes and improve it.

*Eligibility criteria apply

^ Terms, conditions, exclusions and limitations apply. Click here to view the Identity Guard Insurance Policy Information Booklet

Disclaimer: The information contained in this article is general in nature and does not take into account your personal objectives, financial situation or needs. Therefore, you should consider whether the information is appropriate to your circumstance before acting on it, and where appropriate, seek professional advice from a finance professional such as an adviser