7 out of 10 Australians would use credit score to get a better deal: Veda Australian Credit Scorecard offers second Equifax Score analysis

Sydney, Australia: 1 October 2014 – The majority of Australians, 7 in 10 people, would get their credit score or Equifax Score to help them to negotiate a better credit deal with lenders, new research from credit reporting body Veda has found.

This indicates a behavioural shift in consumers following recent changes to the credit industry – which mean credit histories now include positive and negative data – making it more important than ever for people to actively manage their credit report.

Click here to download the Veda Australian Credit Scorecard (October 2014)

This is particularly important for the 2.1 million people (13% of credit active Australians) at risk of credit default in the next year[i] – or 601,380 people (4%) who are at high to extreme risk. Being vigilant about paying bills, like phone bills and credit cards, could impact their ability to access credit. Over time, positive credit behaviour will become essential to negotiate a better deal.

Veda today released the second annual Veda Australian Credit Scorecard, offering market-leading insights into credit habits and Equifax Scores. It combines an analysis of 955,000 Equifax Scores with consumer research of 1,000 Australians[ii].

Key data insights

The national average Equifax Score – a number from 0 to 1,200 which summarises information on an individual’s credit record – is 760. This is a slight improvement since last year with both the national average Equifax Score (up from 751 in 2013[iii]) and the proportion of Australians at risk of default, which decreased marginally from 15% to 13% year on year.

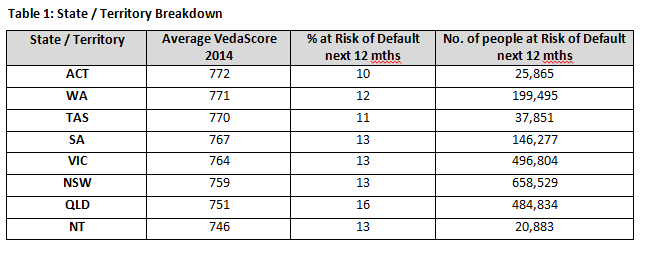

Veda’s analysis has revealed the state carrying the highest proportion of residents at risk of default in the next 12 months is Queensland (16%), while ACT has the smallest proportion at risk (10%). New South Wales, Victoria and Northern Territory all have 13% of residents at risk of default, slightly head of Western Australia (12%) and Tasmania (11%).

The Veda Australian Credit Scorecard also found that Gen Ys have the worst average Equifax Score (676) despite being the most financially ambitious of all generations. Yet Gen Xers (17%) are most at risk of financial trouble in the next 12 months, ahead of Gen Ys and Baby Boomers (both 11%).

Women validated confidence in their own financial behaviour (66% of women expressed confidence compared to 58% of men), with a better average score than men (W 768 vs M 756).

The research revealed that, alarmingly, 3% of people – half a million Australians – admitted they have lied or omitted information on a credit application.

Taking control of finances

Belinda Diprose, Veda spokesperson, encouraged consumers to get informed about what is on their personal credit report. The research showed low awareness of recent changes, with only 1 in 5 people (21%) aware of the new credit reporting landscape.

“Financially savvy Australians are taking the lead in managing their finances following changes to the Privacy Act earlier this year[iv]. This shift has resulted in the first lender offering interest rates based on credit scores, with others likely to follow by year’s end,” she said.

“It is important that people know they will be able to seek out a greater range of credit offers based on their credit worthiness, with some lenders already preparing to offer this opportunity based on Equifax Scores.

“The extra information will enable credit providers to assess risk levels more accurately, which we have seen benefit consumers overseas. Consumers who know they have a poor Equifax Score can gain insights to improve their credit rating and become more attractive to credit providers,” she said.

While consumers have been able to access their individual credit scores since August 2013, Ms Diprose said there is a lack of understanding about what information is on a credit history and the steps people need to take to improve their score.

The research found a majority of Australians are not concerned about their credit history (79%) and have never checked their credit report (78%). Yet that is set to change as we know people are more likely to check their score if they can get a better deal.

“We know that Equifax Scores will become more dynamic in future as positive data is increasingly shared by lenders in the new comprehensive reporting environment. It’s time for consumers to get informed and actively manage their credit profile,” Ms Diprose said.

Consumers can access and actively manage their credit record and Equifax Score, as well as the items on their credit report that contributed to their score being good or bad, through Veda’s consumer online portal at www.veda.com.au.

Click here to download the Veda Australian Credit Scorecard (October 2014)

[i] Analysis based on ABS population figures of 15,443,150 credit active Australians as at July 2013. Of this population, 13% (or 2.1 million Australians) are at risk of credit default or other adverse credit event being recorded on their Veda credit report in the next 12 months. 601,380 (or 4%) of the 2.1 million are considered at high to extreme risk of credit default in the next 12 months.

[ii] Quantitative consumer survey conducted by The Leading Edge in September 2014 using an online panel, on behalf of Veda. It was a representative survey sample (n = 1000) across all Australian states and territories.

[iii] Veda recomputed the 2013 data to reflect changes brought about by Comprehensive Credit Reporting legislation. This has meant a slight adjustment to the historical figures.

[iv] The Privacy Amendment (Enhancing Privacy Protection) Act 2012 took effect on 12 March 2014, incorporating changes to the Privacy Act 1988 to update Australia’s credit reporting system.