Business credit demand shows signs of improvement

Veda Quarterly Business Credit Demand Index: June 2015

-

Overall business credit applications rose 2.9% (vs June quarter 2014)

-

Business loans (+8.2%) and asset finance applications (+3.8%) grew, trade credit declined (-3.6%) (vs June quarter 2014)

-

Upward spike in asset finance and trade credit applications in June for items under $20,000 shows early signs of SMEs responding to Federal Budget tax incentive

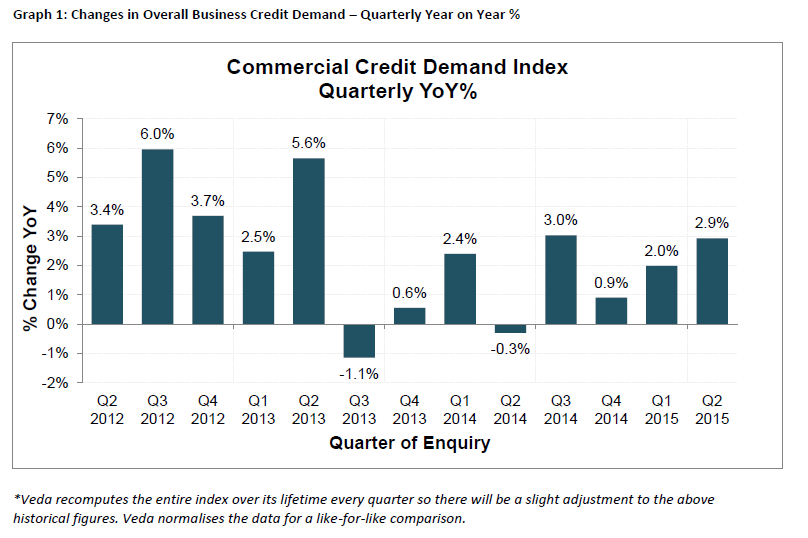

Sydney, Australia: 23 July 2015 – Released today the Veda Quarterly Business Credit Demand Index, measuring applications for business loans, trade credit and asset finance, rose at a rate of 2.9% in the June 2015 quarter.

The increase reflected significant rises in business loan applications (+8.2%) and asset finance applications (+3.8%), offset by a decline in trade credit applications (-3.6%).

The Veda Business Credit Demand Index has historically proven to be a lead indicator of how the overall economy is performing. Overall the June quarter saw an increase in momentum from the March quarter.

Veda’s General Manager Commerical/Property Information Solutions, Moses Samaha said: “The Reserve Bank’s cuts to interest rates in February and May along with a well received Federal Budget have helped business confidence. Veda’s data indicates a moderate pick up in credit demand by business, which is an encouraging sign given that growth in the Australian economy remains below trend.”

The pace of growth in overall business credit applications increased again in the June 2015 quarter. NSW was strongest (+5.6%) with Tasmania (+4.8%), ACT (+3.9%), Victoria (+3.4%) and SA (1.5%) all seeing positive growth. Mining regions apart from Queensland (+1.4) saw decline, with NT (-7.2) and WA (-2.3%).

Business loan applications rose 8.2% in the June quarter. This was driven by a 21.3% growth in business mortgage applications and an 18.9% increase in credit card applications. It appears businesses are responding to a sustained period of low interest rates which makes property investment an attractive option.

Business loan application growth was consistent across the non-mining states. NSW (+12.2%), Victoria (+7.3%), SA (+6.2%), Tasmania (+3.0%) and the ACT (+9.3%) all saw solid growth in business loan applications. Of the mining states, Queensland (+10.0%) also saw strong growth in business loan applications, with weakness concentrated in WA (-2.5%) and the NT (-1.8%).

Mr Samaha said: “There has been a noticeable increase in market driven activities by the banks and an increased share of credit activity by businesses in the construction sector.”

Trade credit applications fell in the June quarter (-3.6%). Trade credit applications recorded a fall over the past year in all states. Victoria (-4.5%), Queensland (-5.8%), Tasmania (-6.8%) and the NT (-13.4%) saw particularly large falls, followed by SA (-3.2%) and WA (-2.3%). More modest falls were seen in NSW (-1.6%) and the ACT (-1.6%).

The easing in the growth of trade credit applications was largely driven by weakness in the main category of 30 day accounts (-3.0%).

Asset finance applications picked up in the June quarter (+3.8%). This represents an improvement in the rate of growth for asset finance applications from 2.2% in the March quarter. Changes to accelerated depreciation rules for small businesses in May’s Federal Budget have provided an additional incentive for small businesses to purchase assets such as motor vehicles and other capital equipment. The improvement in asset finance applications was largely driven by stronger demand in NSW and Victoria. The changes were not able to reinvigorate asset finance demand in Queensland, WA and NT where asset finance applications declined in the year to June.

NSW (+5.5%) and Victoria (+7.1%) both showed strong growth in asset finance applications over the past year, followed by the ACT (+3.1%) and SA (+0.4%). Tasmania (+27.9%) also recorded strong growth but can be volatile due to smaller application volume. Falls were seen in Queensland (-0.8%), the NT (-3.2%) and WA (-2.0%) where the winding down of mining-related construction work continues to take a toll on the demand for asset finance.

“It appears small business owners have responded to the accelerated depreciation available for assets under $20,000 announced in the May Federal Budget. Growth in asset finance applications in the June quarter for items under $20,000 was double that of items greater than $20,000,” Mr Samaha said.

“The stimulus effect can also be seen in trade credit. While overall trade credit contracted, there was a noticeable increase in applications for trade credit on amounts of less than $20,000,” he said.

NOTE TO EDITORS

The Veda Quarterly Business Credit Demand Index measures the volume of credit applications that go through the Veda Commercial Bureau by credit providers such as financial institutions and major corporations in Australia. Based on this it is a good measure of intentions to acquire credit by businesses. This differs to other market measures published by the RBA/ABS, which measure new and cumulative dollar amounts that are actually approved by financial institutions.

DISCLAIMER

Purpose of Veda media releases:

Veda Indices releases are intended as a contemporary contribution to data and commentary in relation to credit activity in the Australian economy. The information in this release is general in nature, is not intended to provide guidance or commentary as to Veda’s financial position and does not constitute legal, accounting or other financial advice. To the extent permitted by law, Veda provides no representations, undertakings or warranties concerning the accuracy, completeness or up-to-date nature of the information provided, and specifically excludes all liability or responsibility for any loss or damage arising out of reliance on information in this release including any consequential or indirect loss, loss of profit, loss of revenue or loss of business opportunity.