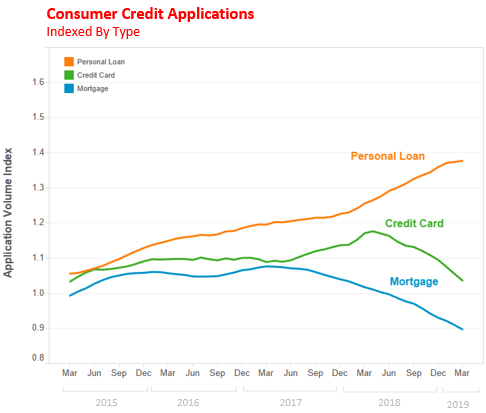

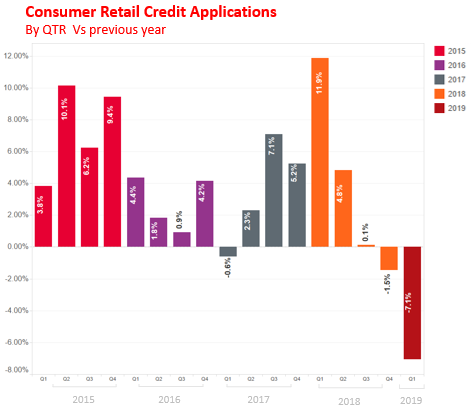

Decline in consumer credit demand driven by a continued fall in credit card applications despite steady growth in personal loans. Mortgage demand decline continues.

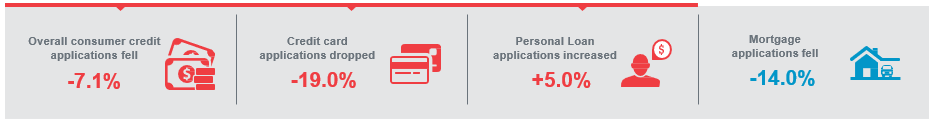

Overall consumer credit applications fell -7.1% (vs March qtr 2018):

- Credit card application decline has accelerated over last four quarters at -19.0% (vs March qtr 2018)

- Personal loan applications continued growth, largely driven by Alternative Lenders up 5% (vs March qtr 2018)

Mortgage applications fell for the eighth consecutive quarter, down -14.0% (vs March qtr 2018)

Note -

Personal Loan includes account types PR, PF & AL.

Credit Card includes account types CC & CA.

Mortgage includes account type RM.

*For improved quality and accuracy, there has been a series recalibration, affecting data beginning Q3 2016 until present. Also, ‘Buy Now, Pay Later’ subscribers have been removed from the Personal Loan Portfolio

NOTE

Historically, movements in Equifax mortgage application demand data has led movements in house prices by around six to nine months. Mortgage applications are not part of the Consumer Credit Demand Index, but are a good indicator of home buyer demand, and an excellent indicator of housing turnover.

Note to Editors

The Quarterly Consumer Credit Demand Index by Equifax measures the volume of credit card and personal loan applications that go through the Consumer Credit Bureau by financial services credit providers in Australia. Credit applications represent an intention by consumers to acquire credit and in turn spend; therefore, the index is a lead indicator. This differs to other market measures published by the RBA which measure credit provided by financial institutions (i.e. balances outstanding).

Purpose of Equifax media releases

The information in this release is general in nature, is not intended to provide guidance or commentary as to the financial position of Equifax and does not constitute legal, accounting or other financial advice. To the extent permitted by law, Equifax provides no representations, undertakings or warranties concerning the accuracy, completeness or up-to-date nature of the information provided, and specifically excludes all liability or responsibility for any loss or damage arising out of reliance on information in this release

including any consequential or indirect loss, loss of profit, loss of revenue or loss of business opportunity.