Financial year commences with moderate growth in consumer credit demand

Veda Quarterly Consumer Credit Demand Index: September 2015 Quarter

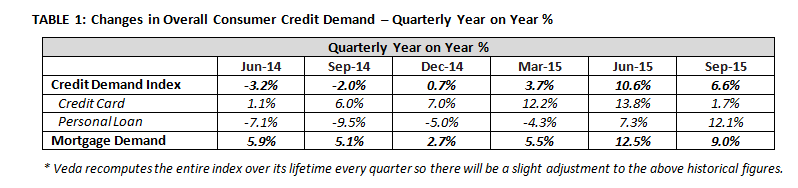

- Overall consumer credit demand grew +6.6% (vs September quarter 2014)

o Credit card applications slowed to +1.7% (vs September quarter 2014)

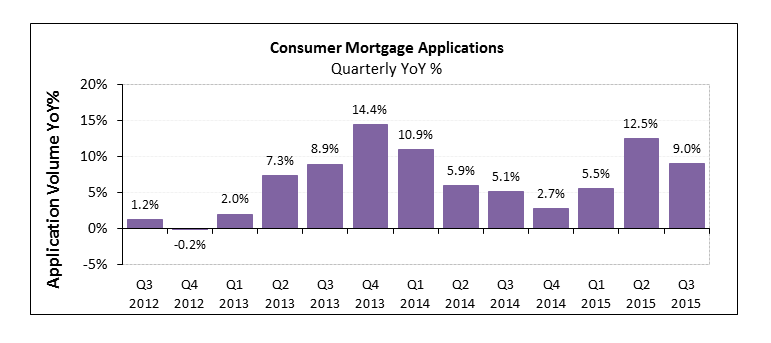

o Personal loan applications rose to +12.1% (vs September quarter 2014) - Growth in mortgage applications eased to +9.0% (vs September quarter 2014)

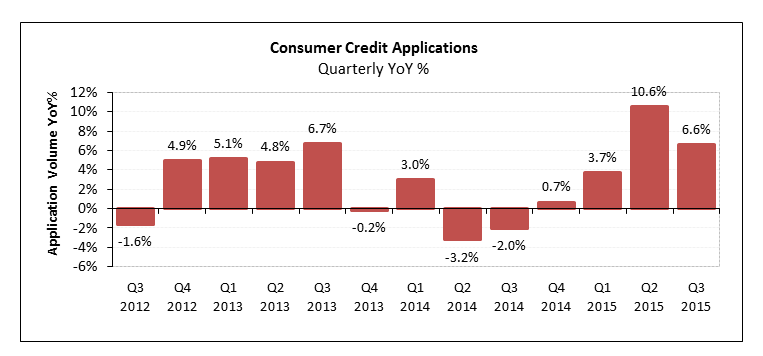

Sydney, Australia: 13 October 2015 – Released today, the Veda Quarterly Consumer Credit Demand Index, measuring the volume of credit card and personal loan applications, started the new financial year with a 6.6% lift in consumer credit demand in the September quarter compared with the same period last year.

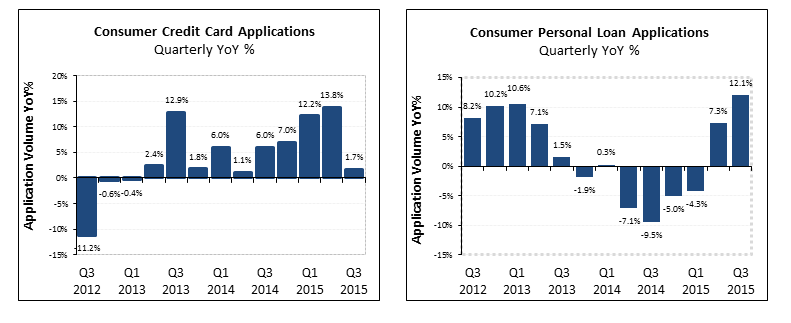

Personal loan applications drove credit demand growth, with a 12.1% increase compared to the September quarter 2014, and a near doubling in the growth rate recorded in the June quarter 2015. However, credit card applications slowed dramatically, increasing only 1.7% for the September quarter 2015, compared to 13.8% for the June quarter 2015.

The Veda Quarterly Consumer Credit Demand Index provides an early indication of movements in consumer spending and retail sales.

Angus Luffman, Veda’s General Manager of Consumer Risk, said the growth in demand for personal loans, building on positive results from the previous quarter, could be attributed to several factors.

“Lower interest rates and a big lift in housing construction are driving spending on a range of big ticket household goods including furniture and electrical items, often financed through a personal loan. ABS data shows a 9.1% increase in household goods retailing in the 12 months to August.

“Amongst the growth in personal loans we are observing some change in the source of the demand, with a portion of the growth coming from more recent market entrants. Typically these organisations have a digital-only presence and are offering borrowers more flexible loan options.

“These lenders are partially growing their share of the applicant market by capturing a larger portion of potential borrowers shopping around for the best deal with multiple lenders.

“Credit card applications were flatter this quarter primarily due to a decrease in major player campaign activity, after relatively strong activity in recent quarters, including the September 2014 quarter,” Mr Luffman said.

Growth in credit card applications slowed sharply to +1.7% in the September quarter. The strongest growth in credit card applications in the September quarter was in SA (+5.2%), followed by NT (+4.9%), WA (+4.5%), ACT (+4.3%), Queensland (+4.0%) and Tasmania (+2.6%). Credit application volumes are relatively unchanged over the past year in Victoria (+0.1%) and NSW (-0.1%).

Personal loan applications rose nationally, up +12.1% in the September quarter. Growth was strongest in Tasmania (+18.2%) and NSW (+13.6%), followed by NT (+12.4%), Victoria (+12.0%), Queensland (+11.5%), WA (+10.6%), SA (+9.6%) and the ACT (+5.8%).

“While overall consumer credit demand remains positive, and despite being driven by personal loan demand growth, the total balances of non-housing credit remain relatively stable, according to ABS data,” Mr Luffman said.

Mortgage application growth slowed nationally in the September quarter to an annual growth rate of +9% (vs +12.5% for the June quarter). The annual rate of growth in mortgage applications was strongest in NSW (+17.4%), followed by the ACT (+12.4%), Victoria (+11.7%), SA (+6.1%) and Queensland (+5.3%). Mortgage applications are falling in the NT (-18.6%), Tasmania (-10.4%) and WA (-8.5%).

Mortgage applications are not part of the Consumer Credit Demand Index, but are a good lead indicator of future activity in homebuyer demand and housing turnover. Historically, movements in Veda mortgage demand have tended to lead movements in house prices by around six to nine months.

“Mortgage demand was down for the September quarter but still saw positive growth. The recent growth in mortgage demand peaked over June and July 2015 and started to tail off in the latter part of this quarter,” Mr Luffman said.

“The established trend of older applicant age groups, continually replacing younger age groups in mortgage applications did not continue in the September quarter, which may confirm a link between investor mortgages and previous mortgage application growth. It may also suggest APRA’s recent regulatory focus on investor mortgages is starting to have an impact on demand.”

NOTE TO EDITORS

The Veda Quarterly Consumer Credit Demand Index measures the volume of credit card and personal loan applications that go through the Veda Consumer Credit Bureau by financial services credit providers in Australia. Credit applications represent an intention by consumers to acquire credit and in turn spend; therefore the index is a lead indicator. This differs to other market measures published by the RBA which measure credit provided by financial institutions (i.e. balances outstanding).

DISCLAIMER

Purpose of Veda media releases: Veda Indices releases are intended as a contemporary contribution to data and commentary in relation to credit activity in the Australian economy. The information in this release is general in nature, is not intended to provide guidance or commentary as to Veda’s financial position and does not constitute legal, accounting or other financial advice. To the extent permitted by law, Veda provides no representations, undertakings or warranties concerning the accuracy, completeness or up-to-date nature of the information provided, and specifically excludes all liability or responsibility for any loss or damage arising out of reliance on information in this release including any consequential or indirect loss, loss of profit, loss of revenue or loss of business opportunity.