Consumers using their Equifax Score are simply better quality credit risk

The introduction of Comprehensive Credit Reporting data is set to increase the creative ways in which innovative lenders will be able to reward positive and improved financial behaviour.

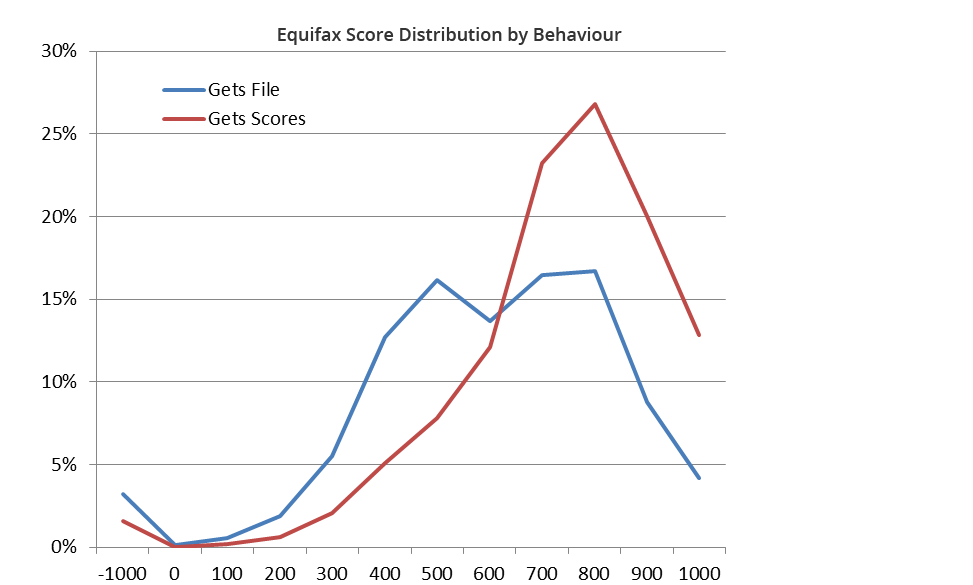

Equifax’s analysis of consumers who get their credit score shows they are significantly lower credit risk than those who do not. Lenders have a window of opportunity to reward high quality consumers and take them out of the market before someone else does.

We are now seeing the start of Australian consumers using their Equifax Score to help negotiate on interest rates as innovative financial institutions offer pricing tailored to individual risk. GetCreditScore.com.au gained huge interest when it launched early September and marked a turning point for customers as they seek a better deal on loans.

The GetCreditScore.com.au site is backed by peer-to-peer lender Society One and uses the credit score from Equifax, Australia’s leading consumer credit bureau, known as an Equifax Score.

On the first day of operation the website crashed due to the overwhelming response from consumers. In the first week it had received over 400,000 hits. The team at GetCreditScore.com.au were surprised at the level of interest generated.

Equifax Score is a number between 1 and 1200 and is an indicator of credit worthiness. Equifax Scores are based on information held in a credit report at a point in time. This information is currently negative information, like credit applications and defaults, despite the new credit regime introduced in March this year which allows positive information to be included on a credit report.

Analysis by Equifax shows since the introduction of Equifax Score the profile of consumers interested in their credit risk is changing. The consumers who interact with scores have better credit risk than those who just check their file.

Credit providers are now able to provide information such as repayment history for payments more than 14 days overdue, and other information such as account type, open and close dates and credit limit. However, it will take time for credit providers to start sharing this information as they work to implement what is a major industry change.

Whilst GetCreditScore.com.au offers a quick snapshot of your Equifax Score, Equifax provides a more comprehensive service whereby you can get your credit report and track your Equifax Score over time as well as set up alerts. Find out more about your Equifax Score here.