Check for the Good and Bad in Your Credit Files

Your credit file basically holds information relating to your credit history – yes even the naughty and nice details. So if you’ve ever applied for credit or a loan, you’re likely to have a credit file held by a credit reporting agency like Equifax.

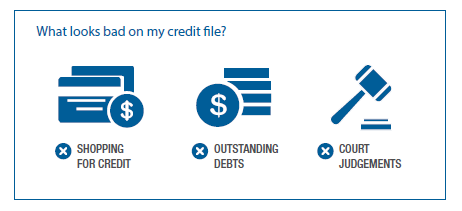

Your credit file is one of your most valuable assets, recording details of some of your dealings with credit providers. It includes information that may be used by lenders as part of the credit assessment process, such as previous applications you’ve made, names of lenders currently providing credit to you, and details of overdue debts.

Your file includes both personal identification information, as well as credit-related information. This may include consumer credit details, business or commercial credit details, and public-record information. Check out What’s in my credit file? for more details.

Credit providers typically outline (in their terms and conditions) the circumstances that will prompt them to access your credit file in. Depending on what part of your credit file they wish to access, they’ll either advise you of their intention to access your file or obtain your consent in advance.

Want to find out what's on your credit file? Get a copy of your free credit report or compare our susbcription packages today.

We also suggest

4 Tips For Managing Late Payers

Chasing a late payment can feel like the most awkward of jobs for the small business owner. These tips show you how to capitalise on a wealth of information now available on your debtors to help avoid those awkward conversations and get paid faster.

Managing Credit History for Small Businesses

Small business owners have a lot on their minds, especially when they are in the crucial first stages of establishment, and again when they start to think about expanding. The attraction of starting up or taking over a small business is the ability to bring a novel idea to the market and be responsible for the direction of your own career.

Financial outlook brighter for businesses as insolvencies fall

A rebound in Australia’s overall economic performance has been reflected in the fall in insolvencies experienced in the December 2016 quarter.

Related products

Business Credit File

Instantly know your business’ credit history and see what lenders and suppliers see.

Credit and Identity Products

Get your free Equifax Credit Report* or check out our subscription plans including tools to help manage your credit profile and protect your identity.